Use Cases and Benefits of Conversational Voice AI in Debt Collection

Use Cases and Benefits of Conversational Voice AI in Debt Collection

Use Cases and Benefits of Conversational Voice AI in Debt Collection

Use Cases and Benefits of Conversational Voice AI in Debt Collection

Anant Sharma

Anant Sharma

Anant Sharma

Use Cases and Benefits of Conversational Voice AI in Debt Collection

Debt collection is essential to keeping your business’s cash flow healthy, but it’s also one of the trickiest areas to manage. You need to be effective in recovering payments but also mindful of maintaining positive relationships with your customers. This balance can be hard to achieve—until now.

Conversational voice AI is changing the game by offering a smarter, more empathetic way to handle debt collection. With voice AI, you can automate tasks, engage customers with a personalized touch, and boost collection rates—all while saving time and reducing costs. In this blog, you will discover voice AI's key use cases and benefits in debt collection and how it can help you streamline your processes while enhancing customer satisfaction.

What is Conversational Voice AI?

Conversational voice AI uses artificial intelligence to simulate human-like interactions with customers. These systems utilize natural language processing (NLP) and machine learning to understand spoken language, interpret it in context, and respond naturally.

When applied to debt collection, conversational voice AI automates most communication tasks. These tasks include payment reminders, inquiries, and even negotiations. Voice AI automates these tasks while maintaining a personal and empathetic tone.

For you, as a business owner or manager, conversational voice AI offers an effective way to automate debt recovery. It can reduce manual workload and create more scalable solutions for customer communication.

Significance of Empathy in Debt Collection

You likely already know that debt collection isn’t just about making calls and sending invoices—it’s about maintaining positive customer relationships while recovering what’s owed. Customers behind on payments might already be under significant financial stress, so an impersonal, aggressive approach can easily alienate them.

Here are a few reasons why the debt collection process requires empathy:

Conversational voice AI excels in recognizing and responding to emotional tones in a human voice.

Unlike traditional robocalls or IVR, it conveys empathy and adapts responses based on the customer’s emotional state.

Voice AI’s capability to convey emotions helps build trust with customers. It increases the chances of customers engaging positively to resolve their debt.

By integrating empathy into automated communication, conversational voice AI allows for debt collection without sacrificing customer relationships.

Boost your debt collection with Rifa's AI automation. It streamlines 70% of workflows, achieves 99% accuracy, and saves over 200 hours weekly—without API integration. Deploy in days and slash costs by up to 70%. Ready for transformation? Let Rifa AI lead the way to success.

Let’s take a look at the key benefits that conversational voice AI offers in debt collection.

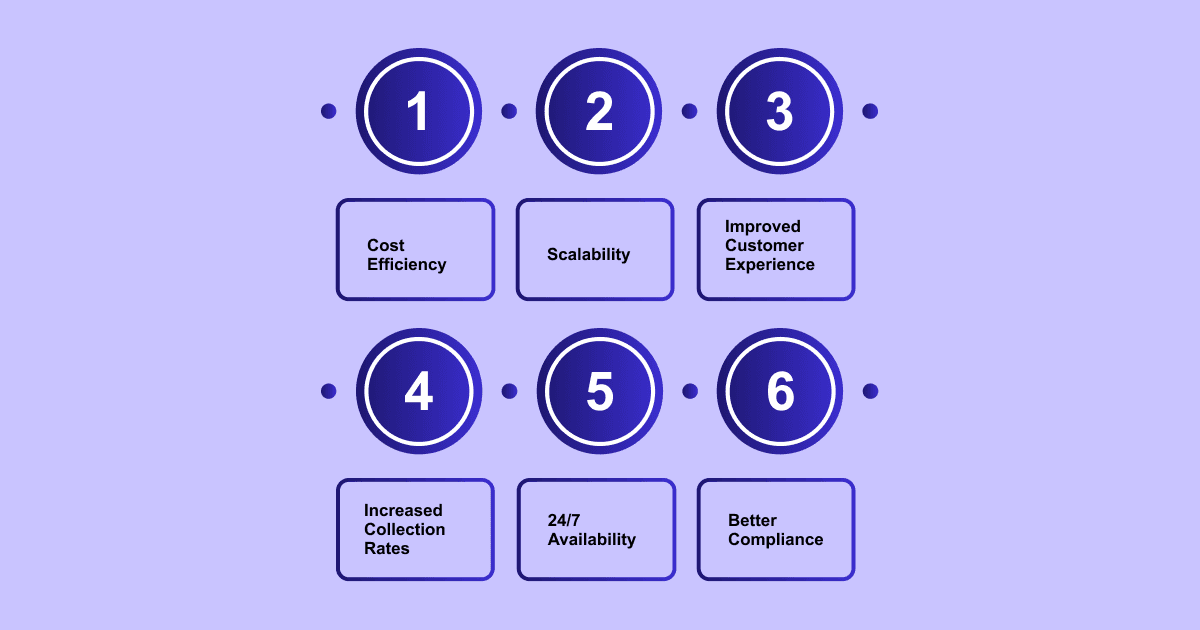

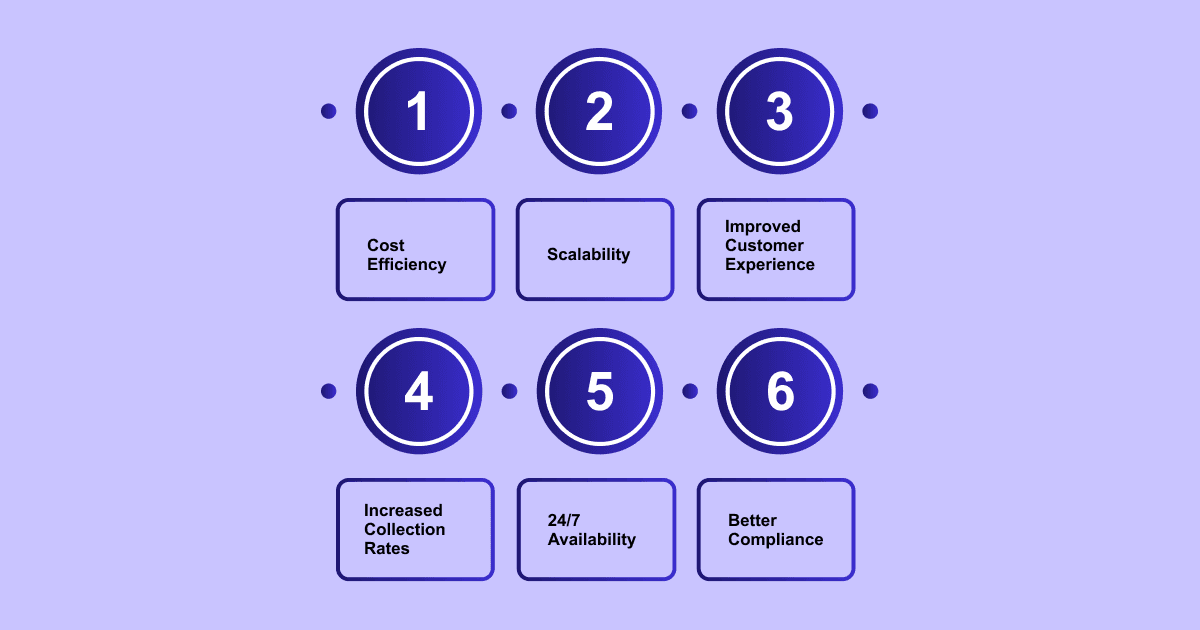

Key Benefits of Voice AI in Debt Collection

The benefits of voice AI in debt collection are clear, and the technology is quickly becoming indispensable for businesses that want to stay ahead. Here's a closer look at some of the major advantages it offers:

Cost Efficiency

Automating routine debt collection tasks with voice AI means reducing reliance on human agents for repetitive processes, such as sending reminders or confirming payment statuses. This results in substantial cost savings since you don’t need to employ as many people for these tasks.

Additionally, AI-driven systems are highly efficient and can handle large volumes of interactions simultaneously, something human agents might not manage. Rifa AI's automation features can significantly reduce operational costs by streamlining these repetitive tasks and freeing up your team to focus on more complex issues.

Scalability

As your business grows, so does your debt collection workload. Conversational voice AI allows you to scale your operations seamlessly without hiring more staff or investing in costly infrastructure. Whether you are dealing with a few dozen or thousands of overdue accounts, voice AI can handle it easily.

It ensures that your customer service and recovery processes remain smooth and efficient. Rifa AI is built for scalability, allowing your debt collection process to grow with your business without adding strain on resources. It does not require API integration and ensures seamless deployment.

Improved Customer Experience

You might assume that automating debt collection could make it feel cold and impersonal, but conversational voice AI enhances customer experiences. It customizes interactions based on the customer’s history, payment behavior, and emotional tone.

Whether you are offering payment options or simply checking in, the AI’s responses feel personalized and respectful, creating a more positive interaction. Powered by advanced AI, Rifa AI can contribute to a more positive and empathetic customer experience, even during difficult conversations about debt.

Increased Collection Rates

Frequent reminders and timely follow-ups are key to reducing overdue accounts, and voice AI helps you do this at scale. Since these systems can reach customers more consistently and at optimal times, the possibility of collecting payments on time increases.

AI can work 24/7, so even if your customers are in different time zones, they can always receive a timely reminder or payment option. By automating timely follow-ups, Rifa AI can help improve your debt collection rates and ensure a steady cash flow.

24/7 Availability

One of the biggest advantages of conversational voice AI is its ability to operate around the clock. Whether it’s 2 AM or a holiday, customers can interact with the system to resolve issues, make payments, or set up a plan.

This constant availability ensures you never miss an opportunity to collect payment, and customers can always engage with your business at their convenience.

Better Compliance

In the debt collection industry, adhering to strict regulations is a must. You can program conversational voice AI to follow legal guidelines, such as when and how often you can contact a customer, ensuring you avoid compliance violations.

For example, you can restrict the AI from contacting customers during specific hours or prevent it from using inappropriate language.

The key benefits of voice AI in debt collection go beyond automation. With increased collection rates, better compliance, and 24/7 availability, voice AI streamlines your debt recovery process while strengthening customer relationships. By adopting this technology, you’re not just improving efficiency—you’re transforming how you engage with customers and recover payments.

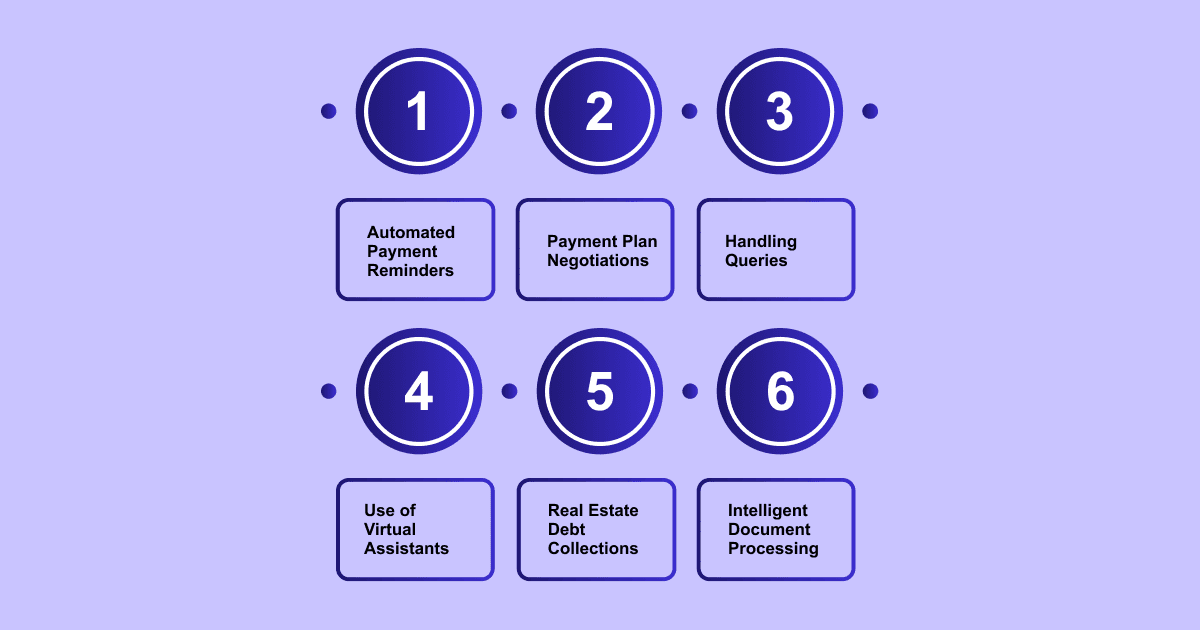

Use Cases of Conversational Voice AI in Debt Collection

Let’s explore some specific use cases of conversational voice AI that demonstrate how it can enhance your debt collection process.

Automated Payment Reminders

One of the most straightforward applications of voice AI is sending automated payment reminders. You can program the system to send personalized reminders based on the customer’s payment history, and it will deliver these reminders in a respectful, empathetic tone.

The AI can also include payment links or details on resolving the debt, streamlining the process for both you and your customers. Rifa AI excels at sending personalized and timely payment reminders, improving the chances of on-time payments, and reducing the number of overdue accounts.

Payment Plan Negotiations

Debt collection isn’t always about getting the full payment in one go. Conversational voice AI can help you offer flexible payment plans. The AI can engage with customers to assess their ability to pay and propose customized repayment options. This makes the process more flexible, and customers feel more in control of how they resolve their debt.

Handling Queries and Dispute Resolution

Voice AI can also handle simple customer queries such as confirming outstanding balances or providing details on payment history. If a customer disputes a debt, the AI can explain the details of the charge in a clear and professional manner. For more complicated issues, the AI can smoothly transfer the customer to a human agent who can address the situation in greater detail.

Rifa AI can efficiently handle routine inquiries and provide clear explanations regarding debts, freeing up human agents to focus on more complex dispute resolutions.

Use of Virtual Assistants in Debt Collection

With conversational voice AI-powered virtual assistants, you can offer 24/7 support for your customers. These assistants handle routine inquiries, provide payment reminders, and suggest repayment options, freeing up your human agents for more complex tasks.

By offering a non-confrontational way to manage debt, virtual assistants help improve customer satisfaction and increase payment compliance while streamlining your processes. Rifa AI's advanced analytics can also provide insights into customer behavior and preferences, allowing for more targeted and effective debt-collection strategies.

Real Estate Debt Collections

In real estate, conversational voice AI can help you manage mortgage payments, property fees, and loan-related queries more effectively. These systems automate payment reminders, assist in negotiating payment plans, and maintain accurate records.

With AI handling these tasks, you can improve efficiency, ensure timely follow-ups, and keep client relationships positive, all while reducing the workload on your human agents.

Intelligent Document Processing in Debt Collection

Using Intelligent Document Processing (IDP) with conversational voice AI, you can automate the extraction of key information from loan agreements, contracts, and payment records. This reduces manual errors and makes it easier for you to access important data quickly.

Combining IDP with voice AI boosts efficiency, accelerates decision-making, and supports accurate debt recovery while simplifying document management. For example, the virtual assistant could use information extracted by the IDP to answer customer queries about their loan terms. Rifa AI's focus on security ensures that sensitive financial information is handled carefully.

Challenges in the Implementation of Voice AI

Although conversational voice AI is revolutionizing debt collection, there are some challenges you will need to consider when implementing this technology. They are:

Data Privacy and Security

Debt collection involves sensitive information, making security and privacy top priorities.

Voice AI systems must comply with data protection laws such as GDPR and CCPA.

You should implement strict encryption protocols, secure data storage, and robust access controls.

Handling Complex Situations

Conversational AI works well for routine tasks, but complex customer situations might still require a human touch.

If a customer disputes a debt or requests a highly personalized repayment plan, the AI might not effectively address these nuances.

Provide an option for your customers to escalate issues to a human agent so that they can be comfortable with discussing sensitive issues.

Voice Recognition Limitations

Although NLP technology has made great strides, voice recognition isn’t perfect.

Accents, background noise, or unclear speech can pose challenges.

You must invest in a high-quality voice AI system trained to handle diverse accents and unclear speech for smooth and accurate communication.

Customer Acceptance

Some customers may feel uneasy interacting with AI, especially when dealing with sensitive matters like debt.

While conversational voice AI can sound natural, some customers may prefer human interaction.

Offer your customers the option to speak with a live agent to create a hybrid solution where AI handles basic tasks, and humans step in for more complex matters.

Rifa AI can improve your debt collection by automating 70% of your processes, reducing human error, and guaranteeing real-time data accuracy. We adhere to laws like GDPR and protect sensitive financial data with our advanced encryption. Take advantage of predictive analytics to maximize collections and compliance. Use Rifa AI to revolutionize your operations, cut expenses, and attain near-perfect accuracy in a matter of days.

Conclusion

How voice AI transforms debt collection is about improving the overall customer experience while increasing efficiency. By automating repetitive tasks, offering empathy in communication, and scaling your operations, voice AI helps you collect debts more effectively. It is also helpful in reducing costs and building trust with customers.

While the technology has its challenges, the advantages far outweigh the drawbacks. Voice AI can make debt collection a smoother, more efficient process for your business and your customers while staying compliant with regulations.

Rifa AI provides a streamlined, affordable, personalized debt collection approach, boosting efficiency and customer satisfaction. Utilizing real-time data, seamless integration across multiple communication channels, and a fully compliant, automated platform, Rifa AI is a reliable solution for debt recovery and other financial tasks.

Given the widespread issue of outstanding credit card debt, where traditional manual processes struggle with accuracy and implementing automated solutions, Rifa AI offers a direct and effective solution without API integration. Discover the next generation of debt collection. Book a demo to see how Rifa AI can transform your financial operations and substantially reduce costs.

Use Cases and Benefits of Conversational Voice AI in Debt Collection

Debt collection is essential to keeping your business’s cash flow healthy, but it’s also one of the trickiest areas to manage. You need to be effective in recovering payments but also mindful of maintaining positive relationships with your customers. This balance can be hard to achieve—until now.

Conversational voice AI is changing the game by offering a smarter, more empathetic way to handle debt collection. With voice AI, you can automate tasks, engage customers with a personalized touch, and boost collection rates—all while saving time and reducing costs. In this blog, you will discover voice AI's key use cases and benefits in debt collection and how it can help you streamline your processes while enhancing customer satisfaction.

What is Conversational Voice AI?

Conversational voice AI uses artificial intelligence to simulate human-like interactions with customers. These systems utilize natural language processing (NLP) and machine learning to understand spoken language, interpret it in context, and respond naturally.

When applied to debt collection, conversational voice AI automates most communication tasks. These tasks include payment reminders, inquiries, and even negotiations. Voice AI automates these tasks while maintaining a personal and empathetic tone.

For you, as a business owner or manager, conversational voice AI offers an effective way to automate debt recovery. It can reduce manual workload and create more scalable solutions for customer communication.

Significance of Empathy in Debt Collection

You likely already know that debt collection isn’t just about making calls and sending invoices—it’s about maintaining positive customer relationships while recovering what’s owed. Customers behind on payments might already be under significant financial stress, so an impersonal, aggressive approach can easily alienate them.

Here are a few reasons why the debt collection process requires empathy:

Conversational voice AI excels in recognizing and responding to emotional tones in a human voice.

Unlike traditional robocalls or IVR, it conveys empathy and adapts responses based on the customer’s emotional state.

Voice AI’s capability to convey emotions helps build trust with customers. It increases the chances of customers engaging positively to resolve their debt.

By integrating empathy into automated communication, conversational voice AI allows for debt collection without sacrificing customer relationships.

Boost your debt collection with Rifa's AI automation. It streamlines 70% of workflows, achieves 99% accuracy, and saves over 200 hours weekly—without API integration. Deploy in days and slash costs by up to 70%. Ready for transformation? Let Rifa AI lead the way to success.

Let’s take a look at the key benefits that conversational voice AI offers in debt collection.

Key Benefits of Voice AI in Debt Collection

The benefits of voice AI in debt collection are clear, and the technology is quickly becoming indispensable for businesses that want to stay ahead. Here's a closer look at some of the major advantages it offers:

Cost Efficiency

Automating routine debt collection tasks with voice AI means reducing reliance on human agents for repetitive processes, such as sending reminders or confirming payment statuses. This results in substantial cost savings since you don’t need to employ as many people for these tasks.

Additionally, AI-driven systems are highly efficient and can handle large volumes of interactions simultaneously, something human agents might not manage. Rifa AI's automation features can significantly reduce operational costs by streamlining these repetitive tasks and freeing up your team to focus on more complex issues.

Scalability

As your business grows, so does your debt collection workload. Conversational voice AI allows you to scale your operations seamlessly without hiring more staff or investing in costly infrastructure. Whether you are dealing with a few dozen or thousands of overdue accounts, voice AI can handle it easily.

It ensures that your customer service and recovery processes remain smooth and efficient. Rifa AI is built for scalability, allowing your debt collection process to grow with your business without adding strain on resources. It does not require API integration and ensures seamless deployment.

Improved Customer Experience

You might assume that automating debt collection could make it feel cold and impersonal, but conversational voice AI enhances customer experiences. It customizes interactions based on the customer’s history, payment behavior, and emotional tone.

Whether you are offering payment options or simply checking in, the AI’s responses feel personalized and respectful, creating a more positive interaction. Powered by advanced AI, Rifa AI can contribute to a more positive and empathetic customer experience, even during difficult conversations about debt.

Increased Collection Rates

Frequent reminders and timely follow-ups are key to reducing overdue accounts, and voice AI helps you do this at scale. Since these systems can reach customers more consistently and at optimal times, the possibility of collecting payments on time increases.

AI can work 24/7, so even if your customers are in different time zones, they can always receive a timely reminder or payment option. By automating timely follow-ups, Rifa AI can help improve your debt collection rates and ensure a steady cash flow.

24/7 Availability

One of the biggest advantages of conversational voice AI is its ability to operate around the clock. Whether it’s 2 AM or a holiday, customers can interact with the system to resolve issues, make payments, or set up a plan.

This constant availability ensures you never miss an opportunity to collect payment, and customers can always engage with your business at their convenience.

Better Compliance

In the debt collection industry, adhering to strict regulations is a must. You can program conversational voice AI to follow legal guidelines, such as when and how often you can contact a customer, ensuring you avoid compliance violations.

For example, you can restrict the AI from contacting customers during specific hours or prevent it from using inappropriate language.

The key benefits of voice AI in debt collection go beyond automation. With increased collection rates, better compliance, and 24/7 availability, voice AI streamlines your debt recovery process while strengthening customer relationships. By adopting this technology, you’re not just improving efficiency—you’re transforming how you engage with customers and recover payments.

Use Cases of Conversational Voice AI in Debt Collection

Let’s explore some specific use cases of conversational voice AI that demonstrate how it can enhance your debt collection process.

Automated Payment Reminders

One of the most straightforward applications of voice AI is sending automated payment reminders. You can program the system to send personalized reminders based on the customer’s payment history, and it will deliver these reminders in a respectful, empathetic tone.

The AI can also include payment links or details on resolving the debt, streamlining the process for both you and your customers. Rifa AI excels at sending personalized and timely payment reminders, improving the chances of on-time payments, and reducing the number of overdue accounts.

Payment Plan Negotiations

Debt collection isn’t always about getting the full payment in one go. Conversational voice AI can help you offer flexible payment plans. The AI can engage with customers to assess their ability to pay and propose customized repayment options. This makes the process more flexible, and customers feel more in control of how they resolve their debt.

Handling Queries and Dispute Resolution

Voice AI can also handle simple customer queries such as confirming outstanding balances or providing details on payment history. If a customer disputes a debt, the AI can explain the details of the charge in a clear and professional manner. For more complicated issues, the AI can smoothly transfer the customer to a human agent who can address the situation in greater detail.

Rifa AI can efficiently handle routine inquiries and provide clear explanations regarding debts, freeing up human agents to focus on more complex dispute resolutions.

Use of Virtual Assistants in Debt Collection

With conversational voice AI-powered virtual assistants, you can offer 24/7 support for your customers. These assistants handle routine inquiries, provide payment reminders, and suggest repayment options, freeing up your human agents for more complex tasks.

By offering a non-confrontational way to manage debt, virtual assistants help improve customer satisfaction and increase payment compliance while streamlining your processes. Rifa AI's advanced analytics can also provide insights into customer behavior and preferences, allowing for more targeted and effective debt-collection strategies.

Real Estate Debt Collections

In real estate, conversational voice AI can help you manage mortgage payments, property fees, and loan-related queries more effectively. These systems automate payment reminders, assist in negotiating payment plans, and maintain accurate records.

With AI handling these tasks, you can improve efficiency, ensure timely follow-ups, and keep client relationships positive, all while reducing the workload on your human agents.

Intelligent Document Processing in Debt Collection

Using Intelligent Document Processing (IDP) with conversational voice AI, you can automate the extraction of key information from loan agreements, contracts, and payment records. This reduces manual errors and makes it easier for you to access important data quickly.

Combining IDP with voice AI boosts efficiency, accelerates decision-making, and supports accurate debt recovery while simplifying document management. For example, the virtual assistant could use information extracted by the IDP to answer customer queries about their loan terms. Rifa AI's focus on security ensures that sensitive financial information is handled carefully.

Challenges in the Implementation of Voice AI

Although conversational voice AI is revolutionizing debt collection, there are some challenges you will need to consider when implementing this technology. They are:

Data Privacy and Security

Debt collection involves sensitive information, making security and privacy top priorities.

Voice AI systems must comply with data protection laws such as GDPR and CCPA.

You should implement strict encryption protocols, secure data storage, and robust access controls.

Handling Complex Situations

Conversational AI works well for routine tasks, but complex customer situations might still require a human touch.

If a customer disputes a debt or requests a highly personalized repayment plan, the AI might not effectively address these nuances.

Provide an option for your customers to escalate issues to a human agent so that they can be comfortable with discussing sensitive issues.

Voice Recognition Limitations

Although NLP technology has made great strides, voice recognition isn’t perfect.

Accents, background noise, or unclear speech can pose challenges.

You must invest in a high-quality voice AI system trained to handle diverse accents and unclear speech for smooth and accurate communication.

Customer Acceptance

Some customers may feel uneasy interacting with AI, especially when dealing with sensitive matters like debt.

While conversational voice AI can sound natural, some customers may prefer human interaction.

Offer your customers the option to speak with a live agent to create a hybrid solution where AI handles basic tasks, and humans step in for more complex matters.

Rifa AI can improve your debt collection by automating 70% of your processes, reducing human error, and guaranteeing real-time data accuracy. We adhere to laws like GDPR and protect sensitive financial data with our advanced encryption. Take advantage of predictive analytics to maximize collections and compliance. Use Rifa AI to revolutionize your operations, cut expenses, and attain near-perfect accuracy in a matter of days.

Conclusion

How voice AI transforms debt collection is about improving the overall customer experience while increasing efficiency. By automating repetitive tasks, offering empathy in communication, and scaling your operations, voice AI helps you collect debts more effectively. It is also helpful in reducing costs and building trust with customers.

While the technology has its challenges, the advantages far outweigh the drawbacks. Voice AI can make debt collection a smoother, more efficient process for your business and your customers while staying compliant with regulations.

Rifa AI provides a streamlined, affordable, personalized debt collection approach, boosting efficiency and customer satisfaction. Utilizing real-time data, seamless integration across multiple communication channels, and a fully compliant, automated platform, Rifa AI is a reliable solution for debt recovery and other financial tasks.

Given the widespread issue of outstanding credit card debt, where traditional manual processes struggle with accuracy and implementing automated solutions, Rifa AI offers a direct and effective solution without API integration. Discover the next generation of debt collection. Book a demo to see how Rifa AI can transform your financial operations and substantially reduce costs.

Feb 19, 2025

Feb 19, 2025

Feb 19, 2025