Applications of Generative AI Voice Bots in Debt Collection

Applications of Generative AI Voice Bots in Debt Collection

Applications of Generative AI Voice Bots in Debt Collection

Applications of Generative AI Voice Bots in Debt Collection

Anant Sharma

Anant Sharma

Anant Sharma

We know you must have tried various strategies for faster debt recovery but how many times were you actually successful? Did the debtors respond every time you reached out to them? Hard to say right?

It’s not your fault. Traditional debt collection methods often have frustratingly low response rates. Different people prefer different communication modes for debt collection purposes. If you reach out to them any other way, you may not get a response.

Generative AI Voice Bots help you automate debt recovery communications while meeting specific communication preferences of the debtors. These AI-driven assistants hold natural conversations, send personalized reminders, and negotiate payments—all without human intervention. They ensure compliance, reduce costs, and improve collection rates irrespective of the number of debtors you’re dealing with.

In this blog, we’ll explore the use cases of generative AI voice bots in debt collection and how Rifa AI can help your debt recovery strategy.

The Role of Generative AI Voice Bots in Debt Collection

Generative AI voice bots are intelligent voice assistants designed to handle debt collection calls. They engage debtors in natural, two-way conversations without human intervention. These bots understand, process, and respond to queries just like a live agent would.

AI voice bots use natural language processing (NLP), machine learning, and speech synthesis to interact with debtors. They analyze speech patterns, detect emotions, and tailor responses based on real-time conversations. This allows them to handle payment reminders, dispute resolutions, and payment negotiations effectively.

Why Generative AI Gaining Traction in Debt Collection?

Traditional debt collection methods rely on manual calls and generic messaging. AI voice bots change this by offering:

Efficiency by automating thousands of calls daily, reducing delays in debt recovery.

Scalability that lets you handle multiple conversations at once without additional staffing costs.

Personalization options to adjust tone, messaging, and repayment options based on debtor behavior.

Regulatory Compliance so your team follows strict debt collection laws, ensuring accurate and legal communication.

As a scaling debt collection agency, you need fast, cost-effective solutions. AI-driven voice bots deliver on these needs while improving debtor engagement.

Next, let’s explore the key use cases of generative AI voice bot in debt collection and how they streamline recovery efforts.

Key Use Cases of Generative AI Voice Bots in Debt Collection

Debt collection requires consistent communication, but manual efforts often fall short. Missed calls, delayed follow-ups, and compliance risks make recovery difficult. AI-driven voice bots excellently solve these shortcomings to give you better results of your efforts. Below are the most impactful use cases of generative AI voice bot in debt collection and how they improve efficiency.

1. Automating Payment Reminders and Follow-ups

Many debtors don’t intentionally miss payments—they forget deadlines or overlook notifications. AI voice bots solve this by sending timely, proactive, and personalized reminders through voice calls. Unlike SMS or emails, voice interactions feel direct and engaging, prompting faster responses.

Personalized Messaging: Bots tailor reminders based on debtor history. If someone frequently misses deadlines, the bot can send earlier reminders.

Optimized Call Timing: AI analyzes debtor behavior to schedule calls when they are most likely to respond.

Multi-Step Follow-ups: If the first reminder is ignored, the bot escalates the urgency while keeping a polite tone.

For example, if a debtor misses a due date, the bot may first send a gentle reminder. If ignored, a second call can offer flexible repayment options. By automating this process, you can recover debts faster without increasing the agent workload.

With Rifa AI’s intelligent Voice AI, you can send reminders at the right time, using debtor behavior insights to maximize response rates. These bots analyze past payment history to tailor the outreach, ensuring debtors engage and take action.

Save 500+ hours per week with automation and experience better results yourself. Book a Demo Now!

2. Handling Inbound Queries and Disputes

Debt-related concerns can overwhelm call centers, leading to long wait times and frustrated customers. AI voice bots can handle a large volume of inbound calls, offering instant assistance for common questions and dispute resolutions.

24/7 Availability: Unlike human agents, AI bots provide round-the-clock support, ensuring no debtor query goes unanswered.

Instant Information Access: Debtors can check balances, due dates, payment history, and settlement options without speaking to an agent.

Automated Dispute Handling: If a debtor disputes a charge, the bot can guide them through verification steps or escalate the case when necessary.

For instance, a debtor questioning a late fee can interact with the AI bot, which will provide a breakdown of charges. If additional verification is needed, the bot can collect required details and forward them to a human agent for review.

3. Negotiating Payment Plans and Settlements

Not every debtor can pay in full immediately. AI-driven voice bots help debtors find suitable repayment plans, improving collection rates while maintaining a positive customer experience.

Customized Payment Options: AI bots assess debtor profiles, past payments, and credit history to suggest realistic plans.

Data-Driven Negotiations: The bot offers structured settlements based on company-approved guidelines, ensuring compliance and consistency.

Instant Plan Adjustments: If a debtor’s financial situation changes, the bot can offer revised terms based on updated data.

For example, if a debtor states they cannot pay the full amount today, the bot may suggest a split payment option. If the debtor still hesitates, the bot can present alternative plans that align with their financial situation.

4. Compliance-Driven Communication

Debt collection is heavily regulated. A single compliance violation can lead to legal penalties, reputational damage, and lost revenue. AI voice bots ensure all interactions adhere to strict regulations such as TCPA, FDCPA, and GDPR.

Pre-Approved Scripts: Bots use legally compliant messaging, reducing the risk of human error.

Audit Trails: Every interaction is logged, providing detailed records for regulatory audits.

Consent Management: AI ensures debtors receive legally required disclosures and obtain necessary permissions before proceeding.

For instance, a bot ensures compliance by obtaining debtor consent before initiating payment discussions. If a debtor refuses to communicate, the bot logs the interaction and prevents further automated outreach until legally permitted.

5. Skip Tracing and Locating Debtors

Finding debtors who change contact details is a major challenge in collections. AI bots assist in skip tracing by verifying and updating debtor information through intelligent outreach strategies.

Multi-Channel Verification: Bots reach out via phone calls and cross-check debtor responses with existing databases.

Real-Time Insights: AI analyzes call outcomes to determine the best contact strategy for each debtor.

Reduced Delinquencies: Faster identification of valid debtor contact details leads to quicker debt resolution.

For example, if a phone number is inactive, the bot can attempt alternate contacts or suggest verification steps to ensure the right person is reached. This reduces wasted effort on outdated information.

6. Reducing Call Center Workload

High call volumes lead to agent burnout, increased costs, and inefficiencies. AI voice bots handle repetitive tasks, allowing human agents to focus on complex cases that require empathy and negotiation skills.

Automated First-Level Support: Bots manage routine queries, payment reminders, and follow-ups, reducing agent workload.

Efficient Call Routing: AI directs complex cases to human agents only when necessary.

Improved Agent Productivity: Agents spend more time on high-value cases instead of answering basic inquiries.

For example, instead of agents making thousands of repetitive payment reminder calls, bots can handle the bulk of these interactions. Your agents then step in only when a debtor requires customized assistance or a settlement negotiation.

Now that you know where and how you can use Voice AI to improve debt recovery rates, you can make the best of it. Next, let’s explore the benefits of using generative AI voice bots in debt collection and how they enhance the overall recovery process.

With Rifa AI, you get an advanced, cost-effective, and highly scalable solution to improve collection rates and enhance debtor engagement. Our AI bots ensure every call is personalized, strategic, and legally compliant.

Get a demo to see how it can solve your debt collection challenges.

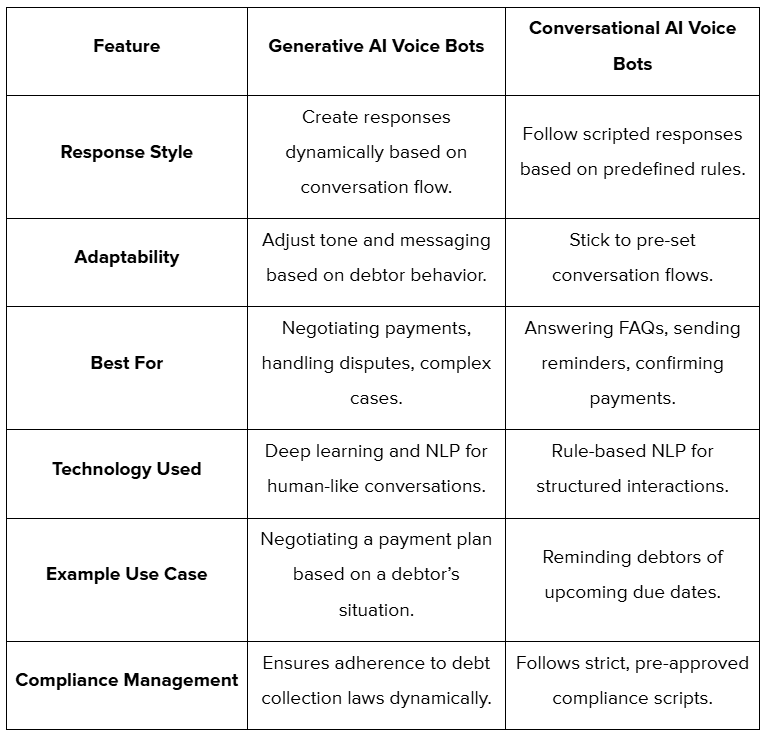

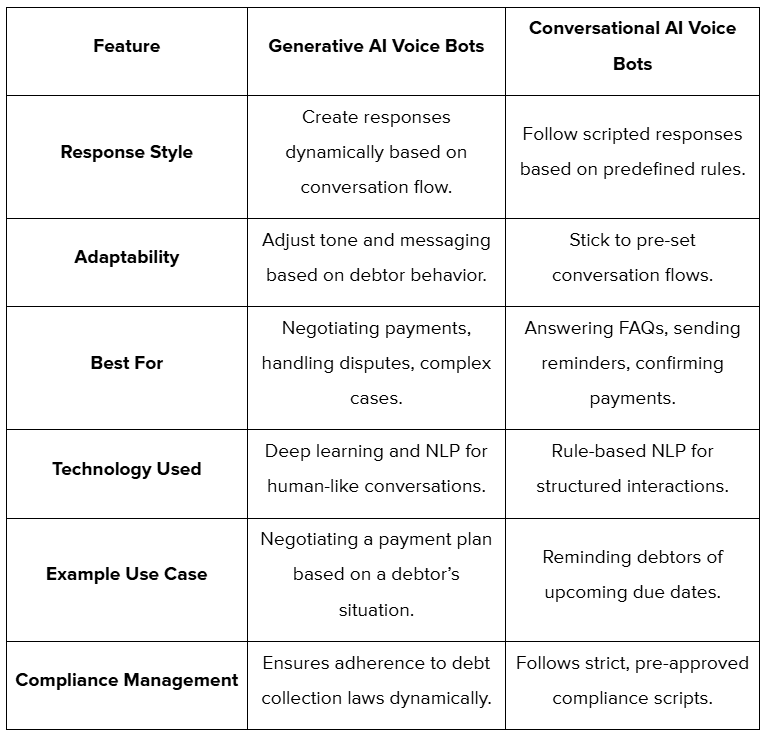

The Difference Between Generative AI and Conversational AI Voice Bots

Both generative AI and conversational AI voice bots play a role in debt collection. But they work differently. Understanding their differences helps you choose the right solution for your needs.

How They Work

Generative AI voice bots create responses in real-time, adapting to conversations naturally. They handle complex interactions like negotiating payment plans or addressing disputes. On the other hand, conversational AI voice bots follow pre-defined scripts, making them ideal for structured tasks like sending payment reminders or answering FAQs.

For example, if a debtor says, “I lost my job and can’t pay right now,” a generative AI bot can respond with empathy and suggest alternative payment options based on company policies. A conversational AI bot, however, will likely direct the debtor to a human agent or provide a standard response.

What Do You Need?

The right choice depends on your needs. If you handle large volumes of repetitive interactions, a conversational AI bot can improve efficiency. But if you want a solution that engages debtors in real-time and improves recovery rates, generative AI voice bots are the better fit.

Here’s a clear comparison for you:

Rifa AI provides both solutions, allowing you to automate debt collection at scale while keeping compliance in check. Whether you need structured automation or dynamic AI conversations, the right solution could improve debt recovery outcomes.

Want to see how Rifa AI’s voice bots can make a difference for you? Book a demo today!

Benefits of Using Generative AI Voice Bots in Debt Collection

When you know the best use cases of generative AI voice bots in debt collection, you can make the best of it to get the following benefits:

Increased Collection Rates

AI voice bots improve collection rates by sending timely reminders and strategic follow-ups. Debtors are more likely to respond to automated calls than emails or texts. Bots can also adapt reminders based on payment history, increasing the chances of repayment without adding pressure.

Cost Savings & Scalability

Manual collection efforts are costly and difficult to scale. AI bots handle thousands of calls simultaneously, reducing the need for additional agents. Agencies can lower operational costs by automating routine interactions, allowing human agents to focus on complex cases.

Enhanced Customer Experience

Debt collection often feels stressful for debtors. AI bots use empathetic, conversational approaches to provide flexible repayment options and polite reminders. This reduces pressure and improves debtor cooperation, leading to more voluntary payments.

Improved Compliance & Risk Mitigation

Debt collection laws are strict, and violations can result in fines and bad reputation. AI bots ensure all interactions follow regulations like TCPA, FDCPA, and GDPR. They provide audit trails, call recordings, and automated dispute handling, reducing compliance risks.

Data-Driven Decision Making

AI-powered analytics track debtor behavior, response rates, and call effectiveness. Collection agencies can use these insights to optimize outreach strategies and personalize follow-ups, increasing recovery rates over time.

AI-powered voice bots don’t just automate collections but go beyond to improve efficiency and establish good connections with customers. Next, let’s explore how Rifa AI’s solutions enhance debt recovery.

How Rifa AI Enhances Debt Collection for You

Debt collection from diverse customers needs automation that is fast, compliant, and effective. Rifa AI provides AI-powered voice bots that improve collection rates, reduce costs, and ensure regulatory compliance. With advanced natural language processing (NLP) and machine learning, Rifa AI’s solutions help you engage debtors efficiently.

Voice AI for Human-like Outreach and Debt Collection

Rifa AI’s voice bots automate payment reminders, handle inbound queries, and negotiate settlements. They interact naturally with debtors, offering personalized repayment options based on debtor profiles. These bots operate 24/7, ensuring that every debtor receives timely communication without agent intervention.

Personalization That Drives Higher Engagement

Every debtor has different financial circumstances. Rifa AI’s bots adapt conversations in real time based on debtor responses and payment history. If a debtor expresses financial hardship, the bot can suggest an alternative repayment plan instead of insisting on full payment. This empathetic approach leads to 40% faster debt recovery and a better customer experience.

Compliance You Can Trust

Regulatory violations in debt collection can be costly. Rifa AI’s voice bots ensure every conversation follows laws like TCPA, FDCPA, and GDPR. They provide audit trails, call recordings, and automated dispute resolution, reducing legal risks for collection agencies.

Efficiency That Reduces Costs and Workload

AI bots handle thousands of calls simultaneously, reducing call center workload. Agents no longer have to spend time on repetitive payment reminders or basic queries. Instead, they can focus on complex cases that require human expertise. This improves productivity while saving up to 70% of operational costs for you.

Rifa AI’s voice bots make debt collection smarter, faster, and fully compliant. Next, let’s look at how AI is shaping the future of debt recovery.

Make Debt Recovery More Efficient With Rifa AI

Traditional debt collection is slow, costly, and prone to compliance risks. Generative AI voice bots change this by automating calls, engaging debtors, and ensuring every interaction meets regulatory standards. The use cases of generative AI voice bot in debt collection prove that AI-driven solutions improve collection rates, reduce costs, and enhance the debtor experience. We hope this blog helps you know how you can use the power of generative AI to get best results. It gets even better when you have reliable solutions to support you.

Rifa AI stands out with its advanced voice AI technology built specifically for debt collection. Our AI voice bots ensure compliance, personalization, and seamless automation. Implementing Rifa AI's solutions can lead to significant improvements in your debt collection processes.

Here's what you can achieve:

Experience up to 40% faster debt recovery cycles with AI-driven negotiation tools, enhancing your cash flow.

Save 500+ hours of your week and reduce operational expenses by up to 70% through streamlined processes and automation.

Achieve 99% accuracy in interactions, minimizing errors and ensuring compliance.

Double your payment success rates by boosting customer engagement with AI-powered strategies.

You can get started within days (No API integrations required!).

Book a demo with Rifa AI today and experience AI-driven efficiency firsthand!

We know you must have tried various strategies for faster debt recovery but how many times were you actually successful? Did the debtors respond every time you reached out to them? Hard to say right?

It’s not your fault. Traditional debt collection methods often have frustratingly low response rates. Different people prefer different communication modes for debt collection purposes. If you reach out to them any other way, you may not get a response.

Generative AI Voice Bots help you automate debt recovery communications while meeting specific communication preferences of the debtors. These AI-driven assistants hold natural conversations, send personalized reminders, and negotiate payments—all without human intervention. They ensure compliance, reduce costs, and improve collection rates irrespective of the number of debtors you’re dealing with.

In this blog, we’ll explore the use cases of generative AI voice bots in debt collection and how Rifa AI can help your debt recovery strategy.

The Role of Generative AI Voice Bots in Debt Collection

Generative AI voice bots are intelligent voice assistants designed to handle debt collection calls. They engage debtors in natural, two-way conversations without human intervention. These bots understand, process, and respond to queries just like a live agent would.

AI voice bots use natural language processing (NLP), machine learning, and speech synthesis to interact with debtors. They analyze speech patterns, detect emotions, and tailor responses based on real-time conversations. This allows them to handle payment reminders, dispute resolutions, and payment negotiations effectively.

Why Generative AI Gaining Traction in Debt Collection?

Traditional debt collection methods rely on manual calls and generic messaging. AI voice bots change this by offering:

Efficiency by automating thousands of calls daily, reducing delays in debt recovery.

Scalability that lets you handle multiple conversations at once without additional staffing costs.

Personalization options to adjust tone, messaging, and repayment options based on debtor behavior.

Regulatory Compliance so your team follows strict debt collection laws, ensuring accurate and legal communication.

As a scaling debt collection agency, you need fast, cost-effective solutions. AI-driven voice bots deliver on these needs while improving debtor engagement.

Next, let’s explore the key use cases of generative AI voice bot in debt collection and how they streamline recovery efforts.

Key Use Cases of Generative AI Voice Bots in Debt Collection

Debt collection requires consistent communication, but manual efforts often fall short. Missed calls, delayed follow-ups, and compliance risks make recovery difficult. AI-driven voice bots excellently solve these shortcomings to give you better results of your efforts. Below are the most impactful use cases of generative AI voice bot in debt collection and how they improve efficiency.

1. Automating Payment Reminders and Follow-ups

Many debtors don’t intentionally miss payments—they forget deadlines or overlook notifications. AI voice bots solve this by sending timely, proactive, and personalized reminders through voice calls. Unlike SMS or emails, voice interactions feel direct and engaging, prompting faster responses.

Personalized Messaging: Bots tailor reminders based on debtor history. If someone frequently misses deadlines, the bot can send earlier reminders.

Optimized Call Timing: AI analyzes debtor behavior to schedule calls when they are most likely to respond.

Multi-Step Follow-ups: If the first reminder is ignored, the bot escalates the urgency while keeping a polite tone.

For example, if a debtor misses a due date, the bot may first send a gentle reminder. If ignored, a second call can offer flexible repayment options. By automating this process, you can recover debts faster without increasing the agent workload.

With Rifa AI’s intelligent Voice AI, you can send reminders at the right time, using debtor behavior insights to maximize response rates. These bots analyze past payment history to tailor the outreach, ensuring debtors engage and take action.

Save 500+ hours per week with automation and experience better results yourself. Book a Demo Now!

2. Handling Inbound Queries and Disputes

Debt-related concerns can overwhelm call centers, leading to long wait times and frustrated customers. AI voice bots can handle a large volume of inbound calls, offering instant assistance for common questions and dispute resolutions.

24/7 Availability: Unlike human agents, AI bots provide round-the-clock support, ensuring no debtor query goes unanswered.

Instant Information Access: Debtors can check balances, due dates, payment history, and settlement options without speaking to an agent.

Automated Dispute Handling: If a debtor disputes a charge, the bot can guide them through verification steps or escalate the case when necessary.

For instance, a debtor questioning a late fee can interact with the AI bot, which will provide a breakdown of charges. If additional verification is needed, the bot can collect required details and forward them to a human agent for review.

3. Negotiating Payment Plans and Settlements

Not every debtor can pay in full immediately. AI-driven voice bots help debtors find suitable repayment plans, improving collection rates while maintaining a positive customer experience.

Customized Payment Options: AI bots assess debtor profiles, past payments, and credit history to suggest realistic plans.

Data-Driven Negotiations: The bot offers structured settlements based on company-approved guidelines, ensuring compliance and consistency.

Instant Plan Adjustments: If a debtor’s financial situation changes, the bot can offer revised terms based on updated data.

For example, if a debtor states they cannot pay the full amount today, the bot may suggest a split payment option. If the debtor still hesitates, the bot can present alternative plans that align with their financial situation.

4. Compliance-Driven Communication

Debt collection is heavily regulated. A single compliance violation can lead to legal penalties, reputational damage, and lost revenue. AI voice bots ensure all interactions adhere to strict regulations such as TCPA, FDCPA, and GDPR.

Pre-Approved Scripts: Bots use legally compliant messaging, reducing the risk of human error.

Audit Trails: Every interaction is logged, providing detailed records for regulatory audits.

Consent Management: AI ensures debtors receive legally required disclosures and obtain necessary permissions before proceeding.

For instance, a bot ensures compliance by obtaining debtor consent before initiating payment discussions. If a debtor refuses to communicate, the bot logs the interaction and prevents further automated outreach until legally permitted.

5. Skip Tracing and Locating Debtors

Finding debtors who change contact details is a major challenge in collections. AI bots assist in skip tracing by verifying and updating debtor information through intelligent outreach strategies.

Multi-Channel Verification: Bots reach out via phone calls and cross-check debtor responses with existing databases.

Real-Time Insights: AI analyzes call outcomes to determine the best contact strategy for each debtor.

Reduced Delinquencies: Faster identification of valid debtor contact details leads to quicker debt resolution.

For example, if a phone number is inactive, the bot can attempt alternate contacts or suggest verification steps to ensure the right person is reached. This reduces wasted effort on outdated information.

6. Reducing Call Center Workload

High call volumes lead to agent burnout, increased costs, and inefficiencies. AI voice bots handle repetitive tasks, allowing human agents to focus on complex cases that require empathy and negotiation skills.

Automated First-Level Support: Bots manage routine queries, payment reminders, and follow-ups, reducing agent workload.

Efficient Call Routing: AI directs complex cases to human agents only when necessary.

Improved Agent Productivity: Agents spend more time on high-value cases instead of answering basic inquiries.

For example, instead of agents making thousands of repetitive payment reminder calls, bots can handle the bulk of these interactions. Your agents then step in only when a debtor requires customized assistance or a settlement negotiation.

Now that you know where and how you can use Voice AI to improve debt recovery rates, you can make the best of it. Next, let’s explore the benefits of using generative AI voice bots in debt collection and how they enhance the overall recovery process.

With Rifa AI, you get an advanced, cost-effective, and highly scalable solution to improve collection rates and enhance debtor engagement. Our AI bots ensure every call is personalized, strategic, and legally compliant.

Get a demo to see how it can solve your debt collection challenges.

The Difference Between Generative AI and Conversational AI Voice Bots

Both generative AI and conversational AI voice bots play a role in debt collection. But they work differently. Understanding their differences helps you choose the right solution for your needs.

How They Work

Generative AI voice bots create responses in real-time, adapting to conversations naturally. They handle complex interactions like negotiating payment plans or addressing disputes. On the other hand, conversational AI voice bots follow pre-defined scripts, making them ideal for structured tasks like sending payment reminders or answering FAQs.

For example, if a debtor says, “I lost my job and can’t pay right now,” a generative AI bot can respond with empathy and suggest alternative payment options based on company policies. A conversational AI bot, however, will likely direct the debtor to a human agent or provide a standard response.

What Do You Need?

The right choice depends on your needs. If you handle large volumes of repetitive interactions, a conversational AI bot can improve efficiency. But if you want a solution that engages debtors in real-time and improves recovery rates, generative AI voice bots are the better fit.

Here’s a clear comparison for you:

Rifa AI provides both solutions, allowing you to automate debt collection at scale while keeping compliance in check. Whether you need structured automation or dynamic AI conversations, the right solution could improve debt recovery outcomes.

Want to see how Rifa AI’s voice bots can make a difference for you? Book a demo today!

Benefits of Using Generative AI Voice Bots in Debt Collection

When you know the best use cases of generative AI voice bots in debt collection, you can make the best of it to get the following benefits:

Increased Collection Rates

AI voice bots improve collection rates by sending timely reminders and strategic follow-ups. Debtors are more likely to respond to automated calls than emails or texts. Bots can also adapt reminders based on payment history, increasing the chances of repayment without adding pressure.

Cost Savings & Scalability

Manual collection efforts are costly and difficult to scale. AI bots handle thousands of calls simultaneously, reducing the need for additional agents. Agencies can lower operational costs by automating routine interactions, allowing human agents to focus on complex cases.

Enhanced Customer Experience

Debt collection often feels stressful for debtors. AI bots use empathetic, conversational approaches to provide flexible repayment options and polite reminders. This reduces pressure and improves debtor cooperation, leading to more voluntary payments.

Improved Compliance & Risk Mitigation

Debt collection laws are strict, and violations can result in fines and bad reputation. AI bots ensure all interactions follow regulations like TCPA, FDCPA, and GDPR. They provide audit trails, call recordings, and automated dispute handling, reducing compliance risks.

Data-Driven Decision Making

AI-powered analytics track debtor behavior, response rates, and call effectiveness. Collection agencies can use these insights to optimize outreach strategies and personalize follow-ups, increasing recovery rates over time.

AI-powered voice bots don’t just automate collections but go beyond to improve efficiency and establish good connections with customers. Next, let’s explore how Rifa AI’s solutions enhance debt recovery.

How Rifa AI Enhances Debt Collection for You

Debt collection from diverse customers needs automation that is fast, compliant, and effective. Rifa AI provides AI-powered voice bots that improve collection rates, reduce costs, and ensure regulatory compliance. With advanced natural language processing (NLP) and machine learning, Rifa AI’s solutions help you engage debtors efficiently.

Voice AI for Human-like Outreach and Debt Collection

Rifa AI’s voice bots automate payment reminders, handle inbound queries, and negotiate settlements. They interact naturally with debtors, offering personalized repayment options based on debtor profiles. These bots operate 24/7, ensuring that every debtor receives timely communication without agent intervention.

Personalization That Drives Higher Engagement

Every debtor has different financial circumstances. Rifa AI’s bots adapt conversations in real time based on debtor responses and payment history. If a debtor expresses financial hardship, the bot can suggest an alternative repayment plan instead of insisting on full payment. This empathetic approach leads to 40% faster debt recovery and a better customer experience.

Compliance You Can Trust

Regulatory violations in debt collection can be costly. Rifa AI’s voice bots ensure every conversation follows laws like TCPA, FDCPA, and GDPR. They provide audit trails, call recordings, and automated dispute resolution, reducing legal risks for collection agencies.

Efficiency That Reduces Costs and Workload

AI bots handle thousands of calls simultaneously, reducing call center workload. Agents no longer have to spend time on repetitive payment reminders or basic queries. Instead, they can focus on complex cases that require human expertise. This improves productivity while saving up to 70% of operational costs for you.

Rifa AI’s voice bots make debt collection smarter, faster, and fully compliant. Next, let’s look at how AI is shaping the future of debt recovery.

Make Debt Recovery More Efficient With Rifa AI

Traditional debt collection is slow, costly, and prone to compliance risks. Generative AI voice bots change this by automating calls, engaging debtors, and ensuring every interaction meets regulatory standards. The use cases of generative AI voice bot in debt collection prove that AI-driven solutions improve collection rates, reduce costs, and enhance the debtor experience. We hope this blog helps you know how you can use the power of generative AI to get best results. It gets even better when you have reliable solutions to support you.

Rifa AI stands out with its advanced voice AI technology built specifically for debt collection. Our AI voice bots ensure compliance, personalization, and seamless automation. Implementing Rifa AI's solutions can lead to significant improvements in your debt collection processes.

Here's what you can achieve:

Experience up to 40% faster debt recovery cycles with AI-driven negotiation tools, enhancing your cash flow.

Save 500+ hours of your week and reduce operational expenses by up to 70% through streamlined processes and automation.

Achieve 99% accuracy in interactions, minimizing errors and ensuring compliance.

Double your payment success rates by boosting customer engagement with AI-powered strategies.

You can get started within days (No API integrations required!).

Book a demo with Rifa AI today and experience AI-driven efficiency firsthand!

Feb 19, 2025

Feb 19, 2025

Feb 19, 2025