AI in Payment Reminder Automation in Debt Collection

AI in Payment Reminder Automation in Debt Collection

AI in Payment Reminder Automation in Debt Collection

AI in Payment Reminder Automation in Debt Collection

Anant Sharma

Anant Sharma

Anant Sharma

Traditional debt collection methods often involve time-consuming processes, constant follow-ups, and strained customer interactions. As businesses strive for efficiency and better customer engagement, the implementation of AI has never been more crucial. One of the most promising innovations in this space is the use of voice-driven payment negotiation bots.

These AI-powered systems are revolutionizing how you deliver payment reminders and handle negotiations, offering a smarter, more efficient alternative to manual processes. By integrating voice technology with automated payment solutions, you can reduce costs, enhance customer experience, and improve collection rates—all while operating around the clock.

In this blog, we will explore how voice payments work, their benefits, challenges, and real-world use cases, shedding light on how this technology is reshaping debt collection for the better.

What Are Voice-Driven Payments?

Voice-driven payments refer to transactions and interactions where customers engage through spoken language to authorize, negotiate, or confirm payments. This can involve anything from making a payment, negotiating a repayment plan, or simply receiving a reminder of a due date. Typically, these interactions are powered by AI-driven voice bots or digital assistants, automating the entire process.

In debt collection, voice payments go beyond simple reminders. It can engage in real-time conversations with customers, guide them through the process, and even suggest payment plans based on their financial situation.

These bots simulate human conversation by integrating advanced speech recognition and natural language processing (NLP), creating a more interactive and personalized experience than traditional payment reminders.

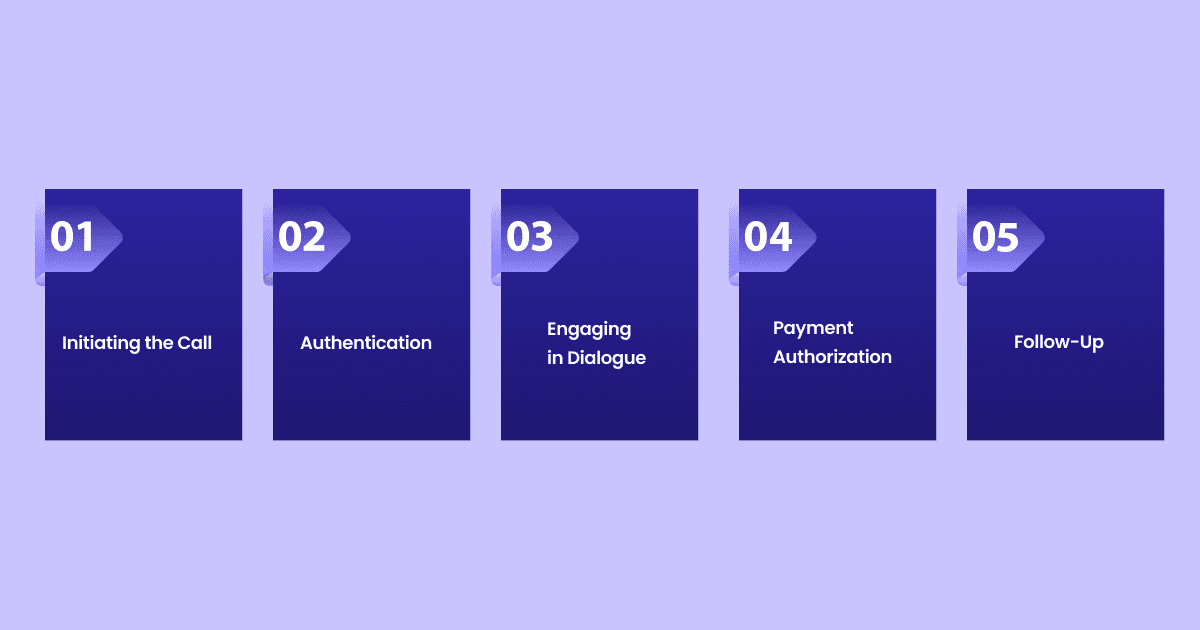

How Do Voice-Driven Payments Work?

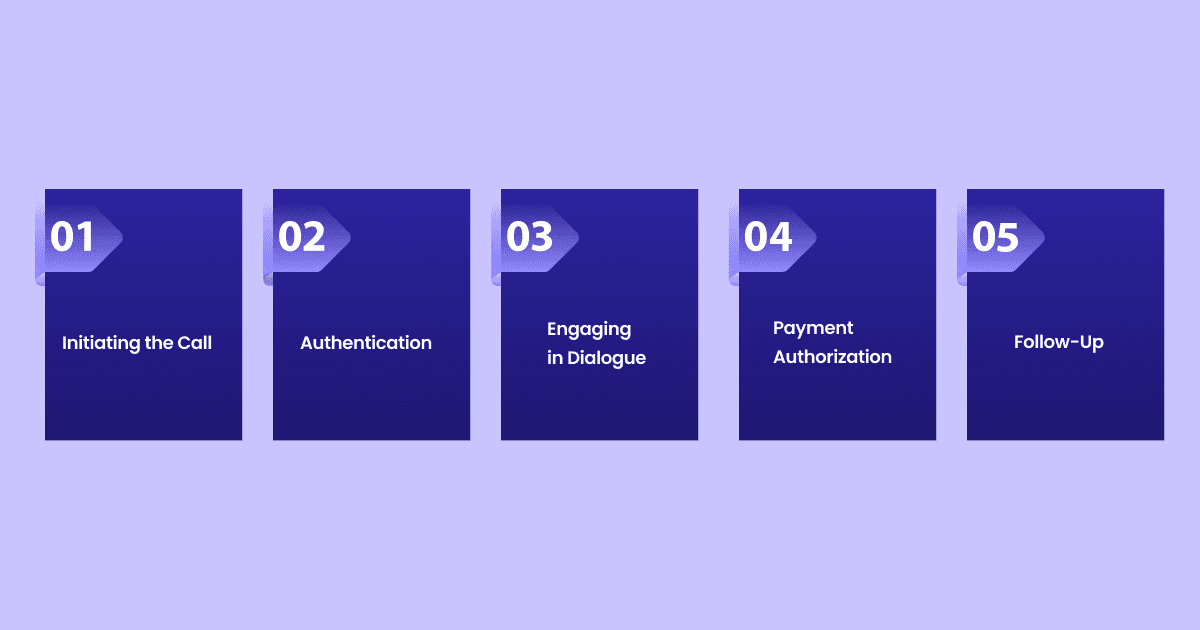

Voice payments work through AI-driven systems designed to understand, process, and respond to spoken language. The interaction typically follows a series of steps, which can vary depending on the system’s complexity. Here’s how the process generally works:

1. Initiating the Call

The process begins when the system contacts your debtor through an automated phone call or voice assistant. The initial interaction serves as a reminder for an overdue payment or as a prompt offering alternative payment options. The voice bot usually introduces itself, identifies the reason for the call, and asks for the customer’s attention. You can customize the message based on the customer’s situation. For example, reminding them of an outstanding balance, informing them of a past-due date, or notifying them about a payment deadline.

This step is essential because it sets the tone for the entire conversation, with the voice bot providing a clear and direct communication channel for the debtor. This ensures your customers understand the purpose of the call.

2. Authentication

Once your debtor is on the line, the voice bot proceeds to authenticate their identity. This step is critical to ensure that it contacts the right person regarding the debt, preventing any errors or potential privacy issues. The customer receives prompts to verify their identity by answering security questions or providing personal account information.

In some cases, you can employ voice biometrics, an advanced form of authentication that uses voice patterns to verify identity and offers an added layer of security. This helps prevent fraud or misidentification, ensuring that you only engage the person responsible for the debt in the payment conversation.

3. Engaging in Dialogue

Once authentication is complete, the voice-driven payment negotiation bot takes over the conversation. The bot explains the details of the outstanding payment, such as the amount due, the due date, and any potential late fees or penalties that might apply. It can provide your customer with a comprehensive overview of their financial obligations in a clear, conversational tone.

At this stage, the bot also presents various payment options available to the customer. It might offer the following:

Full Payment: The voicebot gives the customer the option to pay the full outstanding amount immediately.

Installment Plans: For those who may not be able to pay in full, the bot can suggest flexible repayment plans tailored to the customer’s situation. The bot can walk them through the terms of these plans, such as the amount of each installment and the duration of the repayment period.

Discounts or Incentives: In some cases, the bot may offer a discount for early payment or provide incentives like waiving late fees if the customer settles the balance quickly.

The goal is to make the conversation as interactive as possible, offering solutions that feel personalized to the customer’s circumstances. Using advanced Natural Language Processing (NLP), the bot can even recognize speech nuances, such as tone or hesitance, to adjust its responses accordingly. This makes the interaction feel more human and less mechanical.

4. Payment Authorization

After the customer agrees to a payment option, the bot can process the payment directly through voice commands. This step involves the bot collecting necessary payment information from the customer, such as credit card details, bank account information, or a payment token for digital wallets.

In some cases, the bot may direct the customer to a secure payment portal or mobile app to complete the transaction. For example, if customers prefer to enter their payment details on a webpage for added security, the bot can guide them through that process with clear instructions.

Throughout this step, the bot ensures the payment process is as simple and secure as possible. It allows the customer to authorize the payment using only their voice, which can be more convenient than manually entering information.

5. Follow-Up

Once the payment authorization is complete, the bot may send follow-up reminders or status updates to keep the customer informed. For example, it might confirm that a payment process was successful, send a receipt via email or text, and outline the transaction details. Rifa AI can automate these follow-ups through email or text.

Additionally, the bot can send future reminders about upcoming due dates, missed payments, or any changes to the repayment plan. These follow-ups are important because they help ensure the customer remains on track and prevent future delinquencies. By automating these reminders, the bot reduces the need for human intervention and ensures that the process remains consistent and timely.

Furthermore, the bot can offer additional customer support by directing the customer to a human agent if they have any further questions or concerns about their payment or account.

Benefits of the Voice Payment Process

Voice payments offer numerous advantages that make them an attractive option for businesses, especially in debt collection. Here are some of the primary benefits of voice payment process:

24/7 Availability: One of the major benefits of using voice-driven payment negotiation bots is their ability to operate around the clock. Unlike human agents with working hours restrictions, voice bots can assist your debtors at any time, boosting the possibility of timely payment.

Personalization: Advanced NLP algorithms allow these bots to recognize speech patterns, tones, and preferences, creating more personalized interactions. This makes communication feel more engaging and less robotic, improving overall customer satisfaction.

Cost-Effective: Automating debt collection through voice bots significantly reduces the need for human agents, lowering your operational costs. The bots can handle thousands of calls at once, a task impossible for a human team.

Reduced Human Error: By eliminating human involvement in the payment negotiation process, you can reduce the risk of errors such as miscommunication or inconsistent payment terms. This leads to smoother operations and better outcomes.

Enhanced Customer Experience: Voice bots can speak in a conversational and friendly tone. When customers are dealing with overdue payments, it can be stressful, but the empathetic and engaging nature of the voice bot can help reduce tension. Furthermore, it offers your customers flexible payment options in a non-confrontational way, increasing the likelihood of a positive response.

Automation by Rifa AI can help you increase debt collection by streamlining 70% of procedures, achieving 99% accuracy, and saving over 200 hours per week without requiring API interaction. Deploy in days and slash costs by up to 70%. Ready for transformation? Let Rifa AI lead the way to success.

Challenges of Voice Payments

While voice payments and AI-powered bots offer many advantages, they do come with challenges that you need to consider. They are:

Complexity of Speech Recognition

Despite advancements in Natural Language Processing (NLP), accurately understanding diverse accents, dialects, and speech impediments remains a challenge.

Misinterpretation of responses can lead to frustration, resulting in dropped calls or errors during the collection process.

Limited Emotional Intelligence

While voice bots sound empathetic, they still lack the emotional depth that human agents can provide.

For some of your customers, interacting with a machine instead of a person may feel impersonal, especially when dealing with sensitive financial matters.

Data Privacy Concerns

Voice interactions involve handling sensitive payment data raising concerns about security and privacy.

You must ensure that the voice payment system is secure and compliant with regulations like GDPR or CCPA to protect customer data from breaches.

Integration with Legacy Systems

Implementing voice payment solutions into your existing debt collection infrastructure can be complex.

You might have to invest significant time and resources to resolve integration challenges with legacy software.

Customer Resistance

Some customers may feel uncomfortable or distrustful of automated systems, particularly when it involves financial transactions.

To successfully implement voicebots, you must educate customers about the process and offer them the option to speak with a human agent when needed.

Enhance your debt collection with Rifa AI: automate 70% of your procedures, minimize human error, and ensure real-time data accuracy. Our advanced encryption safeguards sensitive financial data, and we comply with regulations like GDPR. Also, benefit from predictive analytics to optimize compliance and collections. Transform your processes, reduce costs, and achieve near-perfect accuracy in just days with Rifa AI.

Conclusion

AI-driven voice payment bots are revolutionizing debt collection and payment reminders by offering 24/7 availability, personalized interactions, and cost-efficiency. While challenges such as speech recognition accuracy, emotional intelligence, and data privacy need to be addressed, these systems hold significant potential

Despite these obstacles, the growing trend of voice payment automation can lead to a future where AI and human empathy work together. This combination can improve collection rates, enhance customer satisfaction, and create more positive and efficient interactions between businesses and debtors.

Rifa AI offers an efficient, cost-effective, and personalized solution to streamline your collections and improve customer satisfaction. With real-time data processing, seamless omnichannel integration, and a fully compliant, automated system, Rifa AI is your trusted partner in debt recovery and other financial operations.

Consider that over 1 million accounts have outstanding credit card debt. Manual workflows were only 60% accurate, and API integrations for automation would take months. Rifa AI addresses these challenges head-on. Don’t wait—experience the future of debt collection today. Schedule a demo to learn how Rifa AI can revolutionize your financial operations and lead to significant cost savings.

Traditional debt collection methods often involve time-consuming processes, constant follow-ups, and strained customer interactions. As businesses strive for efficiency and better customer engagement, the implementation of AI has never been more crucial. One of the most promising innovations in this space is the use of voice-driven payment negotiation bots.

These AI-powered systems are revolutionizing how you deliver payment reminders and handle negotiations, offering a smarter, more efficient alternative to manual processes. By integrating voice technology with automated payment solutions, you can reduce costs, enhance customer experience, and improve collection rates—all while operating around the clock.

In this blog, we will explore how voice payments work, their benefits, challenges, and real-world use cases, shedding light on how this technology is reshaping debt collection for the better.

What Are Voice-Driven Payments?

Voice-driven payments refer to transactions and interactions where customers engage through spoken language to authorize, negotiate, or confirm payments. This can involve anything from making a payment, negotiating a repayment plan, or simply receiving a reminder of a due date. Typically, these interactions are powered by AI-driven voice bots or digital assistants, automating the entire process.

In debt collection, voice payments go beyond simple reminders. It can engage in real-time conversations with customers, guide them through the process, and even suggest payment plans based on their financial situation.

These bots simulate human conversation by integrating advanced speech recognition and natural language processing (NLP), creating a more interactive and personalized experience than traditional payment reminders.

How Do Voice-Driven Payments Work?

Voice payments work through AI-driven systems designed to understand, process, and respond to spoken language. The interaction typically follows a series of steps, which can vary depending on the system’s complexity. Here’s how the process generally works:

1. Initiating the Call

The process begins when the system contacts your debtor through an automated phone call or voice assistant. The initial interaction serves as a reminder for an overdue payment or as a prompt offering alternative payment options. The voice bot usually introduces itself, identifies the reason for the call, and asks for the customer’s attention. You can customize the message based on the customer’s situation. For example, reminding them of an outstanding balance, informing them of a past-due date, or notifying them about a payment deadline.

This step is essential because it sets the tone for the entire conversation, with the voice bot providing a clear and direct communication channel for the debtor. This ensures your customers understand the purpose of the call.

2. Authentication

Once your debtor is on the line, the voice bot proceeds to authenticate their identity. This step is critical to ensure that it contacts the right person regarding the debt, preventing any errors or potential privacy issues. The customer receives prompts to verify their identity by answering security questions or providing personal account information.

In some cases, you can employ voice biometrics, an advanced form of authentication that uses voice patterns to verify identity and offers an added layer of security. This helps prevent fraud or misidentification, ensuring that you only engage the person responsible for the debt in the payment conversation.

3. Engaging in Dialogue

Once authentication is complete, the voice-driven payment negotiation bot takes over the conversation. The bot explains the details of the outstanding payment, such as the amount due, the due date, and any potential late fees or penalties that might apply. It can provide your customer with a comprehensive overview of their financial obligations in a clear, conversational tone.

At this stage, the bot also presents various payment options available to the customer. It might offer the following:

Full Payment: The voicebot gives the customer the option to pay the full outstanding amount immediately.

Installment Plans: For those who may not be able to pay in full, the bot can suggest flexible repayment plans tailored to the customer’s situation. The bot can walk them through the terms of these plans, such as the amount of each installment and the duration of the repayment period.

Discounts or Incentives: In some cases, the bot may offer a discount for early payment or provide incentives like waiving late fees if the customer settles the balance quickly.

The goal is to make the conversation as interactive as possible, offering solutions that feel personalized to the customer’s circumstances. Using advanced Natural Language Processing (NLP), the bot can even recognize speech nuances, such as tone or hesitance, to adjust its responses accordingly. This makes the interaction feel more human and less mechanical.

4. Payment Authorization

After the customer agrees to a payment option, the bot can process the payment directly through voice commands. This step involves the bot collecting necessary payment information from the customer, such as credit card details, bank account information, or a payment token for digital wallets.

In some cases, the bot may direct the customer to a secure payment portal or mobile app to complete the transaction. For example, if customers prefer to enter their payment details on a webpage for added security, the bot can guide them through that process with clear instructions.

Throughout this step, the bot ensures the payment process is as simple and secure as possible. It allows the customer to authorize the payment using only their voice, which can be more convenient than manually entering information.

5. Follow-Up

Once the payment authorization is complete, the bot may send follow-up reminders or status updates to keep the customer informed. For example, it might confirm that a payment process was successful, send a receipt via email or text, and outline the transaction details. Rifa AI can automate these follow-ups through email or text.

Additionally, the bot can send future reminders about upcoming due dates, missed payments, or any changes to the repayment plan. These follow-ups are important because they help ensure the customer remains on track and prevent future delinquencies. By automating these reminders, the bot reduces the need for human intervention and ensures that the process remains consistent and timely.

Furthermore, the bot can offer additional customer support by directing the customer to a human agent if they have any further questions or concerns about their payment or account.

Benefits of the Voice Payment Process

Voice payments offer numerous advantages that make them an attractive option for businesses, especially in debt collection. Here are some of the primary benefits of voice payment process:

24/7 Availability: One of the major benefits of using voice-driven payment negotiation bots is their ability to operate around the clock. Unlike human agents with working hours restrictions, voice bots can assist your debtors at any time, boosting the possibility of timely payment.

Personalization: Advanced NLP algorithms allow these bots to recognize speech patterns, tones, and preferences, creating more personalized interactions. This makes communication feel more engaging and less robotic, improving overall customer satisfaction.

Cost-Effective: Automating debt collection through voice bots significantly reduces the need for human agents, lowering your operational costs. The bots can handle thousands of calls at once, a task impossible for a human team.

Reduced Human Error: By eliminating human involvement in the payment negotiation process, you can reduce the risk of errors such as miscommunication or inconsistent payment terms. This leads to smoother operations and better outcomes.

Enhanced Customer Experience: Voice bots can speak in a conversational and friendly tone. When customers are dealing with overdue payments, it can be stressful, but the empathetic and engaging nature of the voice bot can help reduce tension. Furthermore, it offers your customers flexible payment options in a non-confrontational way, increasing the likelihood of a positive response.

Automation by Rifa AI can help you increase debt collection by streamlining 70% of procedures, achieving 99% accuracy, and saving over 200 hours per week without requiring API interaction. Deploy in days and slash costs by up to 70%. Ready for transformation? Let Rifa AI lead the way to success.

Challenges of Voice Payments

While voice payments and AI-powered bots offer many advantages, they do come with challenges that you need to consider. They are:

Complexity of Speech Recognition

Despite advancements in Natural Language Processing (NLP), accurately understanding diverse accents, dialects, and speech impediments remains a challenge.

Misinterpretation of responses can lead to frustration, resulting in dropped calls or errors during the collection process.

Limited Emotional Intelligence

While voice bots sound empathetic, they still lack the emotional depth that human agents can provide.

For some of your customers, interacting with a machine instead of a person may feel impersonal, especially when dealing with sensitive financial matters.

Data Privacy Concerns

Voice interactions involve handling sensitive payment data raising concerns about security and privacy.

You must ensure that the voice payment system is secure and compliant with regulations like GDPR or CCPA to protect customer data from breaches.

Integration with Legacy Systems

Implementing voice payment solutions into your existing debt collection infrastructure can be complex.

You might have to invest significant time and resources to resolve integration challenges with legacy software.

Customer Resistance

Some customers may feel uncomfortable or distrustful of automated systems, particularly when it involves financial transactions.

To successfully implement voicebots, you must educate customers about the process and offer them the option to speak with a human agent when needed.

Enhance your debt collection with Rifa AI: automate 70% of your procedures, minimize human error, and ensure real-time data accuracy. Our advanced encryption safeguards sensitive financial data, and we comply with regulations like GDPR. Also, benefit from predictive analytics to optimize compliance and collections. Transform your processes, reduce costs, and achieve near-perfect accuracy in just days with Rifa AI.

Conclusion

AI-driven voice payment bots are revolutionizing debt collection and payment reminders by offering 24/7 availability, personalized interactions, and cost-efficiency. While challenges such as speech recognition accuracy, emotional intelligence, and data privacy need to be addressed, these systems hold significant potential

Despite these obstacles, the growing trend of voice payment automation can lead to a future where AI and human empathy work together. This combination can improve collection rates, enhance customer satisfaction, and create more positive and efficient interactions between businesses and debtors.

Rifa AI offers an efficient, cost-effective, and personalized solution to streamline your collections and improve customer satisfaction. With real-time data processing, seamless omnichannel integration, and a fully compliant, automated system, Rifa AI is your trusted partner in debt recovery and other financial operations.

Consider that over 1 million accounts have outstanding credit card debt. Manual workflows were only 60% accurate, and API integrations for automation would take months. Rifa AI addresses these challenges head-on. Don’t wait—experience the future of debt collection today. Schedule a demo to learn how Rifa AI can revolutionize your financial operations and lead to significant cost savings.

Feb 19, 2025

Feb 19, 2025

Feb 19, 2025