Understanding the Concept of a Compliance Management System

Understanding the Concept of a Compliance Management System

Understanding the Concept of a Compliance Management System

Understanding the Concept of a Compliance Management System

Anant Sharma

Anant Sharma

Anant Sharma

Regulatory requirements are constantly changing, and non-compliance isn’t an option. A strong compliance management system helps you stay ahead, reducing risks and keeping operations smooth. Without a structured approach, you risk fines, operational delays, and legal challenges.

This blog gives you a step-by-step approach to building a foolproof compliance management system. You’ll learn about key components, implementation strategies, best practices, and the right compliance tools to stay ahead.

Let’s begin!

What is a Compliance Management System (CMS)?

A compliance management system helps your business follow laws, regulations, and internal policies. It provides a structured approach to managing risks and ensuring accountability.

With a compliance management system, you can track legal requirements, monitor policies, and reduce regulatory violations. It ensures your team understands compliance rules and follows them correctly. This system also helps in documenting processes, handling audits, and improving transparency.

Industries like finance, healthcare, manufacturing, and IT rely on compliance management systems. Banks use them to follow financial regulations. Healthcare providers ensure patient data security with strict compliance measures. Manufacturers track safety standards, and IT companies maintain data protection protocols.

A strong compliance management system protects your business from fines, lawsuits, and reputational damage.

Let’s break down the essential components that make a compliance management system effective.

Key Components of an Effective Compliance Management System

A strong compliance management system keeps your business on track with legal and industry requirements. It ensures policies are followed, risks are managed, and compliance efforts are well-documented. Below are the key components that make a compliance management system effective.

Policies and Procedures

Clear policies set the foundation for compliance. They outline rules, expectations, and responsibilities for employees. A compliance management system helps you create, update, and enforce these policies consistently. Without clear guidelines, employees may unknowingly violate regulations, leading to fines or legal issues.

Risk Assessment

Identifying risks early prevents compliance failures. A good compliance management system helps assess risks by tracking regulatory updates and internal processes. Businesses in highly regulated industries, like healthcare and finance, must regularly review risks related to data security, fraud, and workplace safety.

Training and Awareness

Compliance training ensures employees understand policies and regulations. Regular training sessions reduce human errors that could lead to violations. A compliance management system allows you to schedule, track, and document training completion.

Monitoring and Auditing

Regular audits catch compliance gaps before they become costly problems. A compliance management system automates monitoring, reducing manual efforts and improving accuracy. Routine checks ensure that policies are followed, and any issues are addressed quickly. Companies subject to GDPR or HIPAA must maintain strict audit records to prove compliance. With Rifa AI’s automated tracking, you can maintain real-time audit logs, flag compliance issues early, and ensure 100% transparency during inspections. Book a demo to see how.

Incident Management

Handling compliance breaches effectively limits damage. A compliance management system helps you track incidents, investigate causes, and implement corrective actions. Quick responses prevent further risks and show regulators that your business takes compliance seriously. Rifa AI streamlines incident reporting and resolution, ensuring compliance breaches are identified and corrected swiftly.

Reporting and Documentation

Accurate records prove compliance during audits and inspections. A compliance management system maintains detailed logs of policies, training, audits, and incidents. Regulatory bodies, such as the SEC and ISO, require businesses to keep detailed compliance reports. Digital documentation simplifies the process and ensures transparency.

Each of these components strengthens your compliance efforts and protects your business from legal risks. Next, let’s go through the steps to successfully implement a compliance management system.

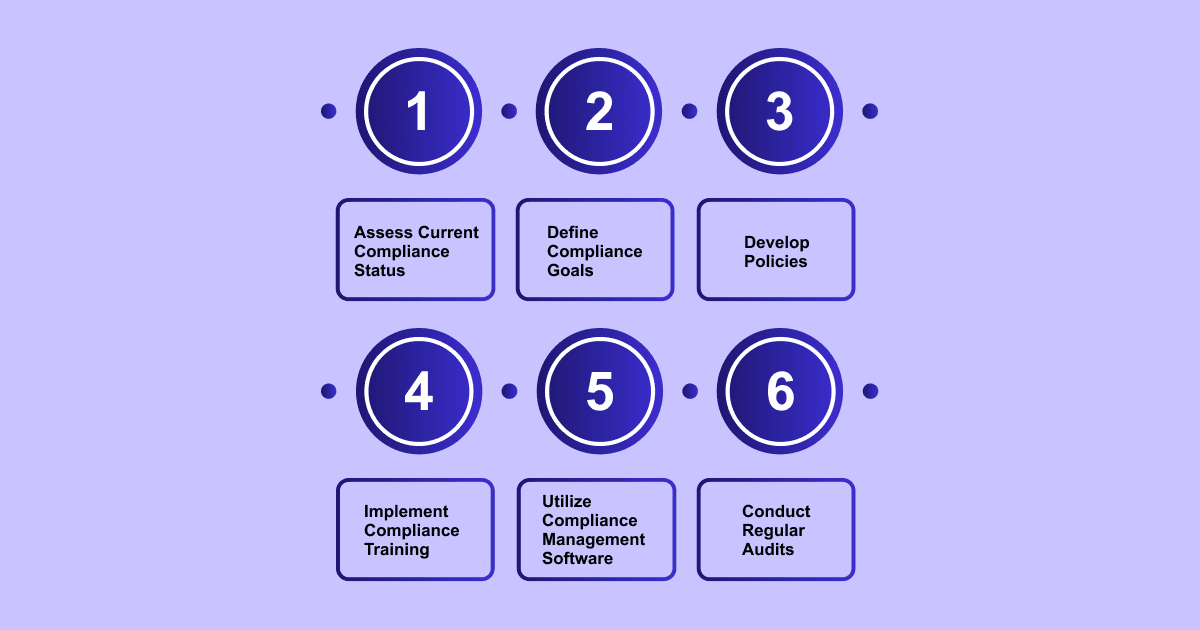

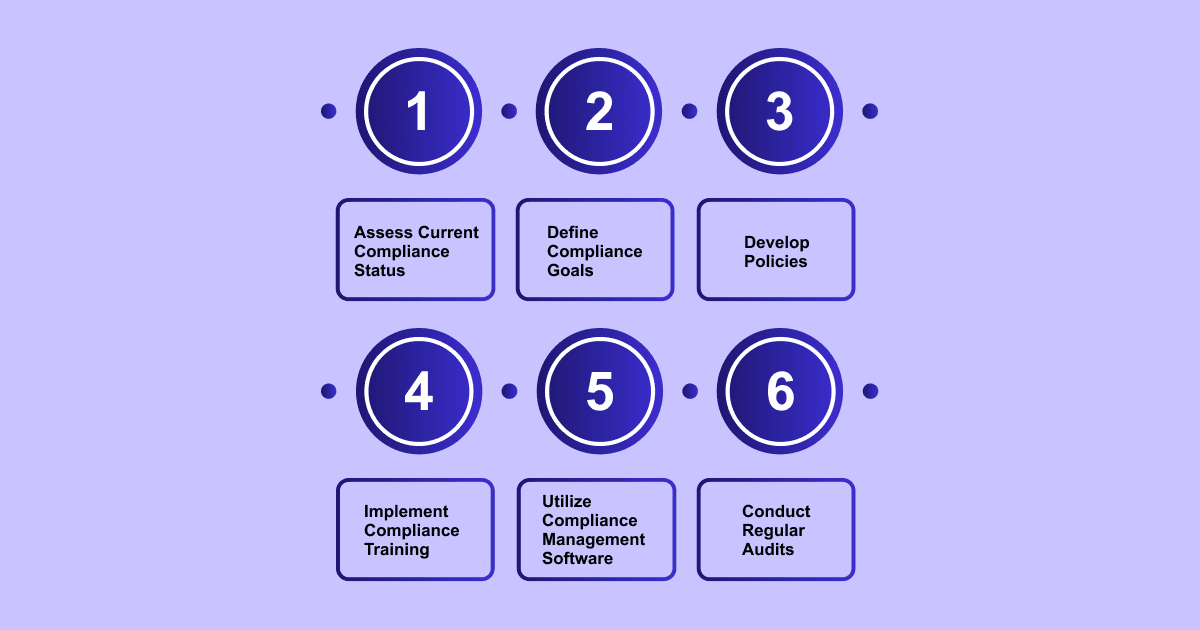

Steps to Implement a Compliance Management System

A structured approach to implementation ensures your compliance management system works effectively. Each step strengthens your ability to meet legal, regulatory, and internal requirements. Follow these key steps to implement a system that minimizes risks and improves compliance efficiency.

1. Assess Current Compliance Status

Start by identifying gaps and risks in your existing compliance processes. Review your policies, training programs, and reporting methods. Identify areas where your business may fall short of industry regulations like GDPR, HIPAA, or SOX. This assessment helps you understand where improvements are needed.

2. Define Compliance Goals

Set clear compliance objectives based on legal and industry requirements. These goals should align with regulations relevant to your business. For example, healthcare companies must meet HIPAA’s data privacy rules, while financial institutions must comply with SOX reporting standards. Clear goals help you measure progress and ensure accountability.

3. Develop Policies and Procedures

Create detailed policies that guide employees on compliance expectations. These policies should cover risk management, ethical practices, and legal responsibilities. A compliance management system helps maintain and update these policies as regulations change. Well-defined rules reduce the chances of non-compliance.

4. Implement Compliance Training

Employees must understand compliance requirements to follow them correctly. Regular training sessions educate staff on company policies, reporting procedures, and regulatory updates. A compliance management system tracks training completion and ensures employees stay informed. Rifa AI offers compliance training solutions tailored to business needs.

5. Utilize Compliance Management Software

Automation improves compliance efficiency. A compliance management system streamlines tracking, reporting, and documentation. It helps monitor policy adherence, manage incidents, and generate audit reports. Rifa AI simplifies compliance management with AI-powered automation, reducing manual work by up to 70%.

Unlike traditional compliance tools, Rifa AI doesn’t require API integrations—making it accessible to businesses of all sizes.

Save time and reduce costs by 70%. Get a FREE trial with Rifa AI.

6. Conduct Regular Audits and Updates

Compliance is an ongoing process. Regular audits help identify weaknesses and ensure continuous improvement. A compliance management system records audit findings and tracks necessary updates. Businesses in regulated industries must frequently update policies to keep up with evolving laws.

By following these steps, you create a compliance management system that protects your business and ensures smooth operations. Next, let’s look at the best practices for maintaining an effective compliance system.

Best Practices for an Effective Compliance Management

Compliance is an ongoing commitment, not a one-time effort. To maintain regulatory adherence and minimize risks, you must integrate best practices into your compliance strategy. Here are the most important practices that help ensure long-term compliance success.

Build a Culture of Compliance from Leadership Down

Compliance starts at the top. Leaders in your organizations must set the right example and reinforce compliance as a core business value. When executives prioritize compliance, employees take it seriously. Ensuring regular communication from management about policies and ethical standards strengthens accountability across all levels.

Use Technology to Simplify Compliance Processes

Manual compliance tracking is time-consuming and error-prone. It’s time to leverage reliable tools and to make things better. A compliance management system automates policy enforcement, risk assessments, and reporting. Rifa AI offers compliance solutions that streamline these processes, ensuring efficiency and accuracy. Wisely choose your automated compliance tools to help track regulatory updates, flag risks, and generate audit reports with minimal effort.

Keep Employees Updated on Regulatory Changes

Laws and industry standards keep changing frequently. Regular training ensures that your employees stay informed about new compliance requirements. Make sure your compliance strategies also include plans to educate your employees on updated laws and protocols. You can rely on a suitable compliance management system to schedule, track, and document training sessions.

Encourage Reporting Without Fear of Retaliation

Employees should feel safe reporting compliance concerns. Establish anonymous reporting channels to encourage transparency. Turn to systems that can track and document reports while ensuring confidentiality. Prioritizing ethical reporting prevents small issues from becoming legal liabilities. Rifa AI’s secure incident reporting system enables anonymous reporting, ensuring transparency while protecting whistleblowers.

Conduct Regular Risk Assessments and Policy Reviews

With newer industry trends and regulatory updates, you’re likely to face greater compliance risks. Conduct periodic assessments to identify vulnerabilities. You can do this better with an effective compliance management system. Regular policy revisions ensure that your business stays ahead of compliance challenges. With Rifa AI, you can automate risk assessments, track changes in regulations, and update policies in real time.

Following these best practices strengthens your compliance management system and reduces regulatory risks. Next, let’s explore the benefits of a well-structured compliance program.

Benefits of a Robust Compliance Management System

A well-structured compliance management system protects your business from legal risks and improves efficiency. It ensures regulatory adherence, builds trust, and enhances overall operations. Here’s how a strong compliance program benefits your organization.

Reduces Legal and Financial Risks

Non-compliance can lead to hefty fines, lawsuits, and operational shutdowns. Regulatory bodies impose strict penalties for violations. A compliance management system helps you stay aligned with laws such as GDPR, HIPAA, and SOX. Automated compliance tracking from Rifa AI ensures your business avoids costly legal consequences.

Enhances Company Reputation and Stakeholder Trust

Clients, investors, and employees expect ethical business practices. Compliance failures damage reputations and erode trust. A strong compliance management system ensures transparency and accountability. Businesses that consistently meet regulatory requirements attract more customers and long-term investors.

Improves Operational Efficiency by Reducing Errors and Non-Compliance

Compliance gaps create inefficiencies and disrupt workflows. A compliance management system streamlines processes, reducing human errors and redundant tasks. Rifa AI’s automated compliance solutions help businesses enforce policies, conduct risk assessments, and maintain real-time regulatory adherence.

Provides Better Data Security and Regulatory Adherence

Industries like healthcare and finance handle sensitive customer data. Compliance regulations such as HIPAA and GDPR mandate strict data protection. A compliance management system helps businesses secure confidential information and prevent data breaches. Rifa AI’s compliance solutions ensure encrypted storage, secure access controls, and continuous monitoring.

A strong compliance program minimizes risks while improving business performance. Next, let’s address common compliance challenges and how to overcome them.

Challenges in Compliance Management & How to Overcome Them

Managing compliance comes with obstacles that can impact operations. A strong compliance management system helps businesses address these challenges effectively. Here are three major compliance hurdles and how to solve them.

Keeping Up with Changing Regulations

Regulations change frequently, making it difficult for your teams to stay compliant. Industries like finance and healthcare must adhere to evolving laws such as GDPR, HIPAA, and SOX. Missing updates can result in fines and legal issues.

Solution: Use automated compliance tracking tools. Rifa AI offers real-time monitoring and regulatory updates, ensuring your compliance management system adapts to new requirements without manual effort.

Employee Resistance

Employees may resist compliance policies due to a lack of awareness or added responsibilities. Without proper engagement, you risk unintentional violations.

Solution: Implement strong training programs and leadership involvement. Compliance training should be clear, practical, and ongoing. Rifa AI’s compliance solutions provide structured learning programs, helping employees understand the importance of compliance and its role in business success.

High Costs of Compliance

Compliance programs can be expensive, especially for small and mid-sized businesses. Manual processes increase costs and require dedicated resources.

Solution: Invest in scalable compliance solutions. A compliance management system with automation reduces operational costs and improves efficiency. Rifa AI’s compliance automation tools help businesses manage compliance without unnecessary expenses.

Overcoming these challenges strengthens compliance efforts and minimizes risks. Next, let’s look at how Rifa AI’s solutions can help streamline your compliance strategy.

Compliance Management System Software & Tools

The right compliance management software takes the complexity out of regulatory adherence. With solutions tailored to different industries, you can streamline compliance processes, reduce manual efforts, and ensure seamless regulatory alignment. Let’s explore top compliance management tools and how they can help you stay ahead.

Popular Compliance Management Software

Several platforms help businesses manage compliance efficiently. Each offers unique features tailored to different industries.

Rifa AI: Rifa AI focuses on automating back-office workflows, dispute resolution, debt collection, and data processing. Its solutions do not require API integration, making them accessible to organizations with minimal technical expertise. By automating repetitive tasks like reconciliations or compliance checks, Rifa AI boosts operational efficiency, reducing costs by up to 70% and minimizing human error with 99% accuracy. Explore Rifa AI’s Solutions.

MetricStream: MetricStream offers an integrated risk management approach with real-time aggregated risk intelligence. Its platform provides forward-looking risk visibility, enabling organizations to reduce losses and risk events. Key features include compliance management, audit management, IT and cyber risk management, and environmental, social, and governance (ESG) management.

NAVEX Global: NAVEX Global provides comprehensive compliance solutions designed to help organizations manage risk and uphold ethical standards. Their offerings include policy and procedure management, incident reporting, third-party risk management, and compliance training programs. These tools aim to protect company culture and reputation by ensuring adherence to regulatory requirements.

SAP GRC: SAP Governance, Risk, and Compliance (GRC) solutions help organizations proactively manage regulations and compliance while automating risk management. Key features include access control, business integrity screening, and audit management. SAP GRC integrates with existing SAP environments, providing a unified approach to managing compliance and risk.

Selecting the right compliance management system software depends on your organization's specific needs, industry regulations, and existing infrastructure. Evaluating each tool's features and how they align with your compliance objectives is crucial.

Wrapping Up

A well-structured compliance management system helps you reduce risks, improve efficiency, and maintain regulatory standards. It ensures that your organization stays compliant while minimizing costly errors and reputational damage. However, managing compliance manually can be time-consuming and prone to oversight.

Rifa AI streamlines compliance processes by automating back-office workflows, document processing, and dispute resolution. Its AI-powered solutions reduce operational costs by up to 70% and improve accuracy to 99%. With Rifa AI, you can simplify compliance tracking, automate reporting, and ensure regulatory adherence without the need for any complex API integrations.

Stay ahead of compliance challenges with automation that works for you. Book a FREE Demo Now!

Regulatory requirements are constantly changing, and non-compliance isn’t an option. A strong compliance management system helps you stay ahead, reducing risks and keeping operations smooth. Without a structured approach, you risk fines, operational delays, and legal challenges.

This blog gives you a step-by-step approach to building a foolproof compliance management system. You’ll learn about key components, implementation strategies, best practices, and the right compliance tools to stay ahead.

Let’s begin!

What is a Compliance Management System (CMS)?

A compliance management system helps your business follow laws, regulations, and internal policies. It provides a structured approach to managing risks and ensuring accountability.

With a compliance management system, you can track legal requirements, monitor policies, and reduce regulatory violations. It ensures your team understands compliance rules and follows them correctly. This system also helps in documenting processes, handling audits, and improving transparency.

Industries like finance, healthcare, manufacturing, and IT rely on compliance management systems. Banks use them to follow financial regulations. Healthcare providers ensure patient data security with strict compliance measures. Manufacturers track safety standards, and IT companies maintain data protection protocols.

A strong compliance management system protects your business from fines, lawsuits, and reputational damage.

Let’s break down the essential components that make a compliance management system effective.

Key Components of an Effective Compliance Management System

A strong compliance management system keeps your business on track with legal and industry requirements. It ensures policies are followed, risks are managed, and compliance efforts are well-documented. Below are the key components that make a compliance management system effective.

Policies and Procedures

Clear policies set the foundation for compliance. They outline rules, expectations, and responsibilities for employees. A compliance management system helps you create, update, and enforce these policies consistently. Without clear guidelines, employees may unknowingly violate regulations, leading to fines or legal issues.

Risk Assessment

Identifying risks early prevents compliance failures. A good compliance management system helps assess risks by tracking regulatory updates and internal processes. Businesses in highly regulated industries, like healthcare and finance, must regularly review risks related to data security, fraud, and workplace safety.

Training and Awareness

Compliance training ensures employees understand policies and regulations. Regular training sessions reduce human errors that could lead to violations. A compliance management system allows you to schedule, track, and document training completion.

Monitoring and Auditing

Regular audits catch compliance gaps before they become costly problems. A compliance management system automates monitoring, reducing manual efforts and improving accuracy. Routine checks ensure that policies are followed, and any issues are addressed quickly. Companies subject to GDPR or HIPAA must maintain strict audit records to prove compliance. With Rifa AI’s automated tracking, you can maintain real-time audit logs, flag compliance issues early, and ensure 100% transparency during inspections. Book a demo to see how.

Incident Management

Handling compliance breaches effectively limits damage. A compliance management system helps you track incidents, investigate causes, and implement corrective actions. Quick responses prevent further risks and show regulators that your business takes compliance seriously. Rifa AI streamlines incident reporting and resolution, ensuring compliance breaches are identified and corrected swiftly.

Reporting and Documentation

Accurate records prove compliance during audits and inspections. A compliance management system maintains detailed logs of policies, training, audits, and incidents. Regulatory bodies, such as the SEC and ISO, require businesses to keep detailed compliance reports. Digital documentation simplifies the process and ensures transparency.

Each of these components strengthens your compliance efforts and protects your business from legal risks. Next, let’s go through the steps to successfully implement a compliance management system.

Steps to Implement a Compliance Management System

A structured approach to implementation ensures your compliance management system works effectively. Each step strengthens your ability to meet legal, regulatory, and internal requirements. Follow these key steps to implement a system that minimizes risks and improves compliance efficiency.

1. Assess Current Compliance Status

Start by identifying gaps and risks in your existing compliance processes. Review your policies, training programs, and reporting methods. Identify areas where your business may fall short of industry regulations like GDPR, HIPAA, or SOX. This assessment helps you understand where improvements are needed.

2. Define Compliance Goals

Set clear compliance objectives based on legal and industry requirements. These goals should align with regulations relevant to your business. For example, healthcare companies must meet HIPAA’s data privacy rules, while financial institutions must comply with SOX reporting standards. Clear goals help you measure progress and ensure accountability.

3. Develop Policies and Procedures

Create detailed policies that guide employees on compliance expectations. These policies should cover risk management, ethical practices, and legal responsibilities. A compliance management system helps maintain and update these policies as regulations change. Well-defined rules reduce the chances of non-compliance.

4. Implement Compliance Training

Employees must understand compliance requirements to follow them correctly. Regular training sessions educate staff on company policies, reporting procedures, and regulatory updates. A compliance management system tracks training completion and ensures employees stay informed. Rifa AI offers compliance training solutions tailored to business needs.

5. Utilize Compliance Management Software

Automation improves compliance efficiency. A compliance management system streamlines tracking, reporting, and documentation. It helps monitor policy adherence, manage incidents, and generate audit reports. Rifa AI simplifies compliance management with AI-powered automation, reducing manual work by up to 70%.

Unlike traditional compliance tools, Rifa AI doesn’t require API integrations—making it accessible to businesses of all sizes.

Save time and reduce costs by 70%. Get a FREE trial with Rifa AI.

6. Conduct Regular Audits and Updates

Compliance is an ongoing process. Regular audits help identify weaknesses and ensure continuous improvement. A compliance management system records audit findings and tracks necessary updates. Businesses in regulated industries must frequently update policies to keep up with evolving laws.

By following these steps, you create a compliance management system that protects your business and ensures smooth operations. Next, let’s look at the best practices for maintaining an effective compliance system.

Best Practices for an Effective Compliance Management

Compliance is an ongoing commitment, not a one-time effort. To maintain regulatory adherence and minimize risks, you must integrate best practices into your compliance strategy. Here are the most important practices that help ensure long-term compliance success.

Build a Culture of Compliance from Leadership Down

Compliance starts at the top. Leaders in your organizations must set the right example and reinforce compliance as a core business value. When executives prioritize compliance, employees take it seriously. Ensuring regular communication from management about policies and ethical standards strengthens accountability across all levels.

Use Technology to Simplify Compliance Processes

Manual compliance tracking is time-consuming and error-prone. It’s time to leverage reliable tools and to make things better. A compliance management system automates policy enforcement, risk assessments, and reporting. Rifa AI offers compliance solutions that streamline these processes, ensuring efficiency and accuracy. Wisely choose your automated compliance tools to help track regulatory updates, flag risks, and generate audit reports with minimal effort.

Keep Employees Updated on Regulatory Changes

Laws and industry standards keep changing frequently. Regular training ensures that your employees stay informed about new compliance requirements. Make sure your compliance strategies also include plans to educate your employees on updated laws and protocols. You can rely on a suitable compliance management system to schedule, track, and document training sessions.

Encourage Reporting Without Fear of Retaliation

Employees should feel safe reporting compliance concerns. Establish anonymous reporting channels to encourage transparency. Turn to systems that can track and document reports while ensuring confidentiality. Prioritizing ethical reporting prevents small issues from becoming legal liabilities. Rifa AI’s secure incident reporting system enables anonymous reporting, ensuring transparency while protecting whistleblowers.

Conduct Regular Risk Assessments and Policy Reviews

With newer industry trends and regulatory updates, you’re likely to face greater compliance risks. Conduct periodic assessments to identify vulnerabilities. You can do this better with an effective compliance management system. Regular policy revisions ensure that your business stays ahead of compliance challenges. With Rifa AI, you can automate risk assessments, track changes in regulations, and update policies in real time.

Following these best practices strengthens your compliance management system and reduces regulatory risks. Next, let’s explore the benefits of a well-structured compliance program.

Benefits of a Robust Compliance Management System

A well-structured compliance management system protects your business from legal risks and improves efficiency. It ensures regulatory adherence, builds trust, and enhances overall operations. Here’s how a strong compliance program benefits your organization.

Reduces Legal and Financial Risks

Non-compliance can lead to hefty fines, lawsuits, and operational shutdowns. Regulatory bodies impose strict penalties for violations. A compliance management system helps you stay aligned with laws such as GDPR, HIPAA, and SOX. Automated compliance tracking from Rifa AI ensures your business avoids costly legal consequences.

Enhances Company Reputation and Stakeholder Trust

Clients, investors, and employees expect ethical business practices. Compliance failures damage reputations and erode trust. A strong compliance management system ensures transparency and accountability. Businesses that consistently meet regulatory requirements attract more customers and long-term investors.

Improves Operational Efficiency by Reducing Errors and Non-Compliance

Compliance gaps create inefficiencies and disrupt workflows. A compliance management system streamlines processes, reducing human errors and redundant tasks. Rifa AI’s automated compliance solutions help businesses enforce policies, conduct risk assessments, and maintain real-time regulatory adherence.

Provides Better Data Security and Regulatory Adherence

Industries like healthcare and finance handle sensitive customer data. Compliance regulations such as HIPAA and GDPR mandate strict data protection. A compliance management system helps businesses secure confidential information and prevent data breaches. Rifa AI’s compliance solutions ensure encrypted storage, secure access controls, and continuous monitoring.

A strong compliance program minimizes risks while improving business performance. Next, let’s address common compliance challenges and how to overcome them.

Challenges in Compliance Management & How to Overcome Them

Managing compliance comes with obstacles that can impact operations. A strong compliance management system helps businesses address these challenges effectively. Here are three major compliance hurdles and how to solve them.

Keeping Up with Changing Regulations

Regulations change frequently, making it difficult for your teams to stay compliant. Industries like finance and healthcare must adhere to evolving laws such as GDPR, HIPAA, and SOX. Missing updates can result in fines and legal issues.

Solution: Use automated compliance tracking tools. Rifa AI offers real-time monitoring and regulatory updates, ensuring your compliance management system adapts to new requirements without manual effort.

Employee Resistance

Employees may resist compliance policies due to a lack of awareness or added responsibilities. Without proper engagement, you risk unintentional violations.

Solution: Implement strong training programs and leadership involvement. Compliance training should be clear, practical, and ongoing. Rifa AI’s compliance solutions provide structured learning programs, helping employees understand the importance of compliance and its role in business success.

High Costs of Compliance

Compliance programs can be expensive, especially for small and mid-sized businesses. Manual processes increase costs and require dedicated resources.

Solution: Invest in scalable compliance solutions. A compliance management system with automation reduces operational costs and improves efficiency. Rifa AI’s compliance automation tools help businesses manage compliance without unnecessary expenses.

Overcoming these challenges strengthens compliance efforts and minimizes risks. Next, let’s look at how Rifa AI’s solutions can help streamline your compliance strategy.

Compliance Management System Software & Tools

The right compliance management software takes the complexity out of regulatory adherence. With solutions tailored to different industries, you can streamline compliance processes, reduce manual efforts, and ensure seamless regulatory alignment. Let’s explore top compliance management tools and how they can help you stay ahead.

Popular Compliance Management Software

Several platforms help businesses manage compliance efficiently. Each offers unique features tailored to different industries.

Rifa AI: Rifa AI focuses on automating back-office workflows, dispute resolution, debt collection, and data processing. Its solutions do not require API integration, making them accessible to organizations with minimal technical expertise. By automating repetitive tasks like reconciliations or compliance checks, Rifa AI boosts operational efficiency, reducing costs by up to 70% and minimizing human error with 99% accuracy. Explore Rifa AI’s Solutions.

MetricStream: MetricStream offers an integrated risk management approach with real-time aggregated risk intelligence. Its platform provides forward-looking risk visibility, enabling organizations to reduce losses and risk events. Key features include compliance management, audit management, IT and cyber risk management, and environmental, social, and governance (ESG) management.

NAVEX Global: NAVEX Global provides comprehensive compliance solutions designed to help organizations manage risk and uphold ethical standards. Their offerings include policy and procedure management, incident reporting, third-party risk management, and compliance training programs. These tools aim to protect company culture and reputation by ensuring adherence to regulatory requirements.

SAP GRC: SAP Governance, Risk, and Compliance (GRC) solutions help organizations proactively manage regulations and compliance while automating risk management. Key features include access control, business integrity screening, and audit management. SAP GRC integrates with existing SAP environments, providing a unified approach to managing compliance and risk.

Selecting the right compliance management system software depends on your organization's specific needs, industry regulations, and existing infrastructure. Evaluating each tool's features and how they align with your compliance objectives is crucial.

Wrapping Up

A well-structured compliance management system helps you reduce risks, improve efficiency, and maintain regulatory standards. It ensures that your organization stays compliant while minimizing costly errors and reputational damage. However, managing compliance manually can be time-consuming and prone to oversight.

Rifa AI streamlines compliance processes by automating back-office workflows, document processing, and dispute resolution. Its AI-powered solutions reduce operational costs by up to 70% and improve accuracy to 99%. With Rifa AI, you can simplify compliance tracking, automate reporting, and ensure regulatory adherence without the need for any complex API integrations.

Stay ahead of compliance challenges with automation that works for you. Book a FREE Demo Now!

Mar 7, 2025

Mar 7, 2025

Mar 7, 2025