Proven Strategies to Boost Debt Collection Efficiency

Proven Strategies to Boost Debt Collection Efficiency

Proven Strategies to Boost Debt Collection Efficiency

Proven Strategies to Boost Debt Collection Efficiency

Anant Sharma

Anant Sharma

Anant Sharma

Struggling with overdue invoices and slow-paying customers? You are not alone! Many businesses face difficulty collecting outstanding debts, leading to cash flow disruptions and financial strain. Without an efficient debt collection process, unpaid invoices pile up, affecting profitability and business growth. But the good news is that you can turn things around and recover payments more effectively with the right strategies.

Improving your debt collection process isn't just about making more calls or sending endless reminders—it’s about adopting smart, efficient, and legally compliant methods that get results. In this blog, you will discover proven strategies to boost debt collection efficiency, reduce bad debts, and strengthen your company’s financial stability. You can achieve these goals all while maintaining positive customer relationships. Whether dealing with a handful of overdue accounts or managing large-scale collections, these strategies will help you recover payments faster and with less effort. Let’s dive in!

What is Debt Collection?

Debt collection is the process of recovering unpaid debts from individuals or businesses that have failed to meet their financial obligations. It typically involves contacting debtors, sending reminders, negotiating repayment terms, and, in extreme cases, taking legal action.

There are two primary types of debt collection:

In-house collections- Businesses manage the process internally through their credit or accounts receivable departments.

Third-party collections- External debt collection agencies handle overdue accounts on behalf of businesses.

Effective debt collection requires a structured approach and clear communication. It should also comply with regulations such as the Fair Debt Collection Practices Act (FDCPA) to avoid legal complications. Without a proper strategy, businesses risk increasing bad debt write-offs, affecting profitability.

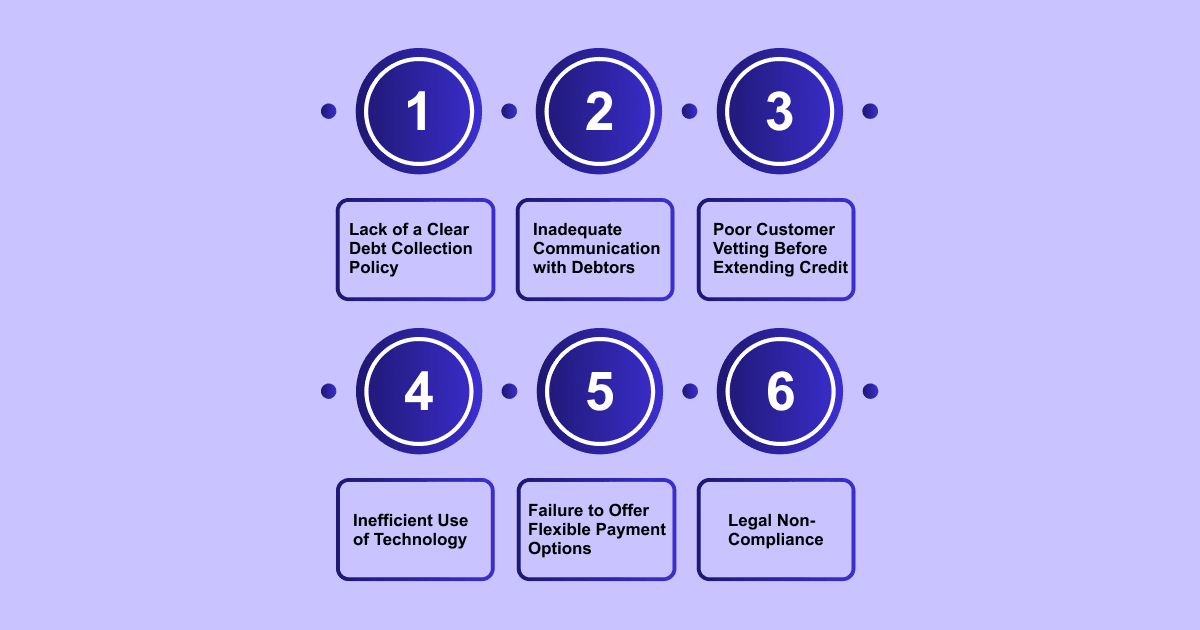

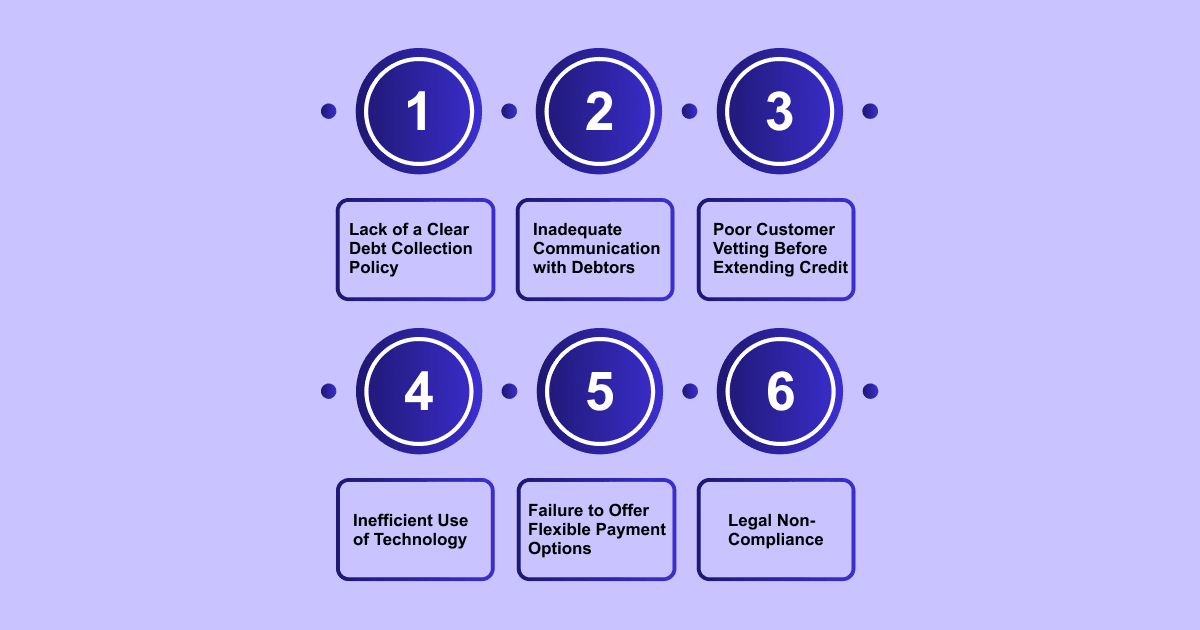

Causes of Low Collection Efficiency for Creditors

Many businesses struggle with recovering overdue payments due to several avoidable mistakes. Understanding these pitfalls will help you refine your approach and boost debt collection efficiency.

Lack of a Clear Debt Collection Policy

A poorly defined or inconsistent collection policy leads to confusion and delays. Without a structured plan, your business might fail to follow up on debts at the right time, reducing recovery chances.

Inadequate Communication with Debtors

Ignoring follow-ups or using ineffective communication methods can make debtors less likely to prioritize payments. Failing to educate customers about their payment obligations can lead to misunderstandings and disputes.

Poor Customer Vetting Before Extending Credit

Extending credit without assessing a customer’s financial health increases the risk of non-payment. If you don’t conduct credit checks, you may end up lending to high-risk customers who are unlikely to pay on time.

Inefficient Use of Technology

Manually tracking debts or relying on outdated systems slows down collection efforts. You must utilize automated payment reminders, CRM tools, or debt collection software to keep up with follow-ups, leading to lower recovery rates.

Failure to Offer Flexible Payment Options

Rigid repayment structures can make it difficult for debtors to settle their balances. Offering multiple payment channels and installment plans increases the possibility of collecting overdue amounts.

Legal Non-Compliance and Poor Documentation

Not keeping accurate records of communication and payment agreements can lead to legal disputes. Non-compliance with debt collection laws can also result in penalties or lawsuits, further reducing efficiency.

To overcome these challenges, businesses must adopt structured and effective debt collection strategies.

Reduce your debt collection costs with Rifa AI. Automate 70% of your process, eliminate errors, and get real-time data. We protect your data with advanced encryption and ensure GDPR compliance. Predictive analytics optimize collections and compliance. Transform your process and achieve near-perfect accuracy in a few days.

Let’s discuss these debt collection strategies in detail

Proven Strategies to Improve Your Debt Collection Efficiency

To boost debt collection efficiency, you need a mix of proactive planning, effective communication, and modern technology. Here are some tested strategies to improve your collection success rate:

1. Establish a Clear Debt Collection Policy

A well-defined policy ensures consistency and improves efficiency. Your policy should include:

Payment terms and conditions

Clear steps for handling overdue accounts

Escalation procedures for unpaid debts

Legal guidelines for compliance

Ensure that your team understands and follows the policy to maintain a structured approach to debt collection.

2. Screen Customers Before Extending Credit

Before granting credit, conduct thorough background checks on potential customers. Use credit reports, financial statements, and references to assess their repayment ability. Establish clear credit limits based on their risk level to reduce future collection challenges.

3. Communicate Proactively and Clearly

Effective communication prevents misunderstandings and encourages timely payments. Follow these best practices:

Send reminders before due dates- A simple email, text, or call before the due date encourages prompt payment.

Be professional and firm- Use clear and respectful language to maintain a good customer relationship while emphasizing the importance of paying on time.

Offer assistance if needed – If a customer faces financial difficulty, negotiate a feasible repayment plan to prevent the debt from becoming unmanageable.

4. Use Automated Payment Reminders

Utilizing technology saves time and improves debt collection efficiency. Automated payment reminders via emails, SMS, or phone calls keep debts top-of-mind for customers and reduce late payments. Consider investing in accounts receivable software that automatically tracks outstanding invoices and schedules follow-ups.

Rifa AI offers features like automated reminders and personalized communication that can significantly streamline this process. By using Rifa AI, you can automate much of your collection process, boosting recovery rates with minimal effort.

5. Offer Multiple Payment Options

Make it easy for customers to pay by providing multiple payment methods, such as:

Online payment portals

Bank transfers

Mobile payment apps

Installment plans for larger balances

Flexible options increase the possibility of receiving payments on time.

6. Train Your Debt Collection Team

A well-trained team improves collection success. Train staff on:

Negotiation Tactics: Teach your team to negotiate with empathy, listen actively, and offer flexible payment solutions that work for both parties. This helps build relationships and resolve issues constructively.

Legal and Ethical Practices: Ensure they understand relevant laws like the Fair Debt Collection Practices Act (FDCPA) to avoid harassment or illegal practices, keeping your company compliant and respectful.

Conflict Resolution: Equip your team with strategies to de-escalate tense situations, stay calm, and handle objections, turning conflicts into resolutions without damaging relationships.

Using Collection Software: Train them to efficiently use software to automate tasks, track communications, and manage accounts, improving efficiency and reducing errors.

Empowered and well-trained employees are more confident and productive in recovering debts.

7. Act Quickly on Overdue Accounts

The longer a debt remains unpaid, the harder it is to collect. Implement a structured follow-up timeline:

Day 1-30: Send friendly reminders through different channels.

Day 31-60: Increase communication frequency and offer payment arrangements.

Day 61-90: Escalate to a senior representative or external collection agency if necessary.

Consistent follow-ups keep customers accountable and increase the chances of debt recovery.

8. Work with a Debt Collection Agency When Necessary

Hiring a reputed third-party collection agency can help recover unpaid debts if internal efforts fail. Agencies have specialized expertise and legal authority to pursue payments more aggressively while remaining compliant with regulations.

9. Keep Detailed Records of All Interactions

Document every communication, agreement, and payment attempt. Maintain accurate records of:

Emails and phone conversations with debtors

Payment agreements and revised terms

Missed deadlines and escalation actions

Documenting interactions with customers protects your business from disputes and legal issues.

10. Stay Legally Compliant

Ensure your debt collection practices align with legal requirements. Make sure that you are complying with laws such as the FDCPA. This will help you prevent lawsuits and maintain ethical standards.

Always verify local and industry-specific debt collection regulations and maintain lawful practices. Rifa AI can assist with compliance by adhering to all the regulations.

Rifa's AI automation capabilities can help you increase debt collection by streamlining 70% of procedures, achieving 99% accuracy, and saving over 200 hours per week without requiring API interaction. Reduce expenses by up to 70% and deploy in a matter of days. Are you prepared to change? Allow Rifa AI to guide you to success!

Now, let’s discuss how you can choose the most effective debt collection strategy that is suitable for you.

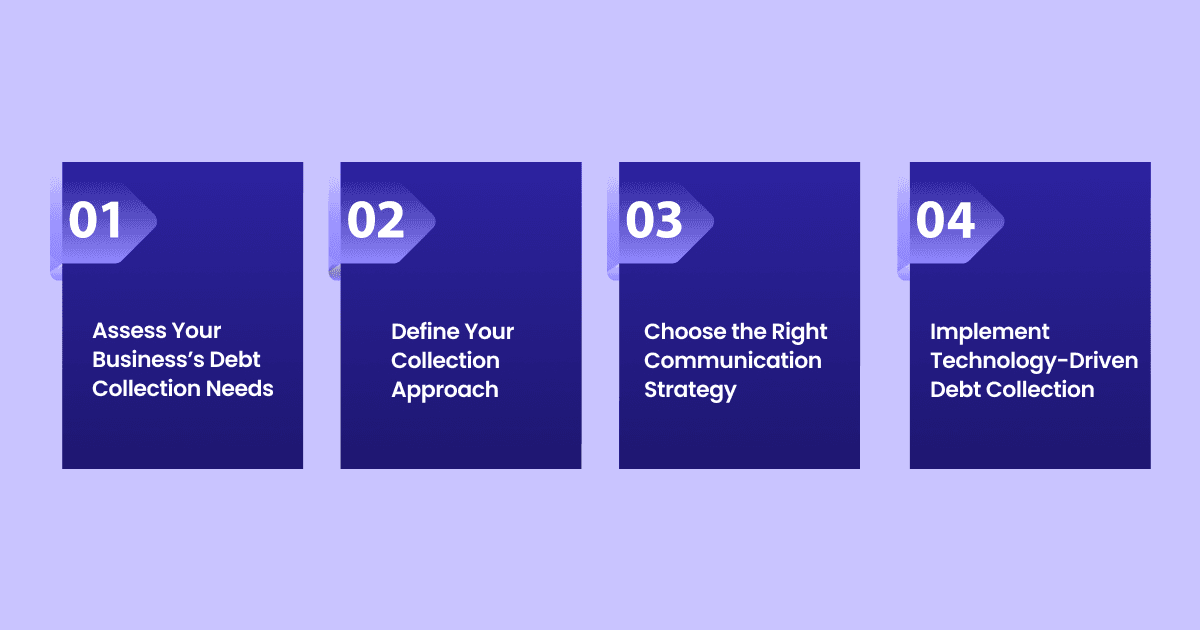

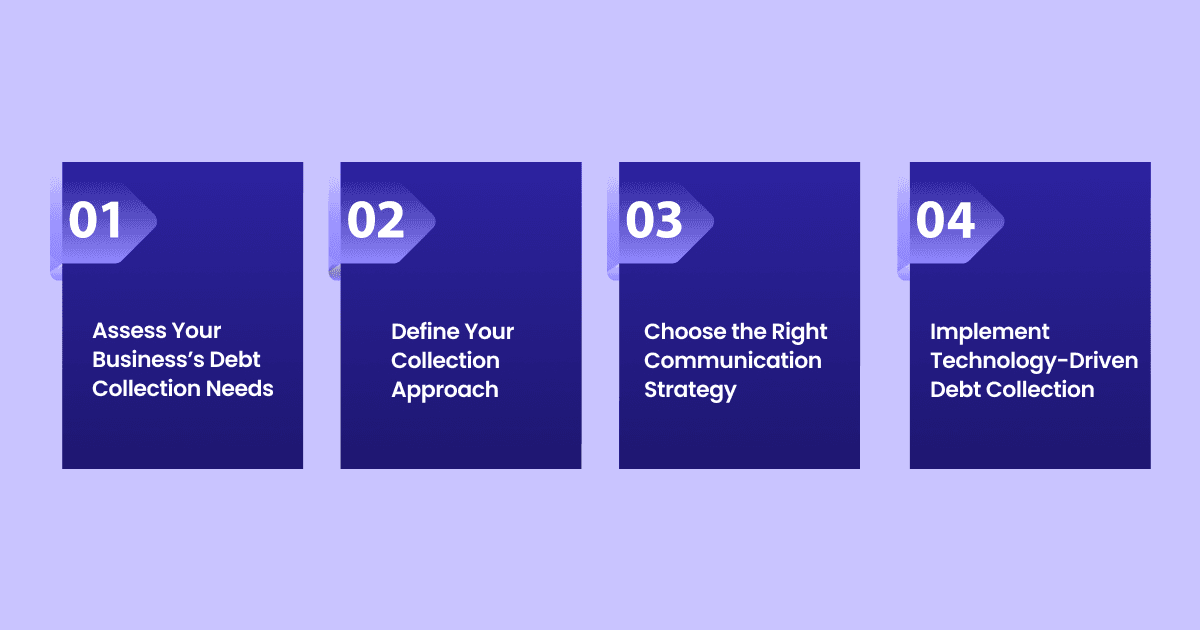

How to Choose the Most Effective Debt Collection Strategy?

The right debt collection strategy is crucial for improving recovery rates while maintaining positive customer relationships. A well-planned approach ensures that overdue payments are collected efficiently, minimizing financial risks. However, not all businesses require the same collection methods. Your strategy should align with your customer base, industry, and outstanding debt volume.

Here’s how to choose the right strategy for your business:

Assess Your Business’s Debt Collection Needs

Before implementing a strategy, analyze your debt collection challenges and needs. Consider the following:

Volume of overdue accounts- Are you dealing with a high number of small debts or a few large ones?

Average debt age- Older debts are harder to collect, requiring more aggressive tactics.

Industry regulations- Some industries have strict rules governing debt recovery practices.

Customer profile- Are your customers individuals, small businesses, or large corporations? Different customer types require different collection approaches.

Understanding these factors will help you tailor your collection strategy to your business model.

Define Your Collection Approach: In-House vs. Outsourced Collection

Businesses can handle debt collection internally or outsource it to a third-party agency. The best choice depends on your company’s resources, expertise, and the complexity of outstanding debts.

In-House Debt Collection

An internal collection team works best when:

You have trained staff capable of handling collection calls professionally.

Debts are relatively new, and customers have a history of paying.

Your business wants to maintain direct customer relationships.

You have access to collection software for automated reminders and tracking. Rifa AI can enhance in-house collections with its AI-powered automation and personalized communication features.

Key Strategies for In-House Collection

Implement automated email, SMS, and phone call reminders.

Offer early settlement discounts to encourage prompt payments.

Establish a clear escalation process for unpaid debts.

Outsourced Debt Collection

Third-party collection agencies are a better option when:

Debts have been overdue for 90+ days: When debts remain unpaid for 90+ days, they often become harder to recover, as customers may have different priorities or financial circumstances. Collection agencies specialize in dealing with aged debt, using advanced strategies and persistence to increase the possibility of recovery.

Internal collection efforts have been unsuccessful: A third-party agency can offer a fresh perspective and advanced techniques if your internal team has no possible avenues without success. Their experience with difficult cases can provide the breakthrough needed, as can access more tools and resources to handle challenging situations.

Your business lacks the resources to manage collections effectively: Managing collections requires both time and expertise—resources that may not be available if your business is already stretched thin. Outsourcing to a collection agency allows you to focus on core operations while they handle the collections process with dedicated professionals and technology.

You need legal expertise for difficult cases: Legal expertise is often necessary to navigate court processes or negotiations for particularly complex or high-value accounts. Collection agencies often have in-house legal teams or strong partnerships with attorneys, ensuring that you handle difficult cases efficiently and within the bounds of the law.

Key Considerations When Choosing a Collection Agency

Reputation and Success Rate in Your Industry: Choose an agency with a proven track record of success in your specific industry. They will better understand the nuances of your customer base and customize their approach accordingly, increasing the chances of successful recovery.

Compliance with Local and International Debt Collection Laws: Ensure the agency complies with all relevant local and international regulations, like the Fair Debt Collection Practices Act (FDCPA). This not only keeps your business legally protected but also ensures ethical treatment of your customers, preventing potential legal issues.

Fee Structure (Fixed Fee, Commission-Based, or Contingency-Based): Understand the agency’s fee structure to determine what works best for your budget and goals. A fixed fee might be better if you want predictable costs, while a commission or contingency-based structure might align with a performance-driven approach, making it a lower-risk option.

Communication Methods and Ethical Collection Practices: Make sure the agency uses transparent and respectful communication methods, maintaining ethical standards in every interaction. The way they handle your customers can directly impact your brand reputation. Hence, it’s important to partner with an agency that values professionalism and customer care while pursuing collections.

Outsourcing allows businesses to focus on core operations while ensuring professional debt recovery.

Choose the Right Communication Strategy

How you communicate with debtors significantly impacts your success rate. Tailoring communication based on debtor behavior increases the possibility of timely payments.

Soft Collection Approach (For Early-Stage Debts)

A diplomatic, customer-friendly approach works best for accounts that are recently overdue. Soft-collection strategies include:

Sending polite payment reminders via email or SMS.

Calling customers to discuss payment difficulties and offer solutions.

Offering flexible payment plans to accommodate financial hardships.

This approach prevents unnecessary conflicts and preserves customer relationships.

Firm Collection Approach (For Long-Overdue Debts)

If a debtor ignores multiple reminders, a more assertive approach is required. Firm-collection strategies include:

Sending formal demand letters outlining the consequences of non-payment.

Increasing call frequency and involving senior representatives.

Issuing final warnings before escalating to legal action.

Maintaining professionalism is key to ensuring compliance with debt collection laws.

Implement Technology-Driven Debt Collection

Using technology streamlines debt collection efforts and improves efficiency. The right tools allow you to automate follow-ups, track payments, and analyze debtor behavior.

Debt Collection Software- It automates reminders, records communications, and provides real-time tracking of overdue accounts.

AI-Powered Chatbots- They engage with debtors via automated messaging, reducing manual workload.

Online Payment Portals- They allow customers to make instant payments through multiple channels.

Data Analytics Tools- These tools help predict payment behavior and prioritize high-risk accounts.

By integrating these technologies, you can boost debt collection efficiency while reducing operational costs.

You can boost debt collection efficiency by utilizing technology, using the right communication methods, and aligning with legal requirements while maintaining strong customer relationships.

Conclusion

Boosting debt collection efficiency requires a strategic approach that combines proactive communication, technology integration, and legal compliance. Implementing a clear policy, training your team, and utilizing automation can significantly improve recovery rates and maintain healthy cash flow.

The key is to act early, be persistent yet professional, and offer flexible payment solutions to debtors. By following these proven strategies, your business can boost debt collection efficiency, reduce financial risk, and strengthen its overall economic stability.

Utilize tools like Rifa AI, which integrates AI-driven features to streamline collections, helps ensure your business stays organized and maximizes recovery rates while minimizing manual effort. Integrating technology and taking a strategic approach can significantly improve your debt recovery process, creating a more efficient and profitable business.

With over a million accounts carrying credit card debt, manual debt collection processes are only 60% accurate, and traditional automation through API integrations is too slow. Rifa AI solves these problems directly! Don't wait—join the revolution of debt collection.

Book a demo and discover how Rifa AI can transform your financial operations and save you a significant amount of money.

Struggling with overdue invoices and slow-paying customers? You are not alone! Many businesses face difficulty collecting outstanding debts, leading to cash flow disruptions and financial strain. Without an efficient debt collection process, unpaid invoices pile up, affecting profitability and business growth. But the good news is that you can turn things around and recover payments more effectively with the right strategies.

Improving your debt collection process isn't just about making more calls or sending endless reminders—it’s about adopting smart, efficient, and legally compliant methods that get results. In this blog, you will discover proven strategies to boost debt collection efficiency, reduce bad debts, and strengthen your company’s financial stability. You can achieve these goals all while maintaining positive customer relationships. Whether dealing with a handful of overdue accounts or managing large-scale collections, these strategies will help you recover payments faster and with less effort. Let’s dive in!

What is Debt Collection?

Debt collection is the process of recovering unpaid debts from individuals or businesses that have failed to meet their financial obligations. It typically involves contacting debtors, sending reminders, negotiating repayment terms, and, in extreme cases, taking legal action.

There are two primary types of debt collection:

In-house collections- Businesses manage the process internally through their credit or accounts receivable departments.

Third-party collections- External debt collection agencies handle overdue accounts on behalf of businesses.

Effective debt collection requires a structured approach and clear communication. It should also comply with regulations such as the Fair Debt Collection Practices Act (FDCPA) to avoid legal complications. Without a proper strategy, businesses risk increasing bad debt write-offs, affecting profitability.

Causes of Low Collection Efficiency for Creditors

Many businesses struggle with recovering overdue payments due to several avoidable mistakes. Understanding these pitfalls will help you refine your approach and boost debt collection efficiency.

Lack of a Clear Debt Collection Policy

A poorly defined or inconsistent collection policy leads to confusion and delays. Without a structured plan, your business might fail to follow up on debts at the right time, reducing recovery chances.

Inadequate Communication with Debtors

Ignoring follow-ups or using ineffective communication methods can make debtors less likely to prioritize payments. Failing to educate customers about their payment obligations can lead to misunderstandings and disputes.

Poor Customer Vetting Before Extending Credit

Extending credit without assessing a customer’s financial health increases the risk of non-payment. If you don’t conduct credit checks, you may end up lending to high-risk customers who are unlikely to pay on time.

Inefficient Use of Technology

Manually tracking debts or relying on outdated systems slows down collection efforts. You must utilize automated payment reminders, CRM tools, or debt collection software to keep up with follow-ups, leading to lower recovery rates.

Failure to Offer Flexible Payment Options

Rigid repayment structures can make it difficult for debtors to settle their balances. Offering multiple payment channels and installment plans increases the possibility of collecting overdue amounts.

Legal Non-Compliance and Poor Documentation

Not keeping accurate records of communication and payment agreements can lead to legal disputes. Non-compliance with debt collection laws can also result in penalties or lawsuits, further reducing efficiency.

To overcome these challenges, businesses must adopt structured and effective debt collection strategies.

Reduce your debt collection costs with Rifa AI. Automate 70% of your process, eliminate errors, and get real-time data. We protect your data with advanced encryption and ensure GDPR compliance. Predictive analytics optimize collections and compliance. Transform your process and achieve near-perfect accuracy in a few days.

Let’s discuss these debt collection strategies in detail

Proven Strategies to Improve Your Debt Collection Efficiency

To boost debt collection efficiency, you need a mix of proactive planning, effective communication, and modern technology. Here are some tested strategies to improve your collection success rate:

1. Establish a Clear Debt Collection Policy

A well-defined policy ensures consistency and improves efficiency. Your policy should include:

Payment terms and conditions

Clear steps for handling overdue accounts

Escalation procedures for unpaid debts

Legal guidelines for compliance

Ensure that your team understands and follows the policy to maintain a structured approach to debt collection.

2. Screen Customers Before Extending Credit

Before granting credit, conduct thorough background checks on potential customers. Use credit reports, financial statements, and references to assess their repayment ability. Establish clear credit limits based on their risk level to reduce future collection challenges.

3. Communicate Proactively and Clearly

Effective communication prevents misunderstandings and encourages timely payments. Follow these best practices:

Send reminders before due dates- A simple email, text, or call before the due date encourages prompt payment.

Be professional and firm- Use clear and respectful language to maintain a good customer relationship while emphasizing the importance of paying on time.

Offer assistance if needed – If a customer faces financial difficulty, negotiate a feasible repayment plan to prevent the debt from becoming unmanageable.

4. Use Automated Payment Reminders

Utilizing technology saves time and improves debt collection efficiency. Automated payment reminders via emails, SMS, or phone calls keep debts top-of-mind for customers and reduce late payments. Consider investing in accounts receivable software that automatically tracks outstanding invoices and schedules follow-ups.

Rifa AI offers features like automated reminders and personalized communication that can significantly streamline this process. By using Rifa AI, you can automate much of your collection process, boosting recovery rates with minimal effort.

5. Offer Multiple Payment Options

Make it easy for customers to pay by providing multiple payment methods, such as:

Online payment portals

Bank transfers

Mobile payment apps

Installment plans for larger balances

Flexible options increase the possibility of receiving payments on time.

6. Train Your Debt Collection Team

A well-trained team improves collection success. Train staff on:

Negotiation Tactics: Teach your team to negotiate with empathy, listen actively, and offer flexible payment solutions that work for both parties. This helps build relationships and resolve issues constructively.

Legal and Ethical Practices: Ensure they understand relevant laws like the Fair Debt Collection Practices Act (FDCPA) to avoid harassment or illegal practices, keeping your company compliant and respectful.

Conflict Resolution: Equip your team with strategies to de-escalate tense situations, stay calm, and handle objections, turning conflicts into resolutions without damaging relationships.

Using Collection Software: Train them to efficiently use software to automate tasks, track communications, and manage accounts, improving efficiency and reducing errors.

Empowered and well-trained employees are more confident and productive in recovering debts.

7. Act Quickly on Overdue Accounts

The longer a debt remains unpaid, the harder it is to collect. Implement a structured follow-up timeline:

Day 1-30: Send friendly reminders through different channels.

Day 31-60: Increase communication frequency and offer payment arrangements.

Day 61-90: Escalate to a senior representative or external collection agency if necessary.

Consistent follow-ups keep customers accountable and increase the chances of debt recovery.

8. Work with a Debt Collection Agency When Necessary

Hiring a reputed third-party collection agency can help recover unpaid debts if internal efforts fail. Agencies have specialized expertise and legal authority to pursue payments more aggressively while remaining compliant with regulations.

9. Keep Detailed Records of All Interactions

Document every communication, agreement, and payment attempt. Maintain accurate records of:

Emails and phone conversations with debtors

Payment agreements and revised terms

Missed deadlines and escalation actions

Documenting interactions with customers protects your business from disputes and legal issues.

10. Stay Legally Compliant

Ensure your debt collection practices align with legal requirements. Make sure that you are complying with laws such as the FDCPA. This will help you prevent lawsuits and maintain ethical standards.

Always verify local and industry-specific debt collection regulations and maintain lawful practices. Rifa AI can assist with compliance by adhering to all the regulations.

Rifa's AI automation capabilities can help you increase debt collection by streamlining 70% of procedures, achieving 99% accuracy, and saving over 200 hours per week without requiring API interaction. Reduce expenses by up to 70% and deploy in a matter of days. Are you prepared to change? Allow Rifa AI to guide you to success!

Now, let’s discuss how you can choose the most effective debt collection strategy that is suitable for you.

How to Choose the Most Effective Debt Collection Strategy?

The right debt collection strategy is crucial for improving recovery rates while maintaining positive customer relationships. A well-planned approach ensures that overdue payments are collected efficiently, minimizing financial risks. However, not all businesses require the same collection methods. Your strategy should align with your customer base, industry, and outstanding debt volume.

Here’s how to choose the right strategy for your business:

Assess Your Business’s Debt Collection Needs

Before implementing a strategy, analyze your debt collection challenges and needs. Consider the following:

Volume of overdue accounts- Are you dealing with a high number of small debts or a few large ones?

Average debt age- Older debts are harder to collect, requiring more aggressive tactics.

Industry regulations- Some industries have strict rules governing debt recovery practices.

Customer profile- Are your customers individuals, small businesses, or large corporations? Different customer types require different collection approaches.

Understanding these factors will help you tailor your collection strategy to your business model.

Define Your Collection Approach: In-House vs. Outsourced Collection

Businesses can handle debt collection internally or outsource it to a third-party agency. The best choice depends on your company’s resources, expertise, and the complexity of outstanding debts.

In-House Debt Collection

An internal collection team works best when:

You have trained staff capable of handling collection calls professionally.

Debts are relatively new, and customers have a history of paying.

Your business wants to maintain direct customer relationships.

You have access to collection software for automated reminders and tracking. Rifa AI can enhance in-house collections with its AI-powered automation and personalized communication features.

Key Strategies for In-House Collection

Implement automated email, SMS, and phone call reminders.

Offer early settlement discounts to encourage prompt payments.

Establish a clear escalation process for unpaid debts.

Outsourced Debt Collection

Third-party collection agencies are a better option when:

Debts have been overdue for 90+ days: When debts remain unpaid for 90+ days, they often become harder to recover, as customers may have different priorities or financial circumstances. Collection agencies specialize in dealing with aged debt, using advanced strategies and persistence to increase the possibility of recovery.

Internal collection efforts have been unsuccessful: A third-party agency can offer a fresh perspective and advanced techniques if your internal team has no possible avenues without success. Their experience with difficult cases can provide the breakthrough needed, as can access more tools and resources to handle challenging situations.

Your business lacks the resources to manage collections effectively: Managing collections requires both time and expertise—resources that may not be available if your business is already stretched thin. Outsourcing to a collection agency allows you to focus on core operations while they handle the collections process with dedicated professionals and technology.

You need legal expertise for difficult cases: Legal expertise is often necessary to navigate court processes or negotiations for particularly complex or high-value accounts. Collection agencies often have in-house legal teams or strong partnerships with attorneys, ensuring that you handle difficult cases efficiently and within the bounds of the law.

Key Considerations When Choosing a Collection Agency

Reputation and Success Rate in Your Industry: Choose an agency with a proven track record of success in your specific industry. They will better understand the nuances of your customer base and customize their approach accordingly, increasing the chances of successful recovery.

Compliance with Local and International Debt Collection Laws: Ensure the agency complies with all relevant local and international regulations, like the Fair Debt Collection Practices Act (FDCPA). This not only keeps your business legally protected but also ensures ethical treatment of your customers, preventing potential legal issues.

Fee Structure (Fixed Fee, Commission-Based, or Contingency-Based): Understand the agency’s fee structure to determine what works best for your budget and goals. A fixed fee might be better if you want predictable costs, while a commission or contingency-based structure might align with a performance-driven approach, making it a lower-risk option.

Communication Methods and Ethical Collection Practices: Make sure the agency uses transparent and respectful communication methods, maintaining ethical standards in every interaction. The way they handle your customers can directly impact your brand reputation. Hence, it’s important to partner with an agency that values professionalism and customer care while pursuing collections.

Outsourcing allows businesses to focus on core operations while ensuring professional debt recovery.

Choose the Right Communication Strategy

How you communicate with debtors significantly impacts your success rate. Tailoring communication based on debtor behavior increases the possibility of timely payments.

Soft Collection Approach (For Early-Stage Debts)

A diplomatic, customer-friendly approach works best for accounts that are recently overdue. Soft-collection strategies include:

Sending polite payment reminders via email or SMS.

Calling customers to discuss payment difficulties and offer solutions.

Offering flexible payment plans to accommodate financial hardships.

This approach prevents unnecessary conflicts and preserves customer relationships.

Firm Collection Approach (For Long-Overdue Debts)

If a debtor ignores multiple reminders, a more assertive approach is required. Firm-collection strategies include:

Sending formal demand letters outlining the consequences of non-payment.

Increasing call frequency and involving senior representatives.

Issuing final warnings before escalating to legal action.

Maintaining professionalism is key to ensuring compliance with debt collection laws.

Implement Technology-Driven Debt Collection

Using technology streamlines debt collection efforts and improves efficiency. The right tools allow you to automate follow-ups, track payments, and analyze debtor behavior.

Debt Collection Software- It automates reminders, records communications, and provides real-time tracking of overdue accounts.

AI-Powered Chatbots- They engage with debtors via automated messaging, reducing manual workload.

Online Payment Portals- They allow customers to make instant payments through multiple channels.

Data Analytics Tools- These tools help predict payment behavior and prioritize high-risk accounts.

By integrating these technologies, you can boost debt collection efficiency while reducing operational costs.

You can boost debt collection efficiency by utilizing technology, using the right communication methods, and aligning with legal requirements while maintaining strong customer relationships.

Conclusion

Boosting debt collection efficiency requires a strategic approach that combines proactive communication, technology integration, and legal compliance. Implementing a clear policy, training your team, and utilizing automation can significantly improve recovery rates and maintain healthy cash flow.

The key is to act early, be persistent yet professional, and offer flexible payment solutions to debtors. By following these proven strategies, your business can boost debt collection efficiency, reduce financial risk, and strengthen its overall economic stability.

Utilize tools like Rifa AI, which integrates AI-driven features to streamline collections, helps ensure your business stays organized and maximizes recovery rates while minimizing manual effort. Integrating technology and taking a strategic approach can significantly improve your debt recovery process, creating a more efficient and profitable business.

With over a million accounts carrying credit card debt, manual debt collection processes are only 60% accurate, and traditional automation through API integrations is too slow. Rifa AI solves these problems directly! Don't wait—join the revolution of debt collection.

Book a demo and discover how Rifa AI can transform your financial operations and save you a significant amount of money.

Feb 19, 2025

Feb 19, 2025

Feb 19, 2025