Overcome Top Challenges Faced by Small Debt Collection Agencies

Overcome Top Challenges Faced by Small Debt Collection Agencies

Overcome Top Challenges Faced by Small Debt Collection Agencies

Overcome Top Challenges Faced by Small Debt Collection Agencies

Anant Sharma

Anant Sharma

Anant Sharma

Debt collection keeps your business running by ensuring unpaid accounts get settled. But if you’re a small agency, the process is a bit challenging. Competing with larger firms, managing compliance, and handling debtor resistance - all at the same time can slow down operations and limit growth.

You might struggle to keep up with evolving regulations or chase payments with outdated methods. Or, your team is stretched thin, and manual tasks are eating up valuable time. These challenges for your small debt collection agencies affect cash flow, client trust, and overall recovery rates.

This blog explores small debt collection agencies' biggest challenges and how you can overcome them. You’ll find practical strategies to improve efficiency, strengthen debtor communication, and increase collections. We’ll also tell you how Rifa AI could be the best solution for you. Keep Reading!

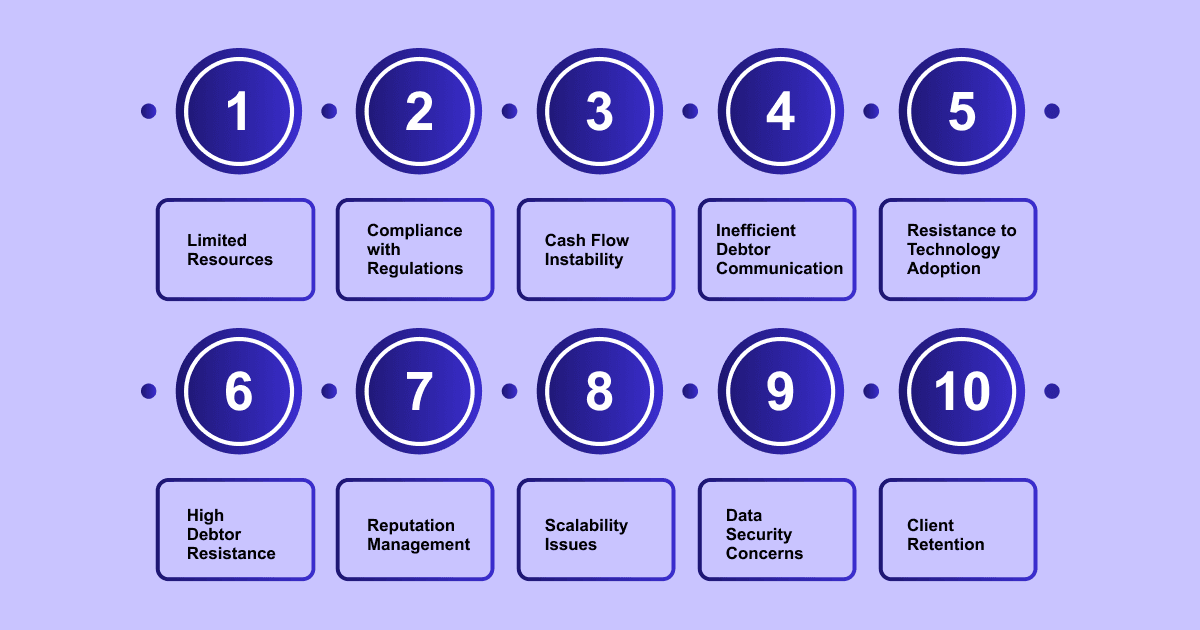

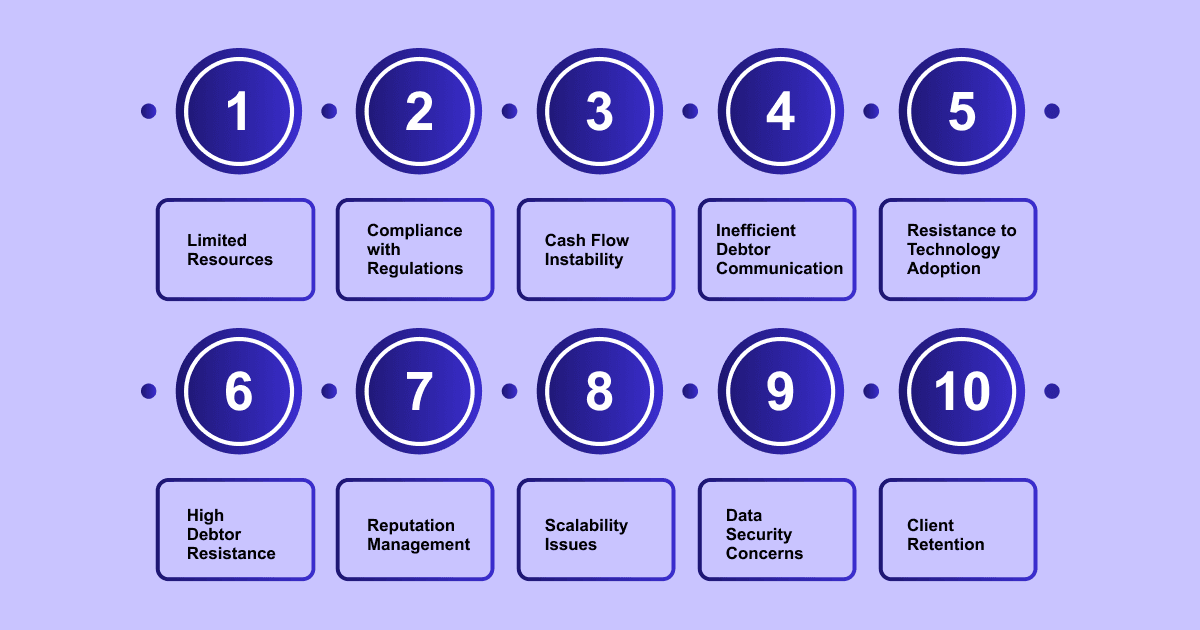

Challenges for Small Debt Collection Agencies and How to Overcome Them

As a debt collection agency, you should be ready to face various operational and financial hurdles. Without the right strategies, these challenges can impact recovery rates and client retention. Below are the most common challenges and practical solutions to address them.

1. Limited Resources

Small teams and tight budgets can slow down operations.

Running a debt collection agency with limited staff and funds is difficult. You need to process accounts, contact debtors, follow compliance rules, and manage client relationships— without the workforce or budget of larger agencies. Manual processes like sending collection notices and tracking payments take too much time. Accounts may go unaddressed if your team is overwhelmed, reducing collection rates.

For example, if your agency handles 500 accounts per month your team may struggle to follow up on every overdue payment. Without automation, staff members might spend hours making calls or sending emails manually, leaving little time for complex cases.

Solution:

Automate repetitive tasks like sending reminders, updating account statuses, and tracking payments. This frees up your team to focus on resolving difficult cases.

Use cost-effective tools like Rifa AI to manage accounts efficiently. It tracks debtor behavior, sends reminders, and prioritizes overdue accounts for follow-up. By integrating seamlessly with your systems, Rifa AI keeps everything up to date in real time, so you can take action before issues arise.

Prioritize high-value accounts while technology handles routine follow-ups. This helps improve recovery rates without adding extra staff.

Image CTA

Struggling with compliance, debtor engagement, or cash flow? Ensure faster recovery and better compliance, and automate collections with Rifa AI. Try It Today!

2. Compliance with Regulations

Laws change frequently, and staying compliant is critical.

Debt collection is a highly regulated industry, and many agencies often struggle to keep up with changing rules. Regulations like the Fair Debt Collection Practices Act (FDCPA) in the U.S. set strict guidelines on how and when you can contact debtors. Non-compliance can lead to fines, lawsuits, and damage to your agency’s reputation.

For example, in 2021, the CFPB (Consumer Financial Protection Bureau) introduced new rules limiting how often collectors can contact debtors by phone. If you’re unaware of these changes you might unknowingly violate the rule and face legal action.

Solution:

Use compliance-focused software to track legal updates in real-time. Automated alerts ensure your agency follows the latest regulations.

Train your staff regularly to avoid legal pitfalls. Simple mistakes, like contacting a debtor at the wrong time, can be costly. Regular training helps staff stay informed.

Document all communication with debtors. Having a clear record can protect your agency in case of disputes.

3. Cash Flow Instability

Delayed client payments cause operational instability.

Small agencies often rely on timely payments from clients to cover operational costs. However, clients may delay payments, leading to cash flow issues. Without steady revenue, it becomes difficult to pay employees, invest in technology, or grow your business.

If your agency collects debts on behalf of businesses but doesn’t receive its commission for months, you can struggle to stay afloat.

Solution:

Offer flexible payment plans to clients. Instead of waiting for lump-sum payments, consider installment options to maintain steady cash flow.

Automate invoicing and follow-ups to ensure timely payments. Late reminders can prompt clients to settle outstanding fees.

Use digital payment solutions to make transactions easier for clients. Faster payments mean better cash flow for your agency.

With Rifa AI, you can recover missing payments, and streamline your payment cycle and cash flow. Our AI agents extract info from different channels-emails, calls, and documents to keep your payments on time and follow up with clients.

4. Inefficient Debtor Communication

Outdated communication methods reduce debtor engagement.

Many small agencies still rely on traditional methods like phone calls and letters. However, debtors are more likely to respond to digital communication. A 2023 study found that SMS has a 98% open rate, while email responses are much lower. If your agency only uses phone calls, you may struggle to reach debtors efficiently. Well, this just means you need to weigh the effectiveness of different communication methods and use the best one.

Solution:

Use omnichannel strategies such as SMS, email, calls, and chat to improve engagement.

Personalize communication by addressing debtors by name and tailoring messages to their situation. This increases response rates.

Leverage automation to send reminders at optimal times. AI-driven communication tools like Rifa AI can determine the best time to contact debtors.

5. Resistance to Technology Adoption

Some agencies hesitate to adopt new technology due to costs or lack of expertise.

Many small agencies rely on outdated software or manual processes because they fear the costs of upgrading. Others worry that new tools will be too complex for their team. However, avoiding technology can put your agency at a disadvantage.

For example, when using spreadsheets for account tracking, you may struggle to scale as the number of cases grows. Without automation, follow-ups become inconsistent, and collection rates drop.

Solution:

Partner with platforms like Rifa AI that offer affordable, scalable solutions designed for small agencies.

Highlight the ROI of automation to your decision making partners or respective authorities by showing how technology improves efficiency and recovery rates. Agencies that use AI-driven tools often recover debts faster than those relying on manual methods. Help them understand why your teams need to be open to automation to operate and compete better.

Provide staff training to ensure a smooth transition. Most modern debt collection software is user-friendly and requires minimal technical expertise.

6. High Debtor Resistance

Some debtors intentionally delay or avoid repayment.

Many debtors are well-informed about consumer protection laws and may use legal loopholes to delay or avoid paying their debts. They might challenge the validity of the debt, request excessive documentation, or refuse to engage with collectors altogether. In some cases, they may block communication channels or claim financial hardship, making it difficult for your agency to collect payments.

For example, a debtor might invoke the Fair Debt Collection Practices Act (FDCPA) to dispute a debt and demand proof, forcing your agency to spend time gathering documentation. Without the right strategies, these situations can drag on, delaying recovery and increasing operational costs for you.

Solution:

Use AI-driven behavioral insights to predict debtor responses. Advanced analytics can assess a debtor’s likelihood to pay and suggest the best approach for engagement.

Train staff on handling objections and disputes professionally. You can conduct regular workshops, role-playing scenarios, and provide scripts for common objections. Incorporate conflict resolution techniques, active listening skills, and continuous feedback to ensure a professional, consistent approach. Having a structured approach helps resolve issues faster.

Offer digital self-service payment options to make repayment easier. Many debtors avoid direct confrontation but are willing to settle their debts when provided with a convenient online platform.

Maintain clear, well-documented records to respond quickly to disputes and prevent unnecessary delays.

7. Reputation Management

Public perception of debt collection agencies is often negative.

Many people view debt collectors as aggressive or unethical due to past industry practices. A single bad experience, whether real or perceived, can damage your agency’s reputation. Poor reviews, complaints to regulatory bodies, or negative word-of-mouth can deter potential clients from working with you.

For instance, if an agency is accused of harassing debtors with excessive calls, it could face legal consequences and loss of business. Today, a negative review can spread quickly and impact future contracts.

Solution:

Emphasize ethical collection practices by treating debtors with respect and fairness. Maintaining a professional tone increases cooperation and reduces complaints.

Use clear and transparent communication to explain debt obligations. Many disputes arise due to misunderstandings. Offer real-time updates and accessible support for clarifications. With Rifa AI’s omni-channel solutions you can provide detailed, easy-to-understand account summaries and use consistent, empathetic messaging across all channels.

Encourage satisfied clients to leave positive reviews and testimonials. A strong reputation builds trust and attracts new business.

Stay compliant with industry regulations to avoid legal trouble. Adhering to laws like the FDCPA protects both your agency and your reputation.

8. Scalability Issues

Expanding operations without sacrificing efficiency is difficult.

As your agency grows, so does the number of accounts to manage. Without scalable processes, increased workload can overwhelm your staff, slow down collections, and decrease overall performance. Many small agencies struggle to scale because they rely on manual processes that cannot keep up with growth.

For example, an agency that starts with 1,000 accounts may find it manageable with a small team. But if the number of accounts grows to 5,000, the same processes may no longer work, leading to missed follow-ups, delayed payments, and decreased recovery rates.

Solution:

Use cloud-based tools to handle increased workloads without overburdening staff. Cloud solutions allow you to scale operations seamlessly.

Automate routine tasks like follow-ups, payment tracking, and debtor categorization. Rifa AI does all this for you using AI-driven insights. This requires minimal manual effort and allows your staff to focus on complex recovery cases.

Develop standardized workflows to ensure efficiency as your agency grows. A structured process minimizes confusion and maintains high collection rates.

Monitor key performance metrics to identify bottlenecks and optimize operations.

9. Data Security Concerns

Debt collection agencies handle sensitive debtor information.

Data security is a major concern, especially with the rise of cyber threats. Collecting and storing personal financial data comes with risks, and failure to secure this information can lead to data breaches, legal penalties, and loss of client trust. Regulations such as the Gramm-Leach-Bliley Act (GLBA) and General Data Protection Regulation (GDPR) impose strict rules on data protection.

If you do not invest in proper security measures you may fall victim to hacking, phishing attacks, or internal leaks, putting debtor information at risk. A single breach can result in hefty fines and reputational damage.

Solution:

Use encryption and multi-layer security protocols to protect sensitive data. Encryption ensures that even if data is intercepted, it remains unreadable.

Store data on secure cloud platforms with built-in compliance features. Cloud-based security measures reduce the risk of unauthorized access.

Limit data access to authorized personnel only. Restricting access minimizes the risk of internal leaks.

Conduct regular security audits to identify vulnerabilities and strengthen protections. Proactive measures help prevent breaches before they occur.

Protect debtor data with enterprise-grade security! Rifa AI ensures 99% accuracy in data handling while maintaining strict compliance. Discover More

10. Client Retention

Competing with larger agencies makes client retention challenging.

Small agencies often struggle to retain clients when competing against larger, more established firms. Clients expect high collection rates, efficiency, and transparent reporting. If you cannot demonstrate value, clients may switch to competitors.

For example, a business working with a small agency might leave if they feel the collection process is too slow or unprofessional. Lack of personalized service or outdated technology can also drive clients away.

Solution:

Offer customized debt recovery strategies tailored to each client’s needs. Personalized solutions create stronger client relationships.

Provide detailed performance reports to show progress and collection rates. Clients want to see measurable results.

Use automation to improve efficiency and increase recovery rates. Clients are more likely to stay if they see high success rates.

Communicate regularly to keep clients informed and engaged. Keeping clients updated builds trust and long-term partnerships.

Overcoming these challenges for small debt collection agencies requires a mix of strategy, technology, and efficiency. By addressing these issues, you can improve collections, and strengthen client relationships, ensuring your agency grows in the long run.

Next, we’ll explore how Rifa AI can help small agencies tackle these challenges with smart, scalable solutions.

What is Rifa AI?

Rifa AI is a next-generation AI-driven debt collection platform designed to help agencies recover more debts, reduce costs, and improve efficiency—without increasing headcount. Tailored for small and mid-sized agencies, Rifa AI automates repetitive tasks, ensures compliance, and optimizes debtor communication for better engagement. You can set it up within days without any API integrations.

With Rifa AI, you can:

Recover More, Faster – 40% faster debt recovery using AI-powered automation.

Save Time & Reduce Costs – Automate manual workflows, saving 500+ hours weekly and cutting operational costs by up to 70%.

Maximize Compliance & Accuracy – AI-driven data extraction ensures 99% accuracy while keeping up with changing regulations.

Omnichannel Communication – Engage debtors through SMS, email, voice, and chatbots, doubling payment conversions.

Setup Quick & Easy – No API integration needed; get started in days, not months.

How Rifa AI Can Address These Challenges for You

Rifa AI offers tailored solutions to help you overcome various debt collection obstacles efficiently.

1. Scalable Solutions for Small Agencies

As your agency grows, managing increased workloads can be challenging. Rifa AI provides automation tools for reminders and follow-ups, allowing your team to handle more accounts without added strain.

2. Simplified Compliance

Rifa AI ensures compliance through real-time monitoring and automated, legally compliant responses, minimizing the risk of non-compliance.

3. Optimized Communication

With Rifa AI's omnichannel approach, you can manage data from emails, calls, and documents seamlessly. This enhances debtor engagement by reaching them through their preferred channels.

4. Predictive Analytics for Prioritization

Rifa AI uses advanced analytics to identify priority accounts based on debtor behavior and payment patterns, improving recovery rates.

5. Budget-Friendly Implementation

Rifa AI offers cost-effective solutions with quick deployment and no API integration, saving time and resources without compromising quality.

Integrating Rifa AI into your operations boosts efficiency and improves recovery rates for small debt collection agencies.

Ensure Faster and Smarter Debt Recovery

Small debt collection agencies face tough challenges, from compliance risks to debtor resistance. But with the right approach, you can improve efficiency, recover more debts, and stay competitive. Automation, smart communication, and secure data management can make all the difference. We hope this blog helps you with suitable solutions to your specific debt collection challenges. But you don’t have to do this alone.

Rifa AI provides tailored solutions to help your agency handle growing demands, streamline compliance, and optimize debtor engagement. With AI-powered tools, you can reduce manual tasks, improve outreach, and maximize collections—without API integrations, deployed in days, not months..

Book a demo today to see how Rifa AI can smoothen debt collection for you!

Debt collection keeps your business running by ensuring unpaid accounts get settled. But if you’re a small agency, the process is a bit challenging. Competing with larger firms, managing compliance, and handling debtor resistance - all at the same time can slow down operations and limit growth.

You might struggle to keep up with evolving regulations or chase payments with outdated methods. Or, your team is stretched thin, and manual tasks are eating up valuable time. These challenges for your small debt collection agencies affect cash flow, client trust, and overall recovery rates.

This blog explores small debt collection agencies' biggest challenges and how you can overcome them. You’ll find practical strategies to improve efficiency, strengthen debtor communication, and increase collections. We’ll also tell you how Rifa AI could be the best solution for you. Keep Reading!

Challenges for Small Debt Collection Agencies and How to Overcome Them

As a debt collection agency, you should be ready to face various operational and financial hurdles. Without the right strategies, these challenges can impact recovery rates and client retention. Below are the most common challenges and practical solutions to address them.

1. Limited Resources

Small teams and tight budgets can slow down operations.

Running a debt collection agency with limited staff and funds is difficult. You need to process accounts, contact debtors, follow compliance rules, and manage client relationships— without the workforce or budget of larger agencies. Manual processes like sending collection notices and tracking payments take too much time. Accounts may go unaddressed if your team is overwhelmed, reducing collection rates.

For example, if your agency handles 500 accounts per month your team may struggle to follow up on every overdue payment. Without automation, staff members might spend hours making calls or sending emails manually, leaving little time for complex cases.

Solution:

Automate repetitive tasks like sending reminders, updating account statuses, and tracking payments. This frees up your team to focus on resolving difficult cases.

Use cost-effective tools like Rifa AI to manage accounts efficiently. It tracks debtor behavior, sends reminders, and prioritizes overdue accounts for follow-up. By integrating seamlessly with your systems, Rifa AI keeps everything up to date in real time, so you can take action before issues arise.

Prioritize high-value accounts while technology handles routine follow-ups. This helps improve recovery rates without adding extra staff.

Image CTA

Struggling with compliance, debtor engagement, or cash flow? Ensure faster recovery and better compliance, and automate collections with Rifa AI. Try It Today!

2. Compliance with Regulations

Laws change frequently, and staying compliant is critical.

Debt collection is a highly regulated industry, and many agencies often struggle to keep up with changing rules. Regulations like the Fair Debt Collection Practices Act (FDCPA) in the U.S. set strict guidelines on how and when you can contact debtors. Non-compliance can lead to fines, lawsuits, and damage to your agency’s reputation.

For example, in 2021, the CFPB (Consumer Financial Protection Bureau) introduced new rules limiting how often collectors can contact debtors by phone. If you’re unaware of these changes you might unknowingly violate the rule and face legal action.

Solution:

Use compliance-focused software to track legal updates in real-time. Automated alerts ensure your agency follows the latest regulations.

Train your staff regularly to avoid legal pitfalls. Simple mistakes, like contacting a debtor at the wrong time, can be costly. Regular training helps staff stay informed.

Document all communication with debtors. Having a clear record can protect your agency in case of disputes.

3. Cash Flow Instability

Delayed client payments cause operational instability.

Small agencies often rely on timely payments from clients to cover operational costs. However, clients may delay payments, leading to cash flow issues. Without steady revenue, it becomes difficult to pay employees, invest in technology, or grow your business.

If your agency collects debts on behalf of businesses but doesn’t receive its commission for months, you can struggle to stay afloat.

Solution:

Offer flexible payment plans to clients. Instead of waiting for lump-sum payments, consider installment options to maintain steady cash flow.

Automate invoicing and follow-ups to ensure timely payments. Late reminders can prompt clients to settle outstanding fees.

Use digital payment solutions to make transactions easier for clients. Faster payments mean better cash flow for your agency.

With Rifa AI, you can recover missing payments, and streamline your payment cycle and cash flow. Our AI agents extract info from different channels-emails, calls, and documents to keep your payments on time and follow up with clients.

4. Inefficient Debtor Communication

Outdated communication methods reduce debtor engagement.

Many small agencies still rely on traditional methods like phone calls and letters. However, debtors are more likely to respond to digital communication. A 2023 study found that SMS has a 98% open rate, while email responses are much lower. If your agency only uses phone calls, you may struggle to reach debtors efficiently. Well, this just means you need to weigh the effectiveness of different communication methods and use the best one.

Solution:

Use omnichannel strategies such as SMS, email, calls, and chat to improve engagement.

Personalize communication by addressing debtors by name and tailoring messages to their situation. This increases response rates.

Leverage automation to send reminders at optimal times. AI-driven communication tools like Rifa AI can determine the best time to contact debtors.

5. Resistance to Technology Adoption

Some agencies hesitate to adopt new technology due to costs or lack of expertise.

Many small agencies rely on outdated software or manual processes because they fear the costs of upgrading. Others worry that new tools will be too complex for their team. However, avoiding technology can put your agency at a disadvantage.

For example, when using spreadsheets for account tracking, you may struggle to scale as the number of cases grows. Without automation, follow-ups become inconsistent, and collection rates drop.

Solution:

Partner with platforms like Rifa AI that offer affordable, scalable solutions designed for small agencies.

Highlight the ROI of automation to your decision making partners or respective authorities by showing how technology improves efficiency and recovery rates. Agencies that use AI-driven tools often recover debts faster than those relying on manual methods. Help them understand why your teams need to be open to automation to operate and compete better.

Provide staff training to ensure a smooth transition. Most modern debt collection software is user-friendly and requires minimal technical expertise.

6. High Debtor Resistance

Some debtors intentionally delay or avoid repayment.

Many debtors are well-informed about consumer protection laws and may use legal loopholes to delay or avoid paying their debts. They might challenge the validity of the debt, request excessive documentation, or refuse to engage with collectors altogether. In some cases, they may block communication channels or claim financial hardship, making it difficult for your agency to collect payments.

For example, a debtor might invoke the Fair Debt Collection Practices Act (FDCPA) to dispute a debt and demand proof, forcing your agency to spend time gathering documentation. Without the right strategies, these situations can drag on, delaying recovery and increasing operational costs for you.

Solution:

Use AI-driven behavioral insights to predict debtor responses. Advanced analytics can assess a debtor’s likelihood to pay and suggest the best approach for engagement.

Train staff on handling objections and disputes professionally. You can conduct regular workshops, role-playing scenarios, and provide scripts for common objections. Incorporate conflict resolution techniques, active listening skills, and continuous feedback to ensure a professional, consistent approach. Having a structured approach helps resolve issues faster.

Offer digital self-service payment options to make repayment easier. Many debtors avoid direct confrontation but are willing to settle their debts when provided with a convenient online platform.

Maintain clear, well-documented records to respond quickly to disputes and prevent unnecessary delays.

7. Reputation Management

Public perception of debt collection agencies is often negative.

Many people view debt collectors as aggressive or unethical due to past industry practices. A single bad experience, whether real or perceived, can damage your agency’s reputation. Poor reviews, complaints to regulatory bodies, or negative word-of-mouth can deter potential clients from working with you.

For instance, if an agency is accused of harassing debtors with excessive calls, it could face legal consequences and loss of business. Today, a negative review can spread quickly and impact future contracts.

Solution:

Emphasize ethical collection practices by treating debtors with respect and fairness. Maintaining a professional tone increases cooperation and reduces complaints.

Use clear and transparent communication to explain debt obligations. Many disputes arise due to misunderstandings. Offer real-time updates and accessible support for clarifications. With Rifa AI’s omni-channel solutions you can provide detailed, easy-to-understand account summaries and use consistent, empathetic messaging across all channels.

Encourage satisfied clients to leave positive reviews and testimonials. A strong reputation builds trust and attracts new business.

Stay compliant with industry regulations to avoid legal trouble. Adhering to laws like the FDCPA protects both your agency and your reputation.

8. Scalability Issues

Expanding operations without sacrificing efficiency is difficult.

As your agency grows, so does the number of accounts to manage. Without scalable processes, increased workload can overwhelm your staff, slow down collections, and decrease overall performance. Many small agencies struggle to scale because they rely on manual processes that cannot keep up with growth.

For example, an agency that starts with 1,000 accounts may find it manageable with a small team. But if the number of accounts grows to 5,000, the same processes may no longer work, leading to missed follow-ups, delayed payments, and decreased recovery rates.

Solution:

Use cloud-based tools to handle increased workloads without overburdening staff. Cloud solutions allow you to scale operations seamlessly.

Automate routine tasks like follow-ups, payment tracking, and debtor categorization. Rifa AI does all this for you using AI-driven insights. This requires minimal manual effort and allows your staff to focus on complex recovery cases.

Develop standardized workflows to ensure efficiency as your agency grows. A structured process minimizes confusion and maintains high collection rates.

Monitor key performance metrics to identify bottlenecks and optimize operations.

9. Data Security Concerns

Debt collection agencies handle sensitive debtor information.

Data security is a major concern, especially with the rise of cyber threats. Collecting and storing personal financial data comes with risks, and failure to secure this information can lead to data breaches, legal penalties, and loss of client trust. Regulations such as the Gramm-Leach-Bliley Act (GLBA) and General Data Protection Regulation (GDPR) impose strict rules on data protection.

If you do not invest in proper security measures you may fall victim to hacking, phishing attacks, or internal leaks, putting debtor information at risk. A single breach can result in hefty fines and reputational damage.

Solution:

Use encryption and multi-layer security protocols to protect sensitive data. Encryption ensures that even if data is intercepted, it remains unreadable.

Store data on secure cloud platforms with built-in compliance features. Cloud-based security measures reduce the risk of unauthorized access.

Limit data access to authorized personnel only. Restricting access minimizes the risk of internal leaks.

Conduct regular security audits to identify vulnerabilities and strengthen protections. Proactive measures help prevent breaches before they occur.

Protect debtor data with enterprise-grade security! Rifa AI ensures 99% accuracy in data handling while maintaining strict compliance. Discover More

10. Client Retention

Competing with larger agencies makes client retention challenging.

Small agencies often struggle to retain clients when competing against larger, more established firms. Clients expect high collection rates, efficiency, and transparent reporting. If you cannot demonstrate value, clients may switch to competitors.

For example, a business working with a small agency might leave if they feel the collection process is too slow or unprofessional. Lack of personalized service or outdated technology can also drive clients away.

Solution:

Offer customized debt recovery strategies tailored to each client’s needs. Personalized solutions create stronger client relationships.

Provide detailed performance reports to show progress and collection rates. Clients want to see measurable results.

Use automation to improve efficiency and increase recovery rates. Clients are more likely to stay if they see high success rates.

Communicate regularly to keep clients informed and engaged. Keeping clients updated builds trust and long-term partnerships.

Overcoming these challenges for small debt collection agencies requires a mix of strategy, technology, and efficiency. By addressing these issues, you can improve collections, and strengthen client relationships, ensuring your agency grows in the long run.

Next, we’ll explore how Rifa AI can help small agencies tackle these challenges with smart, scalable solutions.

What is Rifa AI?

Rifa AI is a next-generation AI-driven debt collection platform designed to help agencies recover more debts, reduce costs, and improve efficiency—without increasing headcount. Tailored for small and mid-sized agencies, Rifa AI automates repetitive tasks, ensures compliance, and optimizes debtor communication for better engagement. You can set it up within days without any API integrations.

With Rifa AI, you can:

Recover More, Faster – 40% faster debt recovery using AI-powered automation.

Save Time & Reduce Costs – Automate manual workflows, saving 500+ hours weekly and cutting operational costs by up to 70%.

Maximize Compliance & Accuracy – AI-driven data extraction ensures 99% accuracy while keeping up with changing regulations.

Omnichannel Communication – Engage debtors through SMS, email, voice, and chatbots, doubling payment conversions.

Setup Quick & Easy – No API integration needed; get started in days, not months.

How Rifa AI Can Address These Challenges for You

Rifa AI offers tailored solutions to help you overcome various debt collection obstacles efficiently.

1. Scalable Solutions for Small Agencies

As your agency grows, managing increased workloads can be challenging. Rifa AI provides automation tools for reminders and follow-ups, allowing your team to handle more accounts without added strain.

2. Simplified Compliance

Rifa AI ensures compliance through real-time monitoring and automated, legally compliant responses, minimizing the risk of non-compliance.

3. Optimized Communication

With Rifa AI's omnichannel approach, you can manage data from emails, calls, and documents seamlessly. This enhances debtor engagement by reaching them through their preferred channels.

4. Predictive Analytics for Prioritization

Rifa AI uses advanced analytics to identify priority accounts based on debtor behavior and payment patterns, improving recovery rates.

5. Budget-Friendly Implementation

Rifa AI offers cost-effective solutions with quick deployment and no API integration, saving time and resources without compromising quality.

Integrating Rifa AI into your operations boosts efficiency and improves recovery rates for small debt collection agencies.

Ensure Faster and Smarter Debt Recovery

Small debt collection agencies face tough challenges, from compliance risks to debtor resistance. But with the right approach, you can improve efficiency, recover more debts, and stay competitive. Automation, smart communication, and secure data management can make all the difference. We hope this blog helps you with suitable solutions to your specific debt collection challenges. But you don’t have to do this alone.

Rifa AI provides tailored solutions to help your agency handle growing demands, streamline compliance, and optimize debtor engagement. With AI-powered tools, you can reduce manual tasks, improve outreach, and maximize collections—without API integrations, deployed in days, not months..

Book a demo today to see how Rifa AI can smoothen debt collection for you!

Feb 19, 2025

Feb 19, 2025

Feb 19, 2025