Outperforms Your Best Agent.

Compliant. Scalable.

Provable.

Voice and chat AI that outperforms your best agents while staying compliant on every call and providing full audit trails.

AI: “I can help set up a payment plan...”

Caller: “I lost my job last month...”

Demo Magic Doesn't Survive Real-World Compliance

Most AI solutions break when they hit regulated environments with real edge cases, audit requirements, and high-stakes conversations.

"Works in Demo" Fails at Scale

Edge cases multiply in production. Without proper exception handling and human escalation paths, AI agents create more problems than they solve.

Auditors Demand Transcripts

When regulators ask "what was said," you need complete records, checkpoint verification, and proof that required disclosures were delivered.

No Unified Visibility

When AI handles some calls and humans handle others, you need unified metrics to compare performance and continuously improve both.

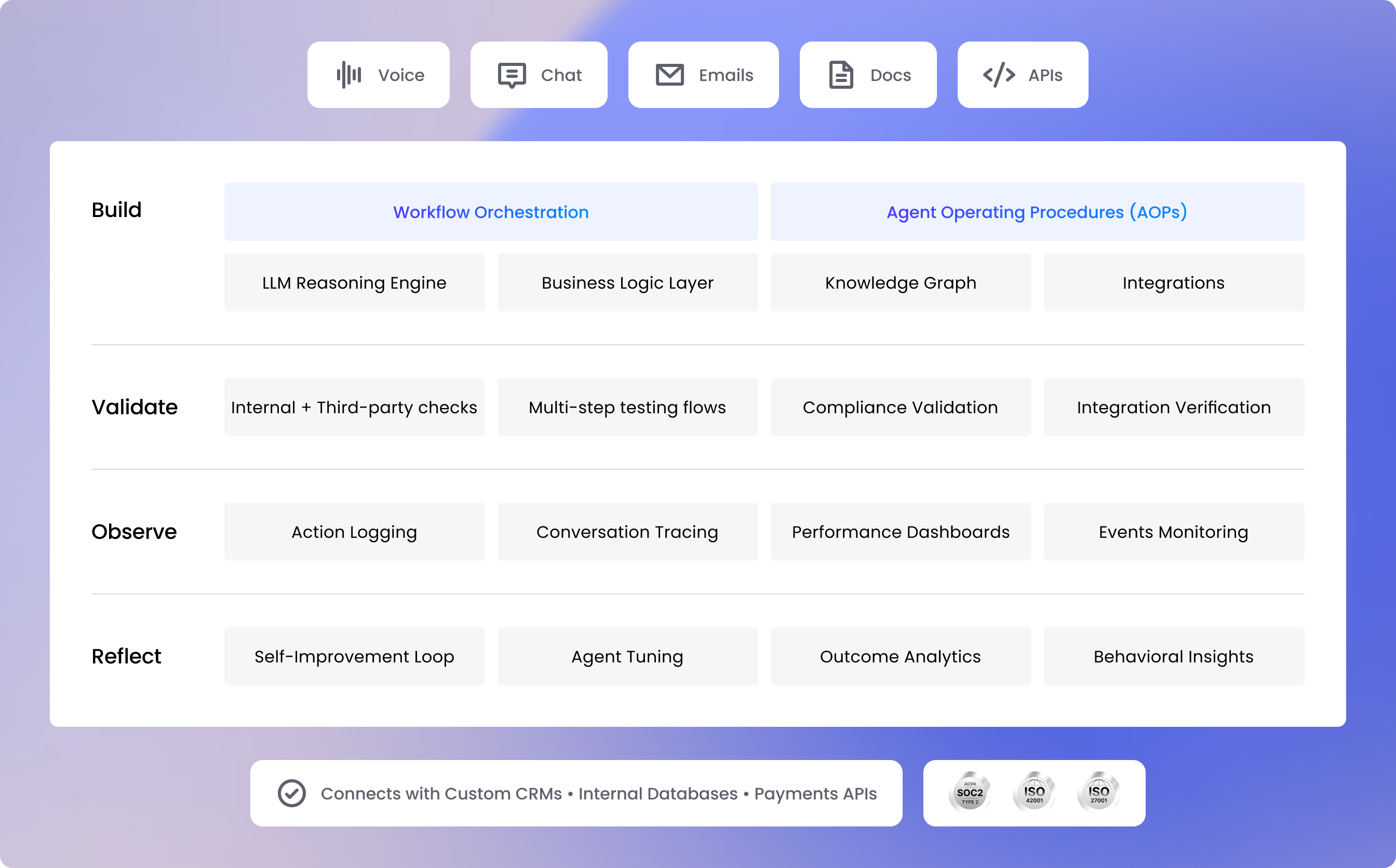

Go Live in Days, Not Months

Build agents yourself or work with our integration team. Either way, you get compliant agents with full observability from day one.

Extremely customizable

Tune every step to match your business

Policy-safe by default

Built-in testing, guardrails & compliance

Self-improving agents

Performance that evolves with your data

What Rifa Agents Actually Do

Handle Routine Conversations End-to-End

Payments, account questions, scheduling, and claim status updates are fully handled from start to finish without agent involvement for routine requests.

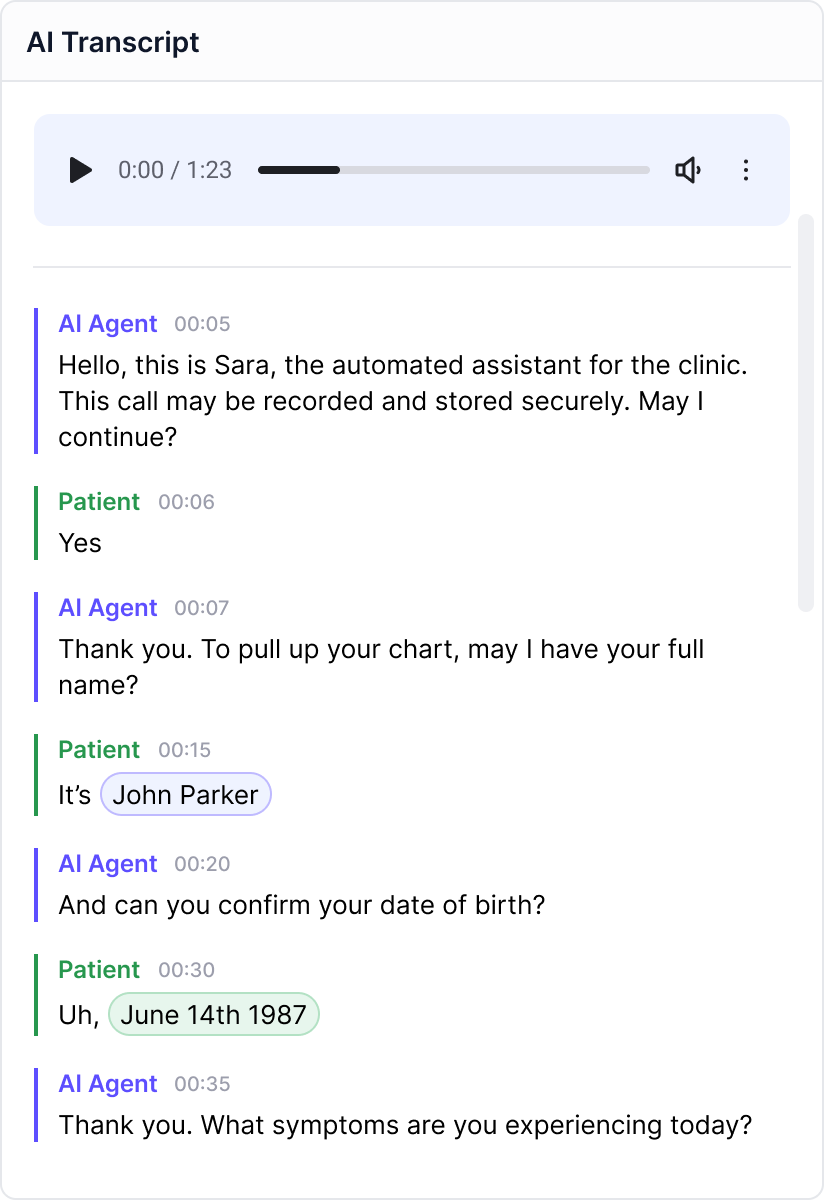

Deliver Required Disclosures Every Time

Mini-Miranda, call recording consent, and HIPAA notices are automatically delivered, confirmed, and logged, ensuring compliance without gaps, delays, or missed disclosures.

Route Exceptions to the Right Human

Disputes, hardship claims, attorney involvement, or high-emotion callers are identified instantly and transferred with full context so agents can step in effectively.

Log Everything for Compliance & QA

Full transcripts, disposition codes, payment confirmations, consent records, automatically captured in Reflect and synced to your CRM.

Work in English and Spanish

Serve Spanish-speaking customers with the same compliance standards. Same disclosures, same quality, same audit trail.

Your Agents, Live in Days

Work with our integration team to get compliant agents deployed fast, or build them yourself. Either way, you get full observability from day one.

Integration Team Support

We help configure agents that are compliant out of the box.

Deploy in Days

Go live on voice or chat in under two weeks.

Deep Integrations

Connect to your CRM and payment systems from day one.

Reflect Observability

Monitor every conversation with full transcripts and metrics.

One Platform for Human + AI Agents

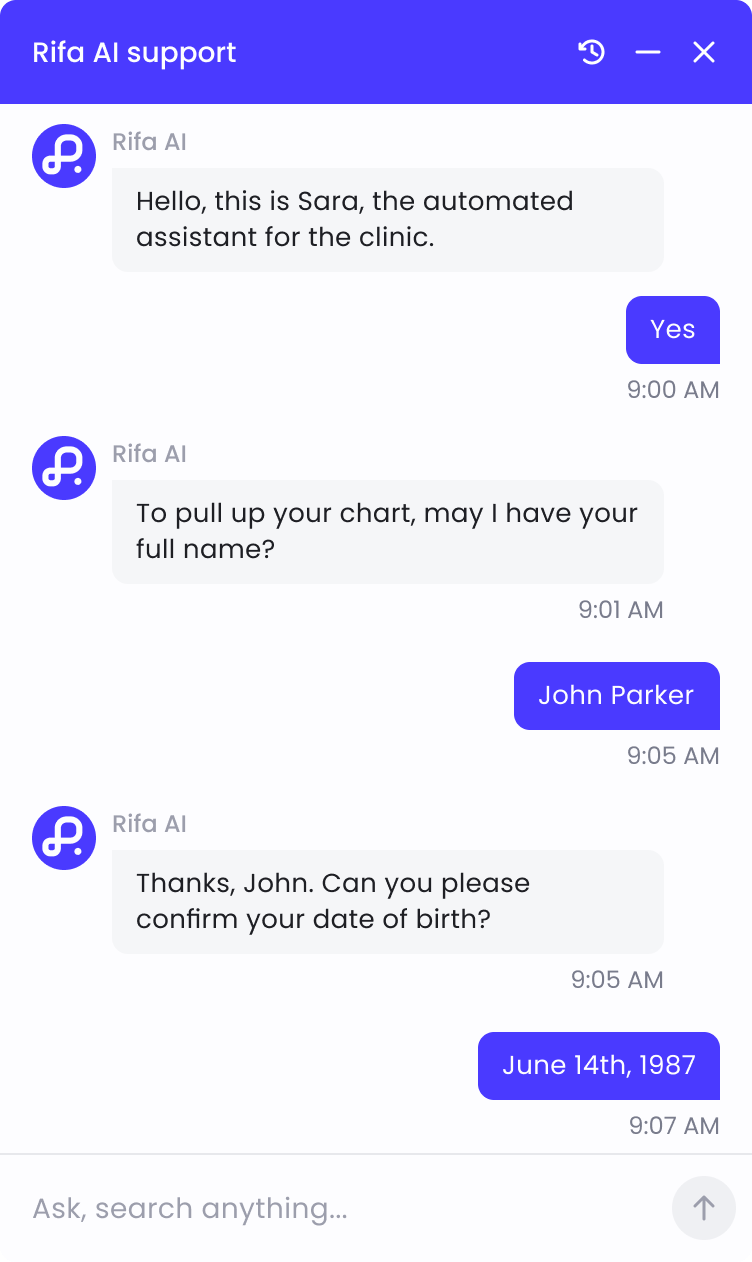

Enable smooth handoffs and AI-powered collaboration for your teams.

Voice and Chat Agents

Same platform. Same compliance controls. Same observability. Deploy on the channels your customers actually use.

Voice Agents

Handle inbound and outbound calls with consistent workflows, required disclosures, and intelligent escalation to human agents.

- Payment arrangements & collections

- Account status & balance inquiries

- Disclosure delivery & verification

- Smart handoff for disputes & hardship

Chat Agents

Deploy on your customer portal to handle inquiries, drive payment conversations, and resolve accounts without human involvement.

- Account inquiries & payment discussions

- Send payment links directly in chat

- Flag disputes, hardship & exceptions

- High containment, humans for edge cases

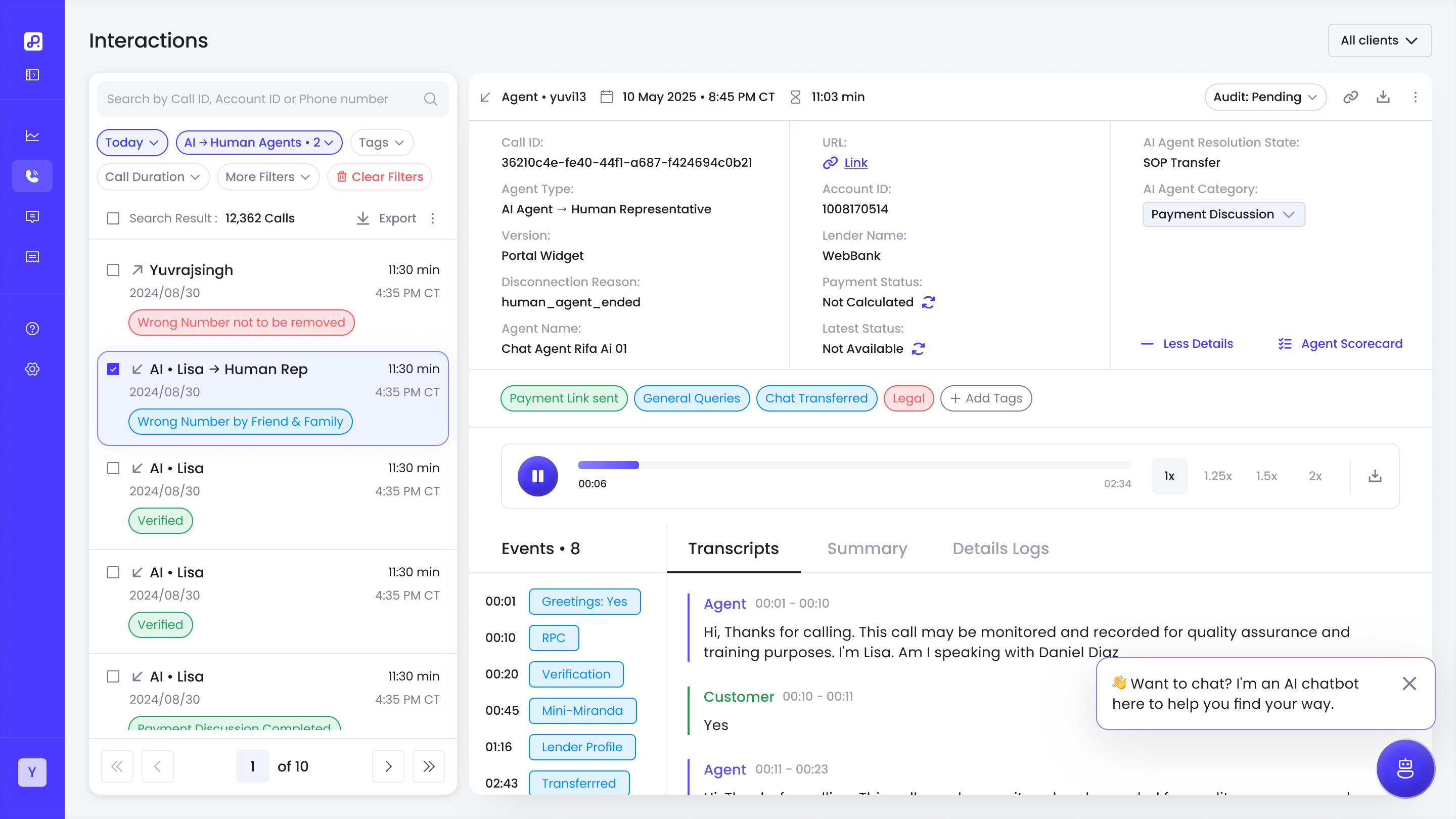

Reflect: Your Control Tower for AI Operations

Transcripts, verification, and unified metrics across AI agents, human agents, and hybrid handoffs so you can scale with proof.

Transcripts + Verification

Move from assumptions to evidence. Reflect captures every interaction and validates performance against your policies.

- Searchable transcripts & interaction history

- Handoff reason codes + context completeness

- Workflow adherence & checkpoint completion

- Required disclosure verification

Unified Performance Metrics

A single view for operational leaders. Compare AI vs human vs hybrid performance across all channels.

Built for High-Stakes Regulated Environments

Rifa AI deploys across industries where compliance isn't optional and every conversation can be reviewed.

Debt Collection

Automate high-volume servicing while preserving FDCPA-compliant workflows and required disclosures like Mini-Miranda.

Healthcare

Improve patient responsiveness while maintaining HIPAA compliance and operational controls.

Insurance

Handle high-volume claims and policy inquiries while measuring outcomes and escalation drivers.

What Success Looks Like

Regulated enterprises using Rifa AI see measurable improvements across containment, cost, and compliance within weeks of deployment.

Efficiency at Scale

Boost operational speed across teams.

Accuracy You Can Trust

AI agents follow rules, policies & workflows.

Outcomes That Matter

Drive measurable business impact.

Smarter conversations. Faster resolutions.

AI agents tailored to complex workflows helped reduce workloads, improve payment outcomes, and boost customer satisfaction across teams.

Performance: AI vs Human Baseline

Containment improved 88% vs baseline

The Controls Your Compliance Team Requires

Built for industries where regulators ask questions and auditors pull transcripts.

Visit our Trust CenterSOC 2 Type II Certified

Independently audited security controls. Annual certification with continuous monitoring. Available upon request.

HIPAA Compliant / BAA Available

Business Associate Agreements available for healthcare deployments. PHI handling controls and audit logging included.

FDCPA & TCPA Controls

Built-in disclosure delivery, time-of-day restrictions, consent tracking, and cease-and-desist handling for collections compliance.

Call Recording & Consent

Automatic two-party consent collection where required. Recordings stored with configurable retention and easy retrieval for disputes.

Encryption & Access Control

AES-256 encryption at rest, TLS 1.3 in transit. Role-based access ensures agents only see what they need.

99.9% Uptime SLA

Enterprise-grade reliability with redundant infrastructure. Your customers get through, every time it matters.

Frequently Asked Questions

Clear answers for buyers evaluating AI agents for regulated industries.

Rifa AI is a platform for building and deploying voice and chat AI agents purpose-built for regulated industries like debt collection, healthcare, and insurance. It includes Reflect, an observability product for compliance verification and performance monitoring.

Most customers deploy their first production AI agent in under 2 weeks. The no-code agent builder and pre-built compliance templates accelerate time-to-value significantly compared to custom development.

Reflect is Rifa AI's observability product that provides transcripts, compliance verification, and unified performance metrics across AI agents, human agents, and hybrid handoffs. It enables audit-ready documentation of every conversation.

Rifa AI includes built-in compliance controls: required disclosure verification (like Mini-Miranda), real-time policy enforcement, automatic escalation triggers, complete audit trails, and checkpoint completion tracking through Reflect.

Rifa AI's smart handoff engine detects exceptions (disputes, hardship claims, attorney involvement) and routes to human agents with full context: conversation summary, key fields, and reason codes, so customers never repeat their story.

Rifa AI is purpose-built for regulated industries including debt collection (FDCPA compliant), healthcare (HIPAA compliant), insurance, financial services, and other high-compliance environments requiring audit-ready AI agents.

Yes, Rifa AI is SOC 2 Type II compliant with independently audited security controls. Additional security features include AES-256 encryption, role-based access control, and data residency options for US, EU, and custom regions.

No. Rifa AI never uses your conversation data to train models. Your data remains yours, with complete audit logs for compliance reporting and security investigations.

Performs. Complies. Proves.

See Rifa AI handle a live collection call with required disclosures, smart escalation, and full audit trail. Then decide if your current system can keep up.