Future Trends and Uses of AI in Debt Collection Industry

Future Trends and Uses of AI in Debt Collection Industry

Future Trends and Uses of AI in Debt Collection Industry

Future Trends and Uses of AI in Debt Collection Industry

Anant Sharma

Anant Sharma

Anant Sharma

Every year, businesses lose billions to unpaid debts. Calls go ignored, emails are deleted, and legal action drains resources. With hefty debts remaining unpaid, traditional collection methods may not seem enough.

But what if AI could transform collections into a proactive, data-driven process—boosting recovery rates while enhancing customer relationships?

AI-powered debt collection isn’t just about automation—it’s about understanding debtor behavior, predicting repayment likelihood, and personalizing every interaction. Businesses using AI-driven collections see a notable increase in recovery rates and manage compliance risks better.

AI is now detecting emotions in real-time, predicting financial behavior, and even negotiating payments in virtual environments. The future isn’t just about collecting debts but doing it smarter, faster, and with empathy. Keep reading to explore the emerging trends in AI and debt collection and how it impacts debt recovery for you in the future.

How AI Simplifies Debt Collection for You

Traditional debt collection struggles with late payments, compliance risks, and high costs. But, AI helps you change this. It automates workflows, improves communication with debtors, and enhances recovery rates.

With smarter AI solutions like Rifa AI, you can reduce manual effort and improve efficiency. Rifa AI's omnichannel approach seamlessly handles data from emails, calls, and physical papers, ensuring accurate data extraction and contextual, legally compliant responses in real-time. Let’s look at it closely.

Tackle Non-Responsiveness and Compliance Efficiently

Debt recovery fails when debtors ignore your calls or emails. AI solves this for you by:

Using data-driven insights to contact debtors at the right time and channel.

Deploying AI voicebots and chatbots that adapt their tone based on debtor responses.

Sending automated, yet personalized, follow-ups to keep conversations active.

Regulatory compliance is another major challenge. However, AI ensures every interaction follows legal guidelines. Smart systems track communication history and flag potential violations. This minimizes legal risks while maintaining ethical practices.

When most tasks are automated, operational costs tend to drop. Rifa AI reduces dependency on large call center teams by automating repetitive tasks. Our AI-powered omnichannel agents handle debt collection workflows across phone, email, SMS, and physical documents—extracting data, responding contextually, and completing tasks within existing CRM and ERP systems.

By streamlining communication and reducing manual effort, Rifa AI enhances operational efficiency while allowing your team to focus on complex cases .

From Simple Automation to Smarter AI

Basic automation easily handles repetitive tasks. But today’s AI does more than that. It understands debtor behavior, predicts responses, and adjusts strategies in real time. For example:

AI analyzes payment history to predict who is likely to pay and when.

Smart assistants modify messaging based on emotional cues detected in voice or text.

AI integrates with CRM systems to provide collectors with real-time recommendations.

This shift means fewer manual interventions and higher success rates. When used well AI enables debt collections efforts that feel personal and well-timed rather than robotic and intrusive.

Ethical AI: Balancing Collections with Customer Experience

Debt collection involves human interaction and making it effective requires empathy. AI ensures ethical engagement by:

Using sentiment analysis to detect stress levels and adjust communication accordingly.

Avoiding aggressive reminders that could pressure debtors unnecessarily.

Offering AI-driven payment plans that align with a debtor’s financial situation.

Rifa AI applies these principles through intelligent, ethical collection strategies. It enhances customer experience while improving recovery rates. Thus, you not only recover debt amounts from your customers but also build a community that trusts you.

Moving ahead, let’s explore the major trends in AI and debt collection and how you can use them to benefit your business.

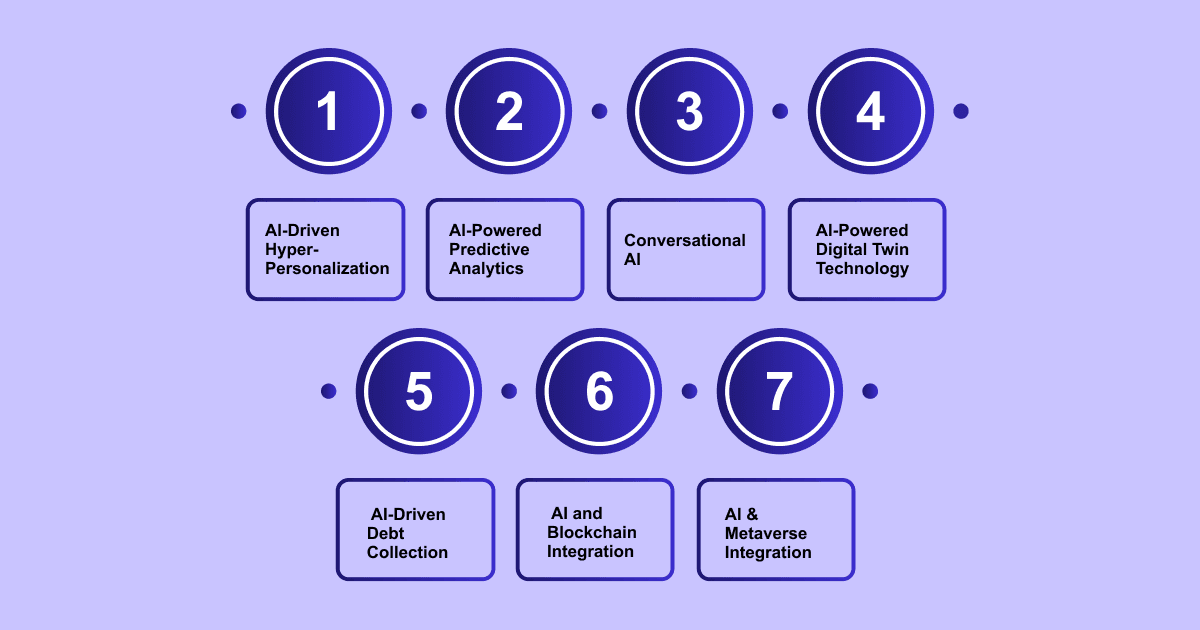

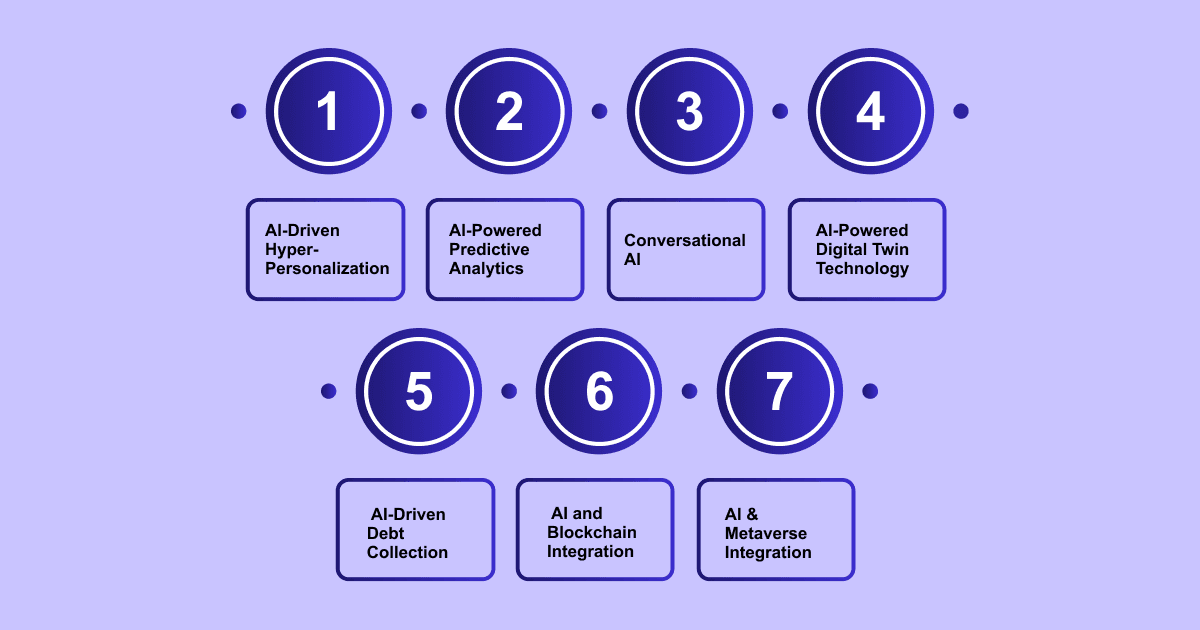

Top 7 Future AI Trends in Debt Collection

Debt collection is now no longer about mass outreach and rigid payment plans. AI-driven tools are becoming more intuitive, helping you recover debts efficiently while enhancing debtor experience. Let’s explore the key trends and how it impacts your company’s future.

1. AI-Driven Hyper-Personalization Using Generative AI

Traditional debt collection relies on scripted messages and standard payment reminders. But every debtor is different, and a one-size-fits-all approach no longer works. Generative AI changes this by drafting personalized messages in real time. It analyzes a debtor’s payment history, previous interactions, and financial stress signals to adjust the tone, language, and messaging style.

Imagine a debtor has missed several payments due to financial hardship. Instead of sending a generic reminder, AI generates a message offering a flexible payment plan, phrased in a way that reduces stress and encourages action. If the debtor shows signs of frustration in previous responses, the AI softens its approach, ensuring communication remains empathetic and effective. This context-aware strategy makes debt collection feel more human, leading to better engagement and higher recovery rates.

2. AI-Powered Predictive Analytics for Better Recovery Rates

Not all debtors are equally likely to repay. AI-powered predictive analytics helps your collection teams prioritize efforts where they matter most. By analyzing real-time financial data, spending habits, and transaction patterns, AI predicts which debtors are most likely to pay, when they will pay, and what type of communication will be most effective.

For example, if AI detects that a debtor recently received a salary deposit, it can time a friendly reminder when repayment is most feasible. If another debtor has a history of partial payments, AI can suggest a tailored installment plan instead of a full repayment demand.

This data-driven approach ensures your collection teams focus on the right accounts at the right time, improving efficiency and increasing recovery rates without unnecessary pressure on debtors.

Rifa AI’s predictive analytics identifies high-potential recoveries, helping your teams focus their efforts where they matter most. You can optimize strategies and recover debts 40% faster with real-time insights. Want to take the guesswork out of debt collection? Try Rifa AI’s predictive analytics today.

3. Conversational AI and Emotionally Intelligent Voicebots

AI voicebots are becoming more sophisticated, moving beyond scripted dialogues to real-time emotional intelligence. These systems analyze speech patterns, tone, and stress levels to detect emotions and adjust responses accordingly. If a debtor sounds anxious or frustrated, AI de-escalates the conversation with a calm, understanding tone. If a debtor appears open to discussion, AI adapts to be more solution-oriented, increasing the chances of a positive outcome.

Consider calling a debtor about an overdue payment. A traditional system would deliver the same scripted message, regardless of their emotional state. An AI voicebot, however, detects stress in their voice and shifts its approach—perhaps offering reassurance or a more flexible payment option.

As AI continues to learn from real interactions, it will refine its responses in real-time, creating more natural and productive conversations that encourage cooperation rather than resistance.

Rifa AI’s AI-powered voicebots adjust their responses in real time, recognizing frustration or willingness to pay and responding with appropriate strategies. Try Rifa AI’s Voice AI Now!

4. AI-Powered Digital Twin Technology for Debt Prediction

Predicting financial behavior is complex, but AI is making it more precise with digital twin technology. A digital twin is a virtual model of a debtor, created using real financial data, transaction history, and behavioral insights. These AI-driven models allow businesses to test different collection strategies before applying them in real life.

For example, if your company wants to introduce a new repayment plan, you can use AI to first simulate its effectiveness using digital twins. It can test different messaging styles, repayment incentives, or even timing strategies to see which approach yields the best response. This ensures that when you roll out new collection methods, they are backed by data-driven insights, reducing trial and error and improving overall success rates.

5. AI-Driven Debt Collection Gamification

While debt collection remains one of the stressful aspects for you and your customers, AI is introducing gamification to make this process more engaging. By incorporating reward-based models and interactive tools, you can turn payments into a goal-oriented experience. So that, instead of viewing debt repayment as a burden, debtors see it as a challenge with achievable milestones.

For instance, AI-driven platforms can offer small incentives for timely payments, such as discounts on late fees or progress badges for consecutive on-time payments. Interactive dashboards allow debtors to track their progress, encouraging them to stay on schedule.

Some AI-powered systems even introduce friendly competition, where users compare repayment progress with peers (while keeping data anonymous). This approach reduces the psychological strain of debt collection while increasing voluntary repayment rates.

6. AI and Blockchain Integration for Transparent Transactions

Let’s not forget trust is a key factor in successful, timely debt recovery. Combining AI with blockchain ensures transparency. Blockchain provides a tamper-proof record of all transactions, eliminating disputes over payments. Smart contracts—self-executing agreements stored on the blockchain—automate repayments, ensuring debtors and collectors adhere to agreed terms without manual intervention.

AI enhances this system by monitoring blockchain transactions for fraud detection and compliance. It flags irregular payment activity and ensures regulatory guidelines are met. For businesses like yours, this means secure, automated, and dispute-free collections. For debtors, it offers confidence that their payments are recorded accurately and fairly.

As blockchain adoption grows, AI will play a critical role in maintaining integrity in financial transactions.

7. AI & Metaverse Integration for Virtual Debt Negotiation

The metaverse is no longer just a concept—it’s becoming a space for real-world business interactions. AI is making virtual debt negotiation a reality by enabling AI-powered avatars to represent collection agents in digital environments. This is particularly useful for international debt recovery, where physical negotiations are impractical.

Imagine a debtor meeting an AI-driven representative in a virtual office. The AI avatar communicates in their preferred language, understands their concerns, and offers real-time payment solutions. You can use AI-driven simulations to train human agents, testing different negotiation tactics in a risk-free virtual space.

In the future, AI-human hybrid negotiation models will combine AI efficiency with human empathy, creating a more balanced and effective approach to debt resolution.

Certainly, with AI, debt collection is becoming more intelligent, efficient, and ethical. However, like all other opportunities this one also brings along new challenges. Next, let’s see how you can deal with these challenges to make the most out of this opportunity.

AI in Debt Collection: Challenges & Opportunities

AI gives a better debt collection, making it faster and more efficient. But like any technology, it comes with challenges. Businesses must ensure AI balances automation with empathy, avoids bias, and follows strict regulations. Here’s how you can prepare.

Opportunities With AI in Debt Collection

AI is transforming debt collection by making the process faster, more efficient, and data-driven. Here are some key benefits:

1. Enhancing Automation While Maintaining Personalization

AI-powered voicebots and chatbots can handle a large volume of debtor interactions, automating payment reminders, negotiation processes, and follow-ups. However, advanced AI ensures that these interactions remain personalized. For instance, AI can detect stress in a debtor’s voice and adjust its tone accordingly, leading to better engagement and higher repayment rates.

2. Predictive Analytics for Better Debt Recovery

AI can analyze historical payment data and identify patterns to predict which debtors are more likely to default. This allows collection teams to focus on high-risk cases proactively, offering flexible payment plans before financial situations worsen.

3. Intelligent Segmentation for Tailored Strategies

Instead of a one-size-fits-all approach, AI segments debtors based on factors like income, past payment behavior, and financial hardships. This ensures collection efforts are targeted and appropriate, improving debtor cooperation.

4. Cost Reduction and Operational Efficiency

AI reduces the need for extensive human intervention, lowering operational costs. Automated follow-ups free up collection teams to handle complex cases, making the process more efficient and scalable.

5. Compliance Assistance and Risk Mitigation

AI can be programmed to align with evolving debt collection regulations, ensuring that all interactions comply with legal frameworks such as GDPR and FDCPA. This minimizes the risk of legal issues while maintaining ethical collection practices.

Challenges of AI in Debt Collection

While AI offers significant benefits, its implementation comes with challenges that must be addressed:

1. Balancing Automation With Human Empathy

AI-driven debt collection must not feel robotic or impersonal. Over-reliance on automation without human oversight can lead to debtor frustration and resistance, ultimately harming collection efforts. Ensuring AI interactions are empathetic and human-like is crucial for success.

2. Preventing Bias in AI Decision-Making

AI relies on past data to make decisions, but biased datasets can lead to discriminatory practices. If AI systems unfairly classify certain demographics as high-risk, they may impose harsher repayment demands, leading to ethical and legal concerns. Regular audits and diverse training data are essential to eliminating bias.

3. Navigating Regulatory Complexities

Debt collection laws vary across regions, and AI must adhere to strict compliance guidelines. Regulations such as GDPR (Europe) and FDCPA (U.S.) restrict how debt collection is conducted, requiring AI to respect debtor privacy and avoid aggressive collection tactics. AI systems need continuous updates to align with changing legal requirements.

4. Data Security and Privacy Risks

Debt collection involves sensitive financial data, making AI-driven processes a potential target for cyber threats. Organizations must implement robust cybersecurity measures to protect debtor information from breaches and unauthorized access.

5. Dependency on Quality Data

AI’s effectiveness depends on the accuracy and quality of data it is trained on. Poor or incomplete data can lead to incorrect risk assessments, inappropriate collection strategies, and reduced efficiency. Businesses must ensure their AI models are built on reliable and up-to-date data sources.

Rifa AI addresses these challenges by offering an intelligent, compliant, and empathetic debt collection solution. Our AI-driven platform balances automation with human-like communication, ensuring debtors feel heard and respected. With advanced predictive analytics, bias-free decision-making, and built-in regulatory compliance, Rifa AI enhances debt recovery while mitigating risks.

Want to transform your debt collection strategy? Explore how Rifa AI can optimize your collection process while maintaining fairness and compliance. Book a demo.

How Businesses Can Prepare for AI-Driven Debt Recovery Innovations

Businesses that embrace AI wisely will improve recovery rates while maintaining trust. Here’s how you can prepare for it:

Use AI to improve engagement, not just efficiency.

AI should help debtors, not intimidate them. Smart repayment reminders, flexible options, and real-time support create a positive experience.Train staff to work with AI.

Employees should understand AI decisions and step in when needed. A human agent should always be available for complex cases.Monitor performance and adjust strategies.

AI is not perfect. Regular checks help ensure it remains ethical, effective, and compliant.

A well-balanced AI approach reduces costs, increases repayments, and keeps debtors engaged without unnecessary stress.

Wrapping Up

AI is reshaping debt collection, making it smarter, faster, and more strategic. From hyper-personalized communication to predictive analytics and ethical automation, the trends in AI and debt collection are transforming how businesses recover debts. AI-driven solutions reduce inefficiencies, improve customer engagement, and ensure compliance in an increasingly complex regulatory environment. However, success depends on choosing the right AI tools—ones that balance automation with human empathy while adapting to future innovations.

This is where Rifa AI steps in. As a specialized AI-driven debt collection platform, With Rifa AI you can automate up to 70% of procedures, minimize human error, and ensure real-time data accuracy. Our AI-powered voice bots engage debtors with personalized, sentiment-aware conversations, increasing repayment rates while maintaining a positive customer experience. With built-in compliance monitoring and advanced predictive analytics, Rifa AI ensures that collections remain both ethical and effective.

If you're looking to enhance your debt recovery strategy with AI, Rifa AI provides the smart, scalable, and regulatory-compliant solutions you need. It can save up to 500+ hours of your week, and get 2X better payment conversions – No API integrations needed. Book a demo and experience the results yourself!

Every year, businesses lose billions to unpaid debts. Calls go ignored, emails are deleted, and legal action drains resources. With hefty debts remaining unpaid, traditional collection methods may not seem enough.

But what if AI could transform collections into a proactive, data-driven process—boosting recovery rates while enhancing customer relationships?

AI-powered debt collection isn’t just about automation—it’s about understanding debtor behavior, predicting repayment likelihood, and personalizing every interaction. Businesses using AI-driven collections see a notable increase in recovery rates and manage compliance risks better.

AI is now detecting emotions in real-time, predicting financial behavior, and even negotiating payments in virtual environments. The future isn’t just about collecting debts but doing it smarter, faster, and with empathy. Keep reading to explore the emerging trends in AI and debt collection and how it impacts debt recovery for you in the future.

How AI Simplifies Debt Collection for You

Traditional debt collection struggles with late payments, compliance risks, and high costs. But, AI helps you change this. It automates workflows, improves communication with debtors, and enhances recovery rates.

With smarter AI solutions like Rifa AI, you can reduce manual effort and improve efficiency. Rifa AI's omnichannel approach seamlessly handles data from emails, calls, and physical papers, ensuring accurate data extraction and contextual, legally compliant responses in real-time. Let’s look at it closely.

Tackle Non-Responsiveness and Compliance Efficiently

Debt recovery fails when debtors ignore your calls or emails. AI solves this for you by:

Using data-driven insights to contact debtors at the right time and channel.

Deploying AI voicebots and chatbots that adapt their tone based on debtor responses.

Sending automated, yet personalized, follow-ups to keep conversations active.

Regulatory compliance is another major challenge. However, AI ensures every interaction follows legal guidelines. Smart systems track communication history and flag potential violations. This minimizes legal risks while maintaining ethical practices.

When most tasks are automated, operational costs tend to drop. Rifa AI reduces dependency on large call center teams by automating repetitive tasks. Our AI-powered omnichannel agents handle debt collection workflows across phone, email, SMS, and physical documents—extracting data, responding contextually, and completing tasks within existing CRM and ERP systems.

By streamlining communication and reducing manual effort, Rifa AI enhances operational efficiency while allowing your team to focus on complex cases .

From Simple Automation to Smarter AI

Basic automation easily handles repetitive tasks. But today’s AI does more than that. It understands debtor behavior, predicts responses, and adjusts strategies in real time. For example:

AI analyzes payment history to predict who is likely to pay and when.

Smart assistants modify messaging based on emotional cues detected in voice or text.

AI integrates with CRM systems to provide collectors with real-time recommendations.

This shift means fewer manual interventions and higher success rates. When used well AI enables debt collections efforts that feel personal and well-timed rather than robotic and intrusive.

Ethical AI: Balancing Collections with Customer Experience

Debt collection involves human interaction and making it effective requires empathy. AI ensures ethical engagement by:

Using sentiment analysis to detect stress levels and adjust communication accordingly.

Avoiding aggressive reminders that could pressure debtors unnecessarily.

Offering AI-driven payment plans that align with a debtor’s financial situation.

Rifa AI applies these principles through intelligent, ethical collection strategies. It enhances customer experience while improving recovery rates. Thus, you not only recover debt amounts from your customers but also build a community that trusts you.

Moving ahead, let’s explore the major trends in AI and debt collection and how you can use them to benefit your business.

Top 7 Future AI Trends in Debt Collection

Debt collection is now no longer about mass outreach and rigid payment plans. AI-driven tools are becoming more intuitive, helping you recover debts efficiently while enhancing debtor experience. Let’s explore the key trends and how it impacts your company’s future.

1. AI-Driven Hyper-Personalization Using Generative AI

Traditional debt collection relies on scripted messages and standard payment reminders. But every debtor is different, and a one-size-fits-all approach no longer works. Generative AI changes this by drafting personalized messages in real time. It analyzes a debtor’s payment history, previous interactions, and financial stress signals to adjust the tone, language, and messaging style.

Imagine a debtor has missed several payments due to financial hardship. Instead of sending a generic reminder, AI generates a message offering a flexible payment plan, phrased in a way that reduces stress and encourages action. If the debtor shows signs of frustration in previous responses, the AI softens its approach, ensuring communication remains empathetic and effective. This context-aware strategy makes debt collection feel more human, leading to better engagement and higher recovery rates.

2. AI-Powered Predictive Analytics for Better Recovery Rates

Not all debtors are equally likely to repay. AI-powered predictive analytics helps your collection teams prioritize efforts where they matter most. By analyzing real-time financial data, spending habits, and transaction patterns, AI predicts which debtors are most likely to pay, when they will pay, and what type of communication will be most effective.

For example, if AI detects that a debtor recently received a salary deposit, it can time a friendly reminder when repayment is most feasible. If another debtor has a history of partial payments, AI can suggest a tailored installment plan instead of a full repayment demand.

This data-driven approach ensures your collection teams focus on the right accounts at the right time, improving efficiency and increasing recovery rates without unnecessary pressure on debtors.

Rifa AI’s predictive analytics identifies high-potential recoveries, helping your teams focus their efforts where they matter most. You can optimize strategies and recover debts 40% faster with real-time insights. Want to take the guesswork out of debt collection? Try Rifa AI’s predictive analytics today.

3. Conversational AI and Emotionally Intelligent Voicebots

AI voicebots are becoming more sophisticated, moving beyond scripted dialogues to real-time emotional intelligence. These systems analyze speech patterns, tone, and stress levels to detect emotions and adjust responses accordingly. If a debtor sounds anxious or frustrated, AI de-escalates the conversation with a calm, understanding tone. If a debtor appears open to discussion, AI adapts to be more solution-oriented, increasing the chances of a positive outcome.

Consider calling a debtor about an overdue payment. A traditional system would deliver the same scripted message, regardless of their emotional state. An AI voicebot, however, detects stress in their voice and shifts its approach—perhaps offering reassurance or a more flexible payment option.

As AI continues to learn from real interactions, it will refine its responses in real-time, creating more natural and productive conversations that encourage cooperation rather than resistance.

Rifa AI’s AI-powered voicebots adjust their responses in real time, recognizing frustration or willingness to pay and responding with appropriate strategies. Try Rifa AI’s Voice AI Now!

4. AI-Powered Digital Twin Technology for Debt Prediction

Predicting financial behavior is complex, but AI is making it more precise with digital twin technology. A digital twin is a virtual model of a debtor, created using real financial data, transaction history, and behavioral insights. These AI-driven models allow businesses to test different collection strategies before applying them in real life.

For example, if your company wants to introduce a new repayment plan, you can use AI to first simulate its effectiveness using digital twins. It can test different messaging styles, repayment incentives, or even timing strategies to see which approach yields the best response. This ensures that when you roll out new collection methods, they are backed by data-driven insights, reducing trial and error and improving overall success rates.

5. AI-Driven Debt Collection Gamification

While debt collection remains one of the stressful aspects for you and your customers, AI is introducing gamification to make this process more engaging. By incorporating reward-based models and interactive tools, you can turn payments into a goal-oriented experience. So that, instead of viewing debt repayment as a burden, debtors see it as a challenge with achievable milestones.

For instance, AI-driven platforms can offer small incentives for timely payments, such as discounts on late fees or progress badges for consecutive on-time payments. Interactive dashboards allow debtors to track their progress, encouraging them to stay on schedule.

Some AI-powered systems even introduce friendly competition, where users compare repayment progress with peers (while keeping data anonymous). This approach reduces the psychological strain of debt collection while increasing voluntary repayment rates.

6. AI and Blockchain Integration for Transparent Transactions

Let’s not forget trust is a key factor in successful, timely debt recovery. Combining AI with blockchain ensures transparency. Blockchain provides a tamper-proof record of all transactions, eliminating disputes over payments. Smart contracts—self-executing agreements stored on the blockchain—automate repayments, ensuring debtors and collectors adhere to agreed terms without manual intervention.

AI enhances this system by monitoring blockchain transactions for fraud detection and compliance. It flags irregular payment activity and ensures regulatory guidelines are met. For businesses like yours, this means secure, automated, and dispute-free collections. For debtors, it offers confidence that their payments are recorded accurately and fairly.

As blockchain adoption grows, AI will play a critical role in maintaining integrity in financial transactions.

7. AI & Metaverse Integration for Virtual Debt Negotiation

The metaverse is no longer just a concept—it’s becoming a space for real-world business interactions. AI is making virtual debt negotiation a reality by enabling AI-powered avatars to represent collection agents in digital environments. This is particularly useful for international debt recovery, where physical negotiations are impractical.

Imagine a debtor meeting an AI-driven representative in a virtual office. The AI avatar communicates in their preferred language, understands their concerns, and offers real-time payment solutions. You can use AI-driven simulations to train human agents, testing different negotiation tactics in a risk-free virtual space.

In the future, AI-human hybrid negotiation models will combine AI efficiency with human empathy, creating a more balanced and effective approach to debt resolution.

Certainly, with AI, debt collection is becoming more intelligent, efficient, and ethical. However, like all other opportunities this one also brings along new challenges. Next, let’s see how you can deal with these challenges to make the most out of this opportunity.

AI in Debt Collection: Challenges & Opportunities

AI gives a better debt collection, making it faster and more efficient. But like any technology, it comes with challenges. Businesses must ensure AI balances automation with empathy, avoids bias, and follows strict regulations. Here’s how you can prepare.

Opportunities With AI in Debt Collection

AI is transforming debt collection by making the process faster, more efficient, and data-driven. Here are some key benefits:

1. Enhancing Automation While Maintaining Personalization

AI-powered voicebots and chatbots can handle a large volume of debtor interactions, automating payment reminders, negotiation processes, and follow-ups. However, advanced AI ensures that these interactions remain personalized. For instance, AI can detect stress in a debtor’s voice and adjust its tone accordingly, leading to better engagement and higher repayment rates.

2. Predictive Analytics for Better Debt Recovery

AI can analyze historical payment data and identify patterns to predict which debtors are more likely to default. This allows collection teams to focus on high-risk cases proactively, offering flexible payment plans before financial situations worsen.

3. Intelligent Segmentation for Tailored Strategies

Instead of a one-size-fits-all approach, AI segments debtors based on factors like income, past payment behavior, and financial hardships. This ensures collection efforts are targeted and appropriate, improving debtor cooperation.

4. Cost Reduction and Operational Efficiency

AI reduces the need for extensive human intervention, lowering operational costs. Automated follow-ups free up collection teams to handle complex cases, making the process more efficient and scalable.

5. Compliance Assistance and Risk Mitigation

AI can be programmed to align with evolving debt collection regulations, ensuring that all interactions comply with legal frameworks such as GDPR and FDCPA. This minimizes the risk of legal issues while maintaining ethical collection practices.

Challenges of AI in Debt Collection

While AI offers significant benefits, its implementation comes with challenges that must be addressed:

1. Balancing Automation With Human Empathy

AI-driven debt collection must not feel robotic or impersonal. Over-reliance on automation without human oversight can lead to debtor frustration and resistance, ultimately harming collection efforts. Ensuring AI interactions are empathetic and human-like is crucial for success.

2. Preventing Bias in AI Decision-Making

AI relies on past data to make decisions, but biased datasets can lead to discriminatory practices. If AI systems unfairly classify certain demographics as high-risk, they may impose harsher repayment demands, leading to ethical and legal concerns. Regular audits and diverse training data are essential to eliminating bias.

3. Navigating Regulatory Complexities

Debt collection laws vary across regions, and AI must adhere to strict compliance guidelines. Regulations such as GDPR (Europe) and FDCPA (U.S.) restrict how debt collection is conducted, requiring AI to respect debtor privacy and avoid aggressive collection tactics. AI systems need continuous updates to align with changing legal requirements.

4. Data Security and Privacy Risks

Debt collection involves sensitive financial data, making AI-driven processes a potential target for cyber threats. Organizations must implement robust cybersecurity measures to protect debtor information from breaches and unauthorized access.

5. Dependency on Quality Data

AI’s effectiveness depends on the accuracy and quality of data it is trained on. Poor or incomplete data can lead to incorrect risk assessments, inappropriate collection strategies, and reduced efficiency. Businesses must ensure their AI models are built on reliable and up-to-date data sources.

Rifa AI addresses these challenges by offering an intelligent, compliant, and empathetic debt collection solution. Our AI-driven platform balances automation with human-like communication, ensuring debtors feel heard and respected. With advanced predictive analytics, bias-free decision-making, and built-in regulatory compliance, Rifa AI enhances debt recovery while mitigating risks.

Want to transform your debt collection strategy? Explore how Rifa AI can optimize your collection process while maintaining fairness and compliance. Book a demo.

How Businesses Can Prepare for AI-Driven Debt Recovery Innovations

Businesses that embrace AI wisely will improve recovery rates while maintaining trust. Here’s how you can prepare for it:

Use AI to improve engagement, not just efficiency.

AI should help debtors, not intimidate them. Smart repayment reminders, flexible options, and real-time support create a positive experience.Train staff to work with AI.

Employees should understand AI decisions and step in when needed. A human agent should always be available for complex cases.Monitor performance and adjust strategies.

AI is not perfect. Regular checks help ensure it remains ethical, effective, and compliant.

A well-balanced AI approach reduces costs, increases repayments, and keeps debtors engaged without unnecessary stress.

Wrapping Up

AI is reshaping debt collection, making it smarter, faster, and more strategic. From hyper-personalized communication to predictive analytics and ethical automation, the trends in AI and debt collection are transforming how businesses recover debts. AI-driven solutions reduce inefficiencies, improve customer engagement, and ensure compliance in an increasingly complex regulatory environment. However, success depends on choosing the right AI tools—ones that balance automation with human empathy while adapting to future innovations.

This is where Rifa AI steps in. As a specialized AI-driven debt collection platform, With Rifa AI you can automate up to 70% of procedures, minimize human error, and ensure real-time data accuracy. Our AI-powered voice bots engage debtors with personalized, sentiment-aware conversations, increasing repayment rates while maintaining a positive customer experience. With built-in compliance monitoring and advanced predictive analytics, Rifa AI ensures that collections remain both ethical and effective.

If you're looking to enhance your debt recovery strategy with AI, Rifa AI provides the smart, scalable, and regulatory-compliant solutions you need. It can save up to 500+ hours of your week, and get 2X better payment conversions – No API integrations needed. Book a demo and experience the results yourself!

Feb 25, 2025

Feb 25, 2025

Feb 25, 2025